Authored by Brandon Smith via BirchGold.com,

The U.S. consumer spending engine and tariffs as leverage

Mainstream economists were surprised last week after Donald Trump closed two massive trade and tariff deals, the first with Japan and the second with the EU. And this happened without triggering an economic crash.

The deal with Europe in particular has made a number of critics look rather foolish; there’s an army of mainstream economists who might reasonably acknowledge they misjudged the situation. But we all know that economists never admit their mistakes.

As I have been telling people for months, the American consumer is the economic engine of the world. There was no chance that any nation, or group of nations, was going to effectively challenge the U.S. on tariffs.

Doing so would mean catastrophic loss of the U.S. export market.

As I noted in my article Europe’s Anti-American Shift: Now Globalists Are The Saviors Of The West? from April:

The U.S. makes up 30%-35% of all global consumer spending and is the largest consumer market in the world. There are no clear numbers for the whole of Europe, but Germany, Europe’s largest economy makes up only 3% of global consumer spending. Germany is also the third largest economy in the world next to China. In other words, Europe has NO capacity whatsoever to fill the void in trade left behind by the U.S. If the U.S. economy detaches from Europe, or if the U.S. economy crashes, Europe would crash also. This is a fact…

It’s safe to expect the EU to fold. They cannot afford not to.

Why the EU folded on trade

I’m not saying that it’s a good thing that the U.S. is the consumption engine of the global economy! Rather, I’m explaining the reality we live in.

Tariff deals help to balance a long running pattern established post-WWII which positions America as the primary consumer market for the planet, while limiting the retention of a robust domestic industrial base. Tariffs also balance the highly uneven relationship the American public experiences with global corporations. As I argued in my article Tariff Freak Out: Why So Many People Cling To The Cancer Of Globalism earlier this year:

I’m getting a little tired of people constantly defending international conglomerates as if they are victims. On the libertarian side of things there are number of well meaning skeptics that suggest tariffs are “unconstitutional” because they symbolize taxation without representation. This is incorrect. Tariffs are not a tax on the public. They are not a tax on foreign economies. They are a tax on global corporations and the foreign goods they import…

And:

Frankly, I do not care that they’re getting taxed for importing foreign goods and exporting American jobs. That’s a good thing. If they want to void the tax, all they have to do is bring manufacturing and jobs back to the U.S. It’s not as if they don’t have options.

Americans can also buy from smaller locally sourced producers to avoid price hikes. Suddenly, the playing field in which international companies get an unfair advantage is a little more level and competition returns. That’s a free market, as opposed to what we have today…

Look: The EU made a deal because they need international conglomerates to continue investing dollars into their industries.

Every other nation (including China and even Canada) is likely to follow suit for similar reasons.

An extra $100 billion is already in the federal government’s coffers as of July. It’s just as important to give Trump props for his successes as it is important to call him out for his mistakes.

Because I think he made one…

The hidden economic threat ahead

That said, Trump has stumbled into one blaring economic blunder that he should have seen coming a hundred miles away. It could undermine his entire term, as well as putting future conservative efforts in the U.S. at risk.

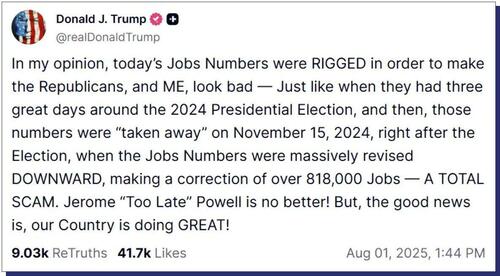

You might have heard of Trump’s abrupt firing of Erika McEntarfer, the head of the Bureau for Labor Statistics (BLS).

You probably didn’t care. Honestly, the incident is barely a blip on the White House’s very busy radar. DOGE pushed over 200,000 bureaucrats out of their jobs – what’s one more?

It’s the reason for the firing that needs to be addressed.

The media is painting the incident as a temper tantrum by Trump. As if he fired McEtarfer because she dared to publish negative numbers about the U.S. economy.

But we’ve seen this before! McEntarfer was head of the BLS throughout the Biden 2024 election campaign! Month after month, the BLS reported oddly optimistic “initial” jobs reports. It seemed as though Biden was a job creation machine.

In truth, labor data was skewed heavily due to illegal immigration (the vast majority of new workers were foreign). Furthermore, it’s quite possible the BLS has been working hand-in-hand with the Federal Reserve; creating whatever employment data the Fed needs to justify cutting interest rates to juice the economy in the run-up to the 2024 election.

The BLS had a track record during Biden’s presidency of releasing overly optimistic data… and then dramatic negative revisions months later. The positive stats are released with fanfare!

The sharp revisions got a lot less attention.

Trump was apparently stunned by the latest BLS revision, which cut at least 258,000 jobs from previous numbers.

Keep in mind, this is the same Bureau of Labor Statistics that overstated jobs growth in March 2024 by approximately 818,000 and, then again, right before the 2024 election, in August and September, by 112,000.

Trump argues that McEtarfer has “rigged” the recent data to the negative to embarrass his administration.

He thinks she’s a Deep State insider trying to sabotage the American economy with phony spreadsheets.

I’m more concerned about something else.

Are we already caught in the stagflation trap?

What if the negative jobs data from August is accurate?

Keep in mind, there are numerous signs of an economic slowdown. There’s no way the U.S. is going to escape a stagflationary crisis without going into a period of declining activity.

Personally, I believe that the Biden administration rigged the numbers to hide this decline.

And now Trump is finally discovering just how bad the jobs numbers really are…

I’ve been warning about this outcome since before the election.

The Biden administration’s “greatest economy in world history” raised everyone’s expectations – so what happens when we wake up to reality under President Trump?

In my article “Smoke And Mirrors: What Happens After Biden’s Economic Manipulations Disappear?”, published in September of 2024, I noted:

Trump’s arrival in the Oval Office will result in a hailstorm of bad economic data, and most of this will be due to the sudden end of statistical manipulations that have been in place for the last four years. We are currently in the midst of a tone-shift in which recessionary forces are pressuring markets more than inflation. But don’t be fooled…

As soon as the Federal Reserve cuts rates inflation will spike again, and if Trump is in office a CPI jump will be even more pronounced. Biden’s oil reserve dumps will be over, no longer anchoring CPI. We will continue to see inflation in necessities with deflation in other areas including jobs and GDP. That’s what happens during a stagflation crisis…

If I’m right then the negative revisions we just witnessed from the BLS are just the beginning.

How many more Biden era officials are still in place within economic tracking agencies?

How did Trump not see this coming?

In my article The Trump Administration’s Biggest Wins And Biggest Fails So Far, I cited this as one of his most egregious errors.

Trump should have called out Biden’s economic manipulation within his first month in office, or better yet, before he entered office.

Now, his explanations are going to look more like the excuses of a politician trying to avoid responsibility for an economic downturn.

It’s not a downturn Trump made! But he’s going to be blamed anyway – unless he can find a path to reverse the downtrends.

I’m not so sure that such a path exists.

Trump’s economic dilemma

Trump has inherited a Catch-22 scenario:

If rates stay high the recessionary data will continue to roll in. It won’t only be revisions in jobs numbers, but cuts to GDP forecasts, a slowdown in consumer spending and a continuing slow-motion collapse of the housing market.

If rates are reduced, prices on food and fuel and everything else will start rising again.

If rates stay the same, the federal government will be stuck trying to sell $1 trillion in debt every 100 days – and as the President’s frequent posts on Truth Social have informed us, he doesn’t believe that’s a tenable situation.

This is not a political argument, by the way. It’s just how math works.

But there’s another way out…

Lies, damned lies and statistics

Why not simply stoop to the same data manipulation methods used over the last four years to conceal the bad news?

As tempting as it might be, I believe the Trump administration is under far more scrutiny than Biden ever was. The media helped Biden hide the stagflation crisis, hide the bad jobs numbers, reported lower energy prices (even though those prices were rigged by dumping strategic reserves on the market) – they even gave Biden credit for raising GDP!

And that doesn’t count, either. It’s easy to boost GDP – all you have to do is spend more federal funds. There’s no offset for government debt in GDP calculations.

The mainstream media aren’t going to do these things for Trump.

I could be wrong. Maybe Trump is right. Maybe the former head of the BLS deliberately released negative revisions to conceal the real job numbers, which would have to be truly fantastic. Otherwise, why try to hide them?

But the more likely scenario is that the real numbers are far uglier than the American public is aware of. And this has been going on a long time. Trump is at risk of taking the blame for a Biden recession.

That would be terrible – and not just for the 2026 midterm elections.

Because, no matter who history blames for the next recession, the truth is that everyday Americans will feel the pain just the same.

Falling growth means fewer jobs and slower wage gains; stubborn inflation erodes what our savings can buy. That’s why I believe it’s wise to diversify our savings with tangible assets that don’t rely on political promises or doctored data. Stable assets that don’t surge or plunge at the whim of a bureaucrat. Physical gold and silver have endured through booms, busts and every kind of leadership.

Presidential administrations come and go – gold and silver endure. Make sure you and your family can endure, as well.

Loading recommendations…