By Jane Foley Senior FX Strategist at Rabobank

Perhaps inevitably, the enthusiasm for AI related stocks in the past few years is now being replaced by questions regarding the returns on investment and specifically whether the costs of developing the technology will be matched in terms of the productivity growth it can create [ZH: actually, no: those questions emerged first last summer, but have been swept under the circle-jerking rug every single time].

The tail-end of the week brought further evidence of investors rotating into cyclical stocks. This had pushed the S&P 500 to a fresh record high at Thursday’s close as the market absorbed last week’s ‘as expected’ 25 bps Fed rate cut and its upward revision to US GDP forecasts. The slew of US data releases in the week ahead will be a strong determinate in how sentiment develops in the final weeks of the year.

In an interview with the WSJ on Friday, President Trump indicated that both Warsh and Hassett remain in the running for the job as the next Fed Chair. Trump reportedly commented that he thought the next Fed Chair should consult him on interest rate policy, though Hassett over the weekend remarked that the job of the Fed is to be independent.

The releases of Chinese retail sales, production, investment and home price data have already kicked off a heavy data week. Retail sales have disappointed with a weaker than expected 1.3% y/y upturn in November – the weakest reading since the pandemic. Chinese fixed asset investment also disappointed at -2.6% y/y ytd, which puts it on track to post the first full year drop since 1998. The weakness in property investment and new home prices compounded the weak tone and underpinned concerns about the challenges facing the Chinese economy in 2026.

Ukraine President Zelensky conceded over the weekend that the country would be willing to give up its long-term goal of Nato membership if security guarantees from the US and Europe were a way to prevent future Russian aggression.

US President Trump has issued Kyiv with a Christmas deadline to accept a peace deal. US Special Envoy Witkoff and Kushner, Trump’s son-in-law, arrived in Berlin yesterday for talks with Zelensky and German Chancellor Merz. The EU 27 will sit down for a summit on Thursday to discuss Ukraine, defence and its multiannual financial framework.

Week ahead

While the market consensus sees scope for another 50 bps of Fed rate cuts in 2026, the majority of G10 central banks are now expected to be tightening policy by the end of next year. Alongside the Fed, market pricing is also pointing to a 50-bps reduction in BoE rates by the end of 2026 in addition to 25 bps more easing by the Norges Bank. There is still a slight suspicion in the market that the SNB may return to negative rates next year. By contrast all other G10 central banks are expected to hike policy. At the start of last week, the ECB’s Schnable encouraged market hawks by her suggestion that she was comfortable with market bets on rate hikes. It is hoped that the rhetoric from the December 18 ECB policy meeting will bring some clarity to this view, though in terms of the policy announcement, a steady outcome is universally expected from the ECB this week. Indeed, it is Rabobank’s view that further easing this cycle would require a material downside surprise. For now caution will likely prevail, while policymakers continue to evaluate the impact on the Eurozone economy from US tariffs, France’s budget challenges and the competitive issues faced by Germany – not least this year’s firmer exchange rate. Although we expect steady policy throughout 2026, we have pencilled in two potential rate hikes in 2027 from the ECB.

Steady policy is also expected from the Norges Bank on December 18, although further easing has been signalled by Norwegian policymakers this cycle. Steady policy is also expected to be on the cards from the Riksbank on the same day, though Sweden could be in the running to be the first G10 country to see a rate hike this cycle. A rate cut is widely expected from the BoE on December 18.

Friday’s release of UK October GDP data disappointed the market with a weaker than expected -0.1% m/m print. The UK has now failed to see any growth for four consecutive months. The data underpinned fears that uncertainty leading up to the UK’s November budget created a drag on confidence and activity levels. At the November 6th BoE policy meeting there was a 5:4 vote in favour of steady rates. Governor Bailey is widely expected to switch sides and vote alongside the doves this week. That said, while UK CPI inflation appears to have peaked, the headline number at 3.6% y/y, is still showing signs of stickiness. This suggests that some element of caution can be expected from the MPC.

The other G10 central bank scheduled to vote on policy this week is the BoJ on December 19. The market now strongly expects a 25-bps hike. This marks a sharp shift in sentiment since, as recently as October, Takaichi’s appointment as PM had sparked widespread fears that she would lean on the central bank not to tighten policy. Last week Governor Ueda remarked that Japan had weathered the shock of US tariffs well and, in an interview with the FT, he expressed some confidence about the rise in underlying inflation towards the BoJ’s 2% target. The overnight release of Japan’s Quarterly Tankan report shows business confidence amongst large manufacturers improving to its best level in four years in Q4 – a reading which will have solidified market hopes for more BoJ rate hikes. Japanese November CPI inflation and December PMI data will be released this week ahead of the BoJ’s policy announcement.

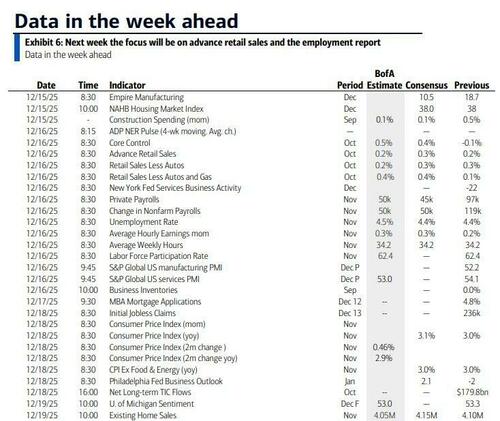

A slew of US data is due out this week as officials continue to make good the absence caused by the government shutdown. The market median points to a 50K gains in Tuesday’s November non-farm payrolls release combined with an unemployment rate of 4.5%. The data follow last week’s robust US export numbers, which had positive implications for US Q3 GDP. Tomorrow will also bring US October retail sales data and December PMIs. Other US releases this week include the December Philly Fed index, initial claims and November existing home sales. Plenty of Fed speakers are also slated this week. UK releases include Labour data and the November CPI inflation report. The latter is expected to show further signs in easing in UK price pressures, which would solidify market expectations for a BoE rate cut on December 18. UK November retail sales are due at the end of the week. PMIs plus Germany’s ZEW and IFO releases will ensure a European theme is included in this week’s data surge, while Canada will see a fresh CPI inflation report. In Australia, PMI data and consumer confidence numbers are due.

Loading recommendations…