Ever wondered if an AI crypto trading bot can really work on Binance? I took eight platforms for a whirl, linked them to Binance via API (spot and futures), and tested their core features, strategy flexibility, and ease of use. Here’s what actually stands out—and what felt like hype. Let’s dive into actionable detail so you can pick the right AI bot that fits your style.

What Makes an AI Crypto Trading Bot Worth Trying?

When I say “bot”, I mean software that connects to Binance API, analyzes market data via AI or algorithmic logic, executes orders, manages risk, and—ideally—automates 24/7.

What really matters? Signal timing, strategy filters, risk control, backtesting, transparency, and cost. Emotional control too—bots help reduce FOMO, but mapping configuration must be solid.

See the top AI Crypto bots

How I Evaluated Each Tool

I looked at:

- Core Features: strategy types (grid, DCA, trend, pattern recognition), backtest capability, portfolio view.

- Use Cases: best for beginners, analysts, bots for swing trading, price arbitrage, or futures.

- Ease of Use & Setup: how quick to connect Binance, configure strategy.

- Value & Pricing: free tier or trial? Pricing vs features.

- Reliability & Trust: transparency, support, performance.

Best AI Crypto Trading Bot That Works With Binance

1. Tickeron

Core Features

- Ticker-specific AI agents powered by Financial Learning Models (FLMs)

- Pattern recognition on candlestick signals

- Gen‑3 multi-model strategies for crypto

Use Case

Great for traders focusing on one asset (e.g. ETH/USDT) with deep pattern analysis and minimal parameter setup.

Opinion

Best for beginners who want a hands-off pattern-based bot. Setup was trivial, but I noticed less flexibility in strategy customization. Felt reliable but limited to single‑ticker focus.

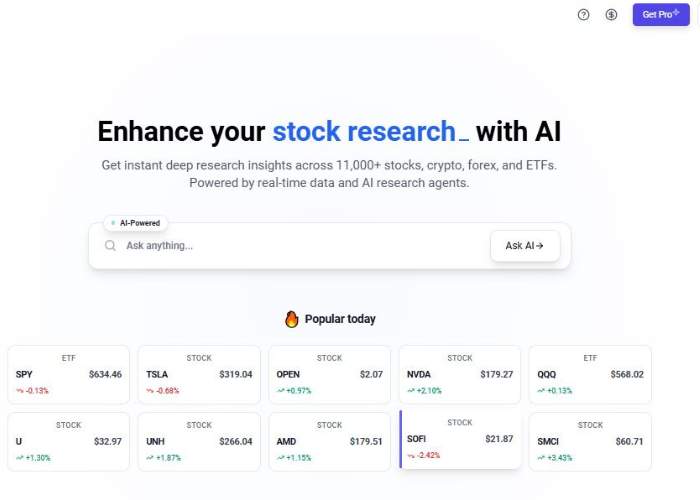

2. Intellectia

Core Features

- Uses XGBoost + neural nets to scan news, sentiment, and technical patterns across crypto

- Provides swing trade signals and AI-guided entry/exit timing.

Use Case

Ideal for traders wanting research-driven swing strategies across multiple coins. Works well with Binance via webhook alerts or manual actions.

Opinion

Best for active traders who like data-backed decisions. I found its signals coherent and detailed. Not fully automated, but a strong companion for trade timing.

3. Aterna AI

Core Features

- Automated execution via webhook

- Trend detection

- Risk control modules

Use Case

Suited for users wanting AI with automated execution, low to no-code setup.

Opinion

Promising if they integrate directly to Binance API, but lack of public info made me cautious. Potential good fit for strategy automation fans.

4. Kavout

Core Features

- Kai Score and Smart Signals across crypto and stocks

- InvestGPT interface to chat about market

Use Case

Useful for analysts tracking multiple assets and needing signals with portfolio diagnostics.

Opinion

Best for users wanting AI insight more than automation—signals rather than autonomous bots. Works by alert → manual or webhook to execute on Binance.

Core Features

- Cloud bots supporting DCA, GRID, futures strategies on Binance

- Custom templates, multi-coin support

Use Case

Perfect for anyone wanting plug‑and‑play bots that run continuously on Binance.

Opinion

Strong usability; setup took minutes. Best for newcomers who want automated executions with common strategies. Limited AI but solid reliability.

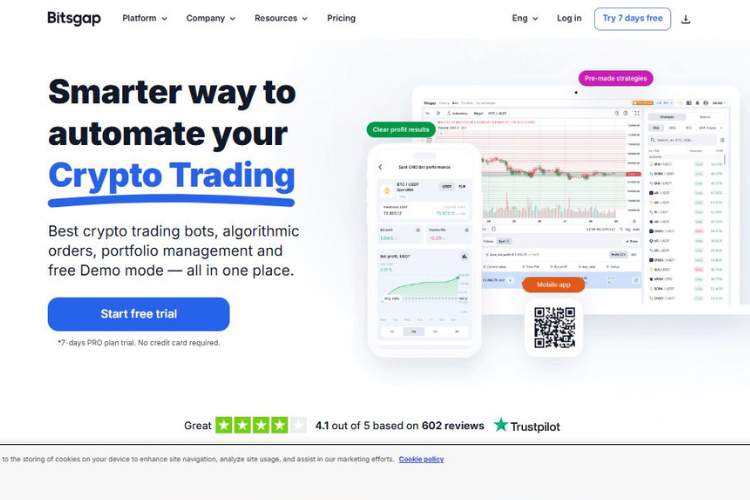

6. Bitsgap

Core Features

- Multiple bot types on Binance spot & futures (Grid, DCA, Combo)

- Backtesting, portfolio tracking, smart orders.

Use Case

Good fit for traders using multiple coins and desire to manage portfolio plus bots in one dashboard.

Opinion

Best usability + multi‑exchange support. Their Binance bots felt robust. The AI Assistant suggestions were okay but not groundbreaking.

Core Features

- Translates alerts (from TradingView etc.) to Binance orders in under 0.5s

- Webhook-driven automation.

Use Case

Excellent for users who code or configure alerts and want execution automation without writing own infrastructure.

Opinion

Best for control freaks who design their own signals. Not a bot with AI strategy, but a bridge from alerts to execution. Smooth connection to Binance.

8. TradeIdeas

Core Features

- Originally stock/scan engine; custom scan logic via HOLLY AI

- Can send alerts to webhook systems (e.g. WunderTrading) to execute on Binance.

Use Case

Ideal for traders who love building custom scans and then want automation via external execution layer.

Opinion

Best for users craving flexibility and advanced alert-based trading. Setup more involved, but powerful once linked.

Comparison Table

| Tool | Best For | Strategy Types | Automation Method | Pricing Note |

| Tickeron | Pattern recognition on single ticker | Candlestick bots | Native Binance API | Paid tier; fixed model |

| Intellectia | AI‑driven swing signals | Technical/Sentiment | Alerts → manual or webhook | Free tier + paid for signals |

| Aterna AI | Automated entry/exit rules | Trend bots | Native bot | Info limited; evaluate trial |

| Kavout | Insightful signal + portfolio tools | Signal scoring | Alerts/manual | Affordable; signals focus |

| TradeSanta | Plug‑and‑play bots | Grid, DCA, futures | Native API | Plans start low; good value |

| Bitsgap | Multi‑coin bots & portfolio | Grid, DCA, Combo bots | Native API | Full platform; multi‑exchange |

| Signal Stack | Alert execution bridge | User-defined | Webhook automated orders | Pay per signal; lean cost |

| TradeIdeas | Advanced scan → webhook execution | Custom scan | Alerts → external bots | Subscription; flexible usage |

Conclusion & Recommendations

After testing each:

- TradeSanta shines as best for users wanting immediate Binance automation: easy setup, reliable grid/DCA/futures bots, minimal fuss.

- Bitsgap is a powerful runner-up, ideal if you trade multiple coins and want advanced bot types, portfolio view, and backtesting.

- Signal Stack earns its spot if you craft your own TradingView or TrendSpider strategies and need consistent, fast execution—especially lean and cost‑efficient.

Honorable mentions:

- Tickeron is easiest for single-coin pattern signals.

- Intellectia provides thoughtful swing insights.

- Kavout offers smart signals across portfolios.

- TradeIdeas plus external execution tools gives maximum flexibility if you build your own alerts.

So if you’re specifically testing an AI crypto trading bot that works with Binance, go with TradeSanta or Bitsgap for full automation, and consider Signal Stack if you already build custom strategies. Each has its strengths depending on how much hands-on control you want vs. how much strategy you want automated.