Authored by Josh Stylman via Substack,

One Chart. Three Generations. Total Extraction.

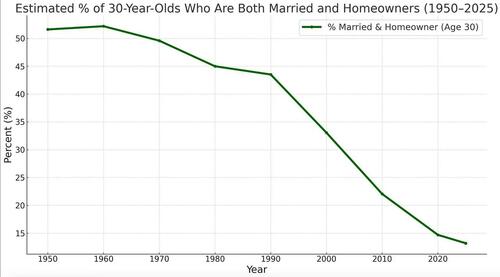

I saw this chart making the rounds on Twitter this week, and it stopped me cold. While the specific figures combine data from multiple sources, the trend is undeniable: in 1950, over half of 30-year-olds were married homeowners. By 2025, some analysts project that number as low as 13%.

That’s not a societal transformation. It’s not an economic fluke. It’s the visible outcome of an invisible strategy—one that extracted everything it could from a three-generation arc and left only illusions in its place.

They’ll tell you people just choose differently now—that marriage rates fell because of changing values. But people can’t choose what they can’t afford. When the economic foundation for family formation disappears, cultural changes follow inevitably. That chart doesn’t show us changing values or new priorities. It shows systemic breakdown, disguised for decades as freedom.

It maps the slow evaporation of the social contract. For one generation, adulthood was a starting point. For the next, a struggle. For the latest, an abstraction—marketed endlessly but almost never attained. What began as a rite of passage has become a paywalled simulation.

The post–World War II boom was never sustainable. In hindsight, this was obvious. It relied on conditions that were always time-limited: cheap energy from newly tapped oil fields, industrial monopolies before globalization kicked in, dollar hegemony that exported inflation globally, and a demographic pyramid with more workers than retirees. It was a golden window, not a golden age. And when the window closed, the illusion had to be maintained—through leverage, narrative, and ever-increasing sacrifice from the generations that followed.

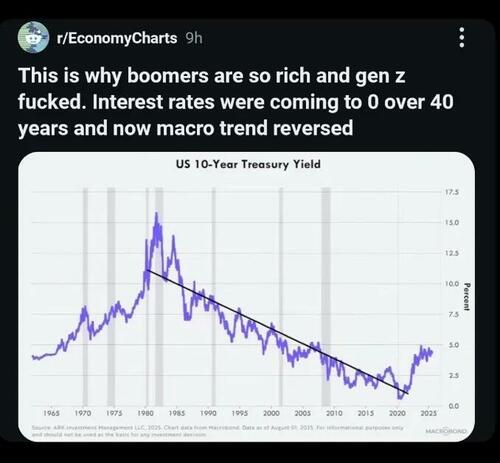

The math quietly stopped working. Boomers bought homes for two or three times their annual income during an era when interest rates would fall for the next four decades—turning their mortgages into wealth-building machines as rates dropped from 15% to near-zero. Today’s buyers face five to six times their income—or more in major cities—while rates can only go up from historic lows. Where Boomers rode a 40-year tailwind of falling borrowing costs that inflated their assets while deflated their debt, current generations face headwinds at every turn. The Federal Reserve data confirms this unprecedented decline, showing rates falling from over 18% in the early 1980s to near 2.6% by 2021.

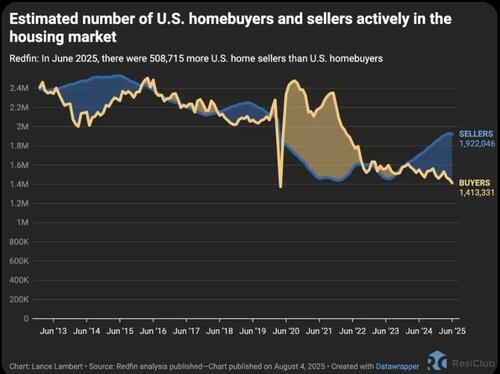

The housing market itself tells the story: recent data shows over 500,000 more sellers than buyers – not because homes are affordable, but because an entire generation has been systematically priced out.

The institutions that promised stability—education, government, media, finance—mutated into extraction machines. Still speaking the old language, they now served a different purpose: to keep people compliant inside a system that no longer offered a way out.

This wasn’t merely economic. It was existential. The foundations of meaning—family, ownership, stability—were quietly downgraded to lifestyle preferences, and then systematically priced out. People without homes are easier to relocate. People without families are easier to isolate. People without rootedness are easier to govern.

The Boomers didn’t design the con, but they lived in its payout phase. They received land, pensions, and a functional society. Many still believe they earned it, unable to recognize how thoroughly their reality was engineered from the start. Their children were left trying to replicate a model that no longer existed. Their grandchildren have grown up in the wreckage, wondering why their competence and effort never translate into traction.

This didn’t happen by accident. As I’ve documented in The Technocratic Blueprint, we’re witnessing the culmination of a century-long plan—a sophisticated pump and dump scheme where the bill is finally coming due. The architecture for this extraction has deep historical roots, dating back to systematic changes in how America was governed and how citizens were legally classified. What followed was a long, slow harvest of the population—one that disguised control as progress, debt as opportunity, and collapse as evolution. The postwar boom didn’t contradict that system—it lubricated it.

Now, the mirage is gone. What was once promised can no longer be afforded. The institutions that upheld the illusion are spent. They extract, but no longer inspire. They preach equity while enforcing dependence. They sell empowerment while removing agency.

And still, they insist the dream is alive.

But here’s where the extraction becomes truly sophisticated. As the traditional American Dream died, a new form of participation emerged: digital membership in what amounts to a global dollar club. As KF recently explained in his analysis of the GENIUS Act, stablecoins—digital bank accounts disguised as innovation—have exploded to serve 400 million users globally while generating massive profits for their issuers.

The trade-off is stark. Boomers got real assets with relative transactional privacy. The next generation gets digital “assets”—stablecoin wallets, app-based banking, algorithmic financial services—in exchange for comprehensive surveillance. What looks like financial inclusion is actually the infrastructure for total economic monitoring.

This represents the systematic replacement of real value with declared value across every domain. America has become a “club promoter” for the global dollar system, offering relaxed entry requirements that have drawn hundreds of billions into U.S. treasury-backed stablecoins. Users get access to “dollar-denominated wealth” through stablecoins that pay them no interest while the issuers pocket billions from the treasury yields. It’s the same extraction model that’s been systematically engineered through culture and media for decades, just scaled globally and digitized.

Experts in these systems, like Aaron Day, warn this represents a “backdoor CBDC”—applying existing financial surveillance laws to what was previously private money.

The surveillance trade-off is particularly insidious. In the short term, these systems offer less monitoring than traditional banks—no extensive paperwork, minimal identity verification. But once everyone is locked into the digital infrastructure, America can impose far stricter controls than ever before. Every transaction becomes trackable, every account becomes freezable, every economic participant becomes manageable.

We’re witnessing the replacement of physical ownership with digital access—and calling it progress. Where Boomers built equity in homes, the next generation builds balances in accounts that can be monitored, modified, or eliminated with keystrokes.

But charts don’t lie. That one chart—the brutal slope from 52% to 13%—says what no institution will admit: the old system is dead. It wasn’t lost. It was liquidated—and we were the product.

What gets built in its place remains an open question. The GENIUS Act’s full-reserve model could enable either unprecedented control—or the first real challenge to fractional-reserve banking in a century. But as Catherine Austin Fitts has pointed out, the Act contains no protections against programmable money, potentially creating private CBDCs with even less oversight than government-issued digital currency. As she explains, ‘the issuing is not centralized, it’s dispersed. But if you look at the control mechanism of a social credit system and we know the federal government is doing remarkable things to pull together all the data they need to do a social credit system controlled by private corporations, tech companies, essentially.’ The outcome isn’t predetermined—it’s being decided right now.

The good news is that once the spell breaks, you stop trying to win the rigged game. You stop competing for scraps and start building something real. Not a nostalgic replica of a world that’s gone—but a new structure, grounded in truth, agency, and actual sovereignty. The chart that documents the death of the old dream becomes the blueprint for something better—if we’re honest enough to read what it’s really telling us.

Loading recommendations…