Update (1050 ET):

Eli Lilly shares plunged the most since the Dotcom bust after the drugmaker’s oral obesity pill, orforglipron, met its primary endpoints but fell short of Wall Street’s expectations. Not even a strong earnings report (detailed in an earlier update) was enough to lift the stock in the early New York cash trading session.

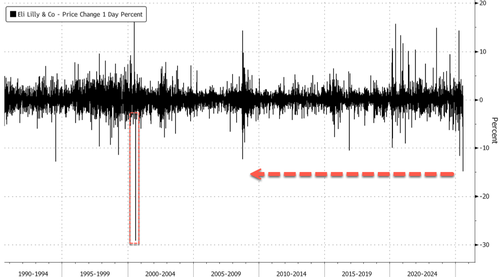

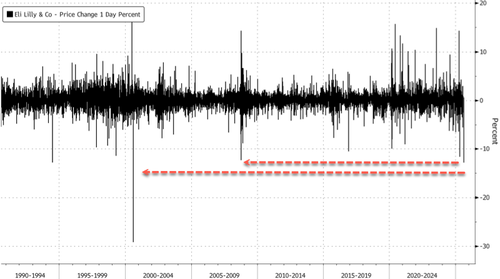

As of 10:15 ET, Lilly shares were down as much as 14%, marking the worst decline since a 29% crash on August 9, 2000. To record the sharpest decline in 25 years, shares needed to close over 12.35%, a level last seen on October 9, 2008.

Here’s Goldman analyst Asad Haider’s first take on Lilly’s second-quarter results and the trial data for orforglipron:

Overshadowing a strong 2Q earnings results, LLY announced results of the ATTAIN-1 trial for oral obesity pill orforglipron which met the primary endpoints but underwhelmed by coming at the lower-end of our and Street expectations, delivering 12.4% weight-loss at 72 weeks (vs. our 12-15% base case). Offsetting this, to some extent, the company delivered a strong set of 2Q25 results, and raised 2025 revenue guidance to $60-$62bn (vs. prior $58-$61bn).

More commentary from Wall Street desks (courtesy of Bloomberg):

Cantor, Carter Gould (overweight)

“The stand-out 2Q print – particularly Mounjaro OUS – and a $1.5 billion raise at the mid-point of the top-line will be overshadowed this morning by disappointing weight-loss seen in the ATTAIN-1 study of its oral orforglipron”

Says study data “looks a tier below that achieved with semaglutide, and comes in below the 13-15% we and the Street had expected”

Adds that “how much it will grow the market / franchise is now in doubt”

JPMorgan, Chris Schott (overweight)

Notes weight loss for the pill “was slightly below expectations (11% vs 13-15% expectation) with tolerability in line”

“While we expect some debate on the efficacy from today’s results, it is not clear to us that ~2 pct point lower weight loss meaningfully changes the use case for orforglipron”

Sees stock’s weakness as a buying opportunity

BMO Capital Markets, Evan David Seigerman (outperform)

Says study results likely underperform investor expectations but still shows a profile worthy of uptake

“Overall, this hits our bearish scenario, but we still see a path forward with orforglipron’s profile still usable for many patients”

Citi, Geoff Meacham (buy)

Says the 2Q quarter “had a solid print, though shares are weighed by conflicted opinions over orforglipron’s commercial opportunity given ATTAIN data”

“We continue to see immense growth in the space and are buyers on weakness”

* * *

Eli Lilly shares plunged in premarket trading after disappointing results from its new weight-loss drug (a pill, rather than an injection) overshadowed strong second-quarter results and raised full-year guidance.

Starting with the bad news: The topline data from the 72-week trial of orforglipron was underwhelming. Patients on the highest dose lost 11.2% of their body weight, compared to 2.1% for placebo. For comparison, Novo Nordisk’s Wegovy demonstrated an average of 15% weight loss over 68 weeks in late-stage trials, while Lilly’s Zepbound was around 20%.

Orforglipron’s results fall short of the current standard set by Wegovy and others, overshadowing strong second-quarter results and an increased full-year guidance.

Here’s a summary of Lilly’s second-quarter results:

Adjusted EPS: Came in at $6.31, a sharp increase from $3.92 a year ago. This shows strong profit growth.

Revenue: Tops $15.56B, up 38% year-over-year, and beat the $14.7B Bloomberg Consensus estimate.

Product Highlights:

Zepbound (obesity drug): Generated $3.38B, up 46% quarter-over-quarter, and beat the estimate of $3.07B.

Verzenio (cancer drug): Revenue was $1.49B, up 12% y/y, slightly misses the $1.52B estimate.

Mounjaro (diabetes/obesity): Brought in a massive $5.20B. It remains a blockbuster.

Other Notables:

- R&D Expenses: Spending rose to $3.34B, up 23% y/y, slightly above the estimate of $3.2B, indicating continued high investment trends in pipeline development.

In markets, Lilly shares in New York plunged as much as 12% in premarket trading. If the losses hold through the cash session, sustaining at least a 12.35% decline (last seen on Oct. 9, 2008), then it would mark the largest single-day drop since the 29% crash on August 9, 2000.

Wall Street also overlooked Lilly lifting both sales and profit forecasts for the year:

-

Revenue: Lilly now expects to bring in $60B to $62B this year, up from its previous forecast of $58B to $61B. Bloomberg Consensus estimate: $60.07, so the new guidance is slightly more optimistic than what Wall Street was expecting.

-

Adjusted EPS: Raised to $21.75 to $23.00, up from $20.78 to $22.28, signaling higher expected profitability.

Lilly’s decline sparked a bid in Novo shares.

Loading recommendations…