Update (1020ET): President Trump rage-posted about the lack of inflation amid all the tariff-fearmongering…

“Trillions of Dollars are being taken in on Tariffs, which has been incredible for our Country, its Stock Market, its General Wealth, and just about everything else.

It has been proven, that even at this late stage, Tariffs have not caused Inflation, or any other problems for Country, other than massive amounts of CASH pouring into our Treasury’s coffers.

Also, it has been shown that, for the most part, Consumers aren’t even paying these Tariffs, it is mostly Companies and Governments, many of them Foreign, picking up the tabs. “

Then took direct aim at Goldman Sachs:

“But David Solomon and Goldman Sachs refuse to give credit where credit is due.

They made a bad prediction a long time ago on both the Market repercussion and the Tariffs themselves, and they were wrong, just like they are wrong about so much else.

I think that David should go out and get himself a new Economist or, maybe, he ought to just focus on being a DJ, and not bother running a major Financial Institution.”

Ouch!

Meanwhile, just between us girls, Goldman has been somewhat more in the ‘one-time, marginal’ incremental impact of tariffs (as opposed to the UMich terror tantrum), with one of their latest notes highlighting the ““Sharp Declines” In Import Prices As Foreigners Absorb Trump’s Tariffs,” even though Jan Hatzius did claim that US firms are eating up to two-thirds of the increased tariff costs most recently (even though that was not evident in the earnings data this season).

well would you look at that: three days later Powell has to discuss this chart https://t.co/6AfkRRSjJp pic.twitter.com/SOGjff2Fsl

— zerohedge (@zerohedge) June 25, 2025

* * *

With a new boss looming at The BLS, one wonders what the ‘old boss’ has in hand for today’s CPI data (with consensus seeing both headline and core YoY price changes ticking higher) after June’s consumer prices came in cooler than expected, disappointing the Trump Tariff Tantrum crowd. Will this time be different… Will the dreaded tariff-flation show up this time?

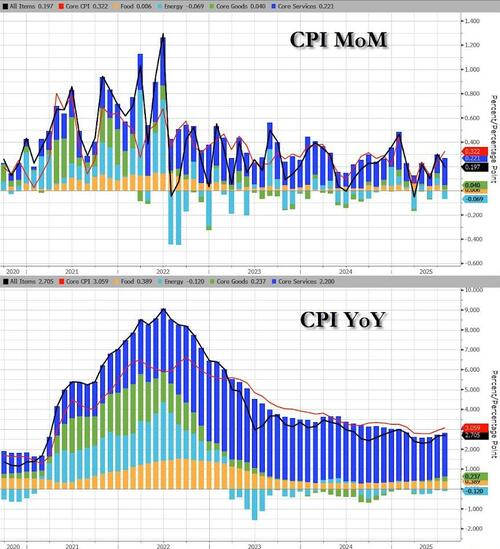

Headline CPI rose 0.2% MoM in July (as expected) and +2.7% YoY (cooler than the 2.8% expected) and in line with the June print…

Source: Bloomberg

Headline CPI rose 0.2%, after rising 0.3% in June. CPI Core rose 0.3% in July, following a 0.2% increase in June.

-

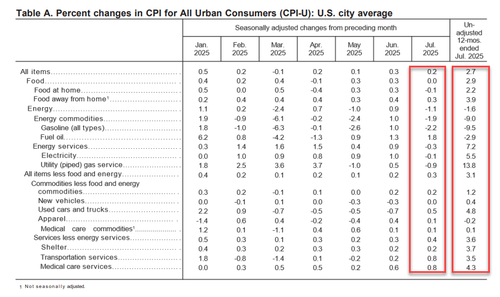

Indexes that increased over the month include medical care, airline fares, recreation, household furnishings and operations, and used cars and trucks.

-

The indexes for lodging away from home and communication were among the few major indexes that decreased in July.

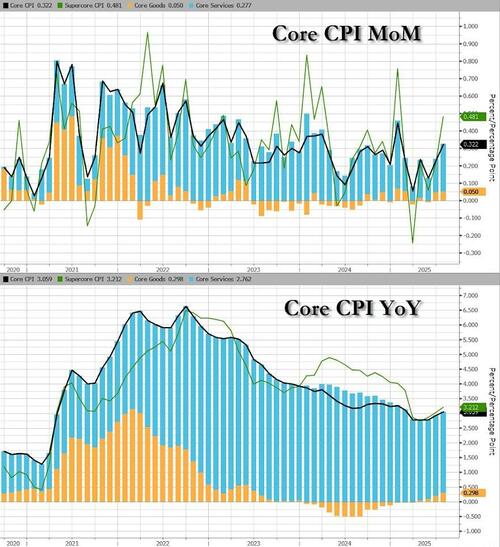

Core CPI rose 0.3% MoM (as expected) but YoY rose 3.1% (hotter than the 3.0% expected) – the highest since February…

Source: Bloomberg

Under the hood, Fuel Oil and Transportation costs rose the most but Gasoline and Food at Home costs fell MoM…

Core CPI MoM Details:

-

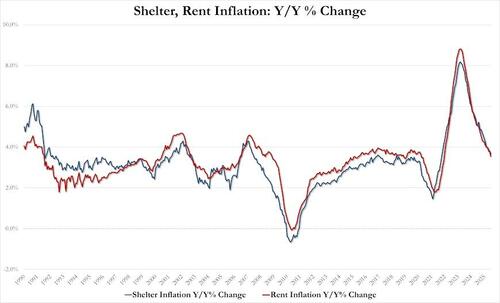

The shelter index increased 0.2 percent over the month.

-

The index for owners’ equivalent rent rose 0.3 percent in July as did the index for rent.

-

Conversely, the lodging away from home index fell 1.0 percent in July.

-

-

The medical care index increased 0.7 percent over the month, following a 0.5-percent increase in June.

-

The index for dental services increased 2.6 percent in July and the index for hospital and related services increased 0.4 percent.

-

The physicians’ services index rose 0.2 percent over the month, while the prescription drugs index fell 0.2 percent.

-

-

The index for airline fares increased 4.0 percent over the month, after declining 0.1 percent in June.

-

The recreation index increased 0.4 percent over the month, as did the household furnishings and operations index.

-

The index for used cars and trucks rose 0.5 percent in July and the index for personal care rose 0.4 percent.

-

The new vehicles index was unchanged over the month while the communication index fell 0.3 percent.

Annual changes:

-

The shelter index increased 3.7 percent over the last year. Other indexes with notable increases over the last year include medical care (+3.5 percent), household furnishings and operations (+3.4 percent), motor vehicle insurance (+5.3 percent), and recreation (+2.4 percent).

Goods inflation is accelerating (some will argue ‘tariffs’, some will argue fuel) while Services inflation has stabilized…

Source: Bloomberg

The latest inflation report continues to show no negative impact from tariffs. Core goods prices were up 0.2% in July. They are up just 1.1% over the past 12 months and are actually up a lesser 0.8% since President Trump began phasing in tariffs.

— Joseph Lavorgna (@Lavorgnanomics) August 12, 2025

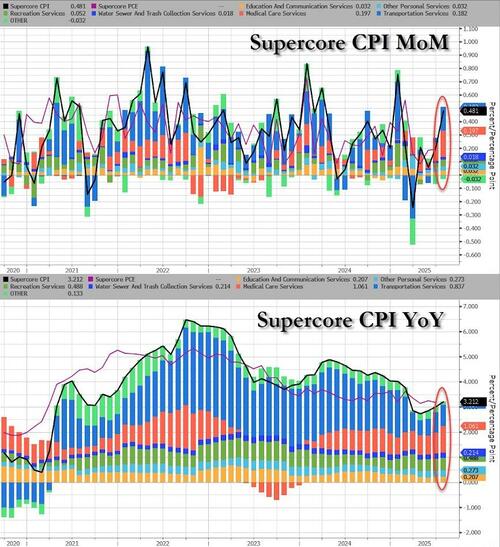

There is one problem in the data… SuperCore CPI (Services ex-Shelter) rose 0.55% MoM (hottest since January) and up 3.59% YoY (hottest since February)…

Source: Bloomberg

The jump in Transportation costs and Medical Care Services stood out for SuperCore (neither seem like they are affected in any way by tariffs)…

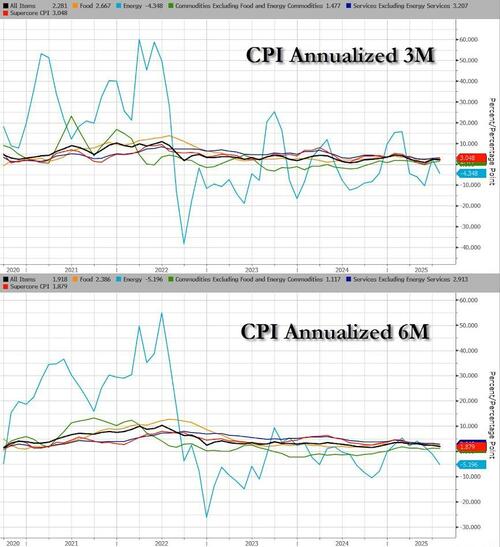

3m and 6m annualized CPI is also refusing to bow to the terror predicted by Trump tariff haters…

So, not exactly the screaming spike in prices that Democrats interviewed by UMich have hallucinated about?

Tiffany Wilding, Pimco economist, tells Bloomberg TV that tariff-related pressures are contained within certain areas of the report:

“It’s very concentrated within goods, it’s happening slowly, and outside of that, inflationary pressures look very manageable. So I think for a Federal Reserve, that is a very good sign.”

Art Hogan, B. Riley Wealth chief market strategist, weighs in:

“Core goods are the real driver of the move up in the index, while being somewhat offset by energy and shelter cost. The report will likely not change the path forward for the Fed, as we expect to see rate cuts at the next three meetings.”

Rate-cut expectations rose after the CPI print with September now trading at 95%…

But there is a silver lining…

The new BLS commissioner will not be fired today

— zerohedge (@zerohedge) August 12, 2025

So, Airfares, Dental Care, Auto Insurance, Medical Care, and Rent were among the biggest drivers of upside in CPI… NONE of which have ANYTHING to do with tariffs (even if you squint)

And tariff-related items such as New Cars, Apparel, and Toys barely budged.

And cue the “just wait until next month” arguments!!…

Liesman: “I don’t want to rain on the market’s parade here”

Kernen: “You do”

— zerohedge (@zerohedge) August 12, 2025

Loading recommendations…