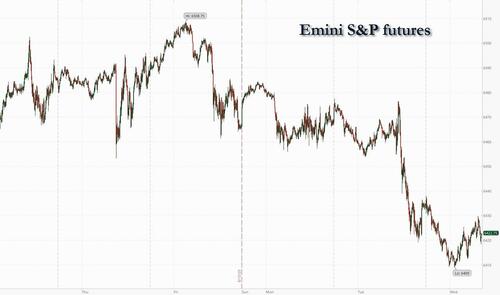

US equity futures are down and headed for a 4th day of losses, but trade well off session lows as markets assess if the sharp momentum selloff we have discussed for the past week will extend into today’s session: the JPM Momentum Basket (JPMPURE Index) is down more than 7% since the CPI print while Goldman said it’s time to resume buying momentum factor. As of 8:00am S&P futures are down 0.2%, after dipping 0.5% earlier in the session; Nasdaq futures are also down 0.2% after the index logged its second-biggest decline since April on Tuesday, with Mag7 names lower premarket ex-NVDA/MSFT; Defensives are outperforming Cyclicals. According to JPM “today feels like a test for the dip-buyers, as Flash PMIs tomorrow and Powell at Jackson Hole on Friday may prove to be market movers/narrative changers.” The yield curve is twisting flatter with the USD not flat. Commodities are seeing a bid across all 3 complexes highlighted by WTI. The macro data today is mortgage applications and Fed Minutes with tomorrow delivering Flash PMIs, jobless data, leading index, and existing home sales.

In premarket trading, Mag 7 stocks are mostly lower (Nvidia +0.05%, Microsoft +0.1%, Tesla -0.3%, Alphabet -0.5%, Meta -0.4%, Amazon -0.4%, Apple -0.5%). Target plunged 10% after saying management still sees a sales decline of low-single digit percentage. The company also named veteran Michael Fiddelke as its next chief executive officer, betting that the insider will rejuvenate sales and help the storied retailer regain its footing. Here are the other notable premarket movers>

- Analog Devices (ADI) rises 3% after the semiconductor-device company reported adjusted earnings per share for the third quarter that beat the average analyst estimate.

- Celldex Therapeutics (CLDX) falls 18% after the drug developer said it was discontinuing development of barzolvolimab in eosinophilic esophagitis after a Phase 2 study.

- Custom Truck One Source (CTOS) declines 4% after being downgraded at JPMorgan to underweight from neutral, on expectations that vocational truck sales will soften over the coming quarters due to weak orders data.

- Dayforce (DAY) rises 2% after the software firm said it’s in advanced discussions with Thoma Bravo regarding a potential acquisition for $70 per share.

- Estee Lauder (EL) falls 7% after issuing an annual adjusted EPS forecast that trails expectations. The organic sales decline for 4Q was slightly worse than expected, driven by Skin Care and Makeup segments.

- Hertz (HTZ) rises 10% after CNBC reported that the car-rental company will start selling pre-owned cars on Amazon Autos. Shares of Carvana (CVNA) decline 5%, while CarMax (KMX) drops 4%.

- La-Z-Boy (LZB) falls 22% after the home furniture retailer posted weaker-than-expected first-quarter adjusted earnings per share.

- Lowe’s Cos. (LOW) rises 3% after agreeing to buy Foundation Building Materials for about $8.8 billion in cash as it expands further beyond home-improvement supplies to serve more professional customers.

- Novavax (NVAX) drops 7% after BofA Global Research downgraded the vaccine maker to underperform from neutral, citing a “bumpy road” ahead.

- Nubank (NU) rises 2% as Citi double upgrades to buy from sell, with analysts saying the bank is now able to accelerate in key portfolios while maintaining good asset quality.

- Rocket Pharmaceuticals (RCKT) falls 18% after announcing that the FDA lifted the clinical hold on the Phase 2 trial of RP-A501 for the treatment of Danon disease.

- Toll Brothers (TOL) is down 2% after the luxury builder’s quarterly orders missed estimates as affordability challenges and economic uncertainty held back buyers.

Investors pared back positions in tech amid growing concern that the S&P 500’s recent record-breaking rally has run too far, too fast and has leaned heavily on a few growth leaders. That momentum will get a further test this week as focus turns to Jackson Hole, Wyoming, where Fed Chair Jerome Powell is set to speak on Friday with traders betting on a September cut in interest rates.

“This was a textbook case of profit-taking after a powerful tech rally,” wrote Bjarne Breinholt Thomsen, head of cross-asset strategy at Danske Bank A/S. “Yesterday’s move does not alter our tactical stance. On fundamentals alone, we would likely overweight tech. But when factoring in stretched positioning and valuations, we remain neutral.”

Investors are also waiting to hear whether Powell will validate current market expectations or counter them by stressing that fresh economic data arriving before the next policy meeting could alter the outlook. They’re also scanning for hints about how the Fed foresees the pace of rate cuts extending into next year.

“If we get an indication that they are more inclined to cutting interest rates, that will be more supportive again,” HSBC Head of APAC Equity Strategy Herald van der Linde said in a Bloomberg TV interview.

Europe’s Stoxx 600 is slightly higher after erasing an earlier drop, and edges closer toward a new high after erasing losses. Personal care stocks outperform, while industrials and construction shares are the biggest laggards. European tech stocks also decline. In the UK, money markets kept wagers on Bank of England interest-rate cuts broadly steady, seeing around a 40% chance of another reduction by year-end after inflation climbed for a second month in July. A full quarter-point cut had been expected earlier this month. Gilts rose, with the two-year yield falling four basis points at 3.93%. The pound fluctuated. Here are the biggest movers Wednesday:

- Emmi gains 6.4%, the most since 2024, after the Swiss dairy producer published solid results in a challenging environment, with a beat on organic growth driven entirely by the Americas segment, according to Vontobel

- Convatec shares rise as much as 6%, the most in two months, after the medical equipment manufacturer announced the start of a buyback program, with Morgan Stanley saying the announcement signals confidence

- Sensirion rises as much as 11%, the most since April, after the semiconductor device manufacturer posted results that beat analysts’ estimates, with higher sales volumes attributed to US demand for a refrigerant sensor product

- Ithaca Energy shares jumped as much as 8.6% to the highest level since February 2023 after the UK oil and gas company boosted its production forecast for the full year

- ASR Nederland climbs as much as 2.5% to a record high after the Dutch insurance company released first-half results. Morgan Stanley said it was another strong print, while KBC highlighted the good performance in the Life unit

- NEPI Rockcastle rallied as much as 3% in Johannesburg to its highest intraday level since Feb. 24 after the property investor posted Ebit for the first half that increased 10% year-on-year

- Paradox Interactive gains as much as 4.7% after the Swedish video game company announced release dates for two highly anticipated game releases, Europa Universalis V and Vampire: The Masquerade – Bloodlines 2

- Alcon drops as much as 11% in Zurich, the most since March 2020, after delivering sales growth below expectations in the second quarter and announcing downward revisions to its full-year net sales guidance

- K+S falls as much as 3.3% as Berenberg double-downgrades to sell, with previous buy thesis no longer standing up due to expectations of “broadly lower” prices for agricultural commodities from 2026

- Geberit falls as much as 4.3%, the most in more than four months, after the Swiss building materials firm reported a lower-than-expected Ebitda in the second quarter

- European defense stocks remain under pressure this morning after Russian President Vladimir Putin “agreed to begin the next phase of the peace process,” according to White House Press Secretary Karoline Leavitt

- UK housebuilder shares drop after inflation climbed for a second month in July, adding pressure on the Bank of England to reconsider its pace of interest-rate cuts

- LINK Mobility falls as much as 9.4%, the most since November last year and trimming large YTD gains, after the Norwegian communications technology group reported its latest earnings. DNB Carnegie sees a “minor miss”

- EVS Broadcast Equipment drops as much as 13%, the most since March 2020, as ING Bank describes the company’s first-half results as “very weak”

Earlier in the session, Asian stocks fell, as technology shares tracked declines in US peers amid valuation concerns ahead of upcoming key events. The MSCI Asia Pacific Index dropped 0.7%, falling for the third consecutive session, with TSMC and Softbank among the biggest drags. Taiwan led declines, with South Korea and Japan also notably in the red. Risk-off mood has gripped markets ahead of the Jackson Hole symposium, with Federal Reserve Chair Jerome Powell expected to speak on Friday. Investors also await Nvidia’s earnings next week for indications on the health of the artificial intelligence boom that has driven gains in global tech shares. Meanwhile, New Zealand stocks climbed after the nation’s central bank lowered its benchmark interest rate by 25 basis points. Indonesian stocks gained as the central bank surprised markets by cutting its benchmark rate for a second straight month and signaling more easing was on the table. Shares in India, Australia and China rose.

In FX, the Bloomberg dollar index is flat; the pound adds 0.1% on modest CPI support. The kiwi lags, down more than 1% after the RBNZ cut rates and flagged further easing. The krona is little changed after the Riksbank held policy as expected.

In rates, treasuries are steady, with 10-year yields flat at 4.30%. Gilts lead a rally in European bonds even as UK inflation topped forecasts, sending 10-year yields 4 bps lower to 4.70%.

In commodities, Brent crude rose more than 1% to around $66.60 a barrel while spot gold climbs $10.

Today’s US economic data calendar features FOMC minutes; the Fed speaker slate includes Governor Waller on payments at blockchain symposium at 11am and Atlanta Fed President Bostic at 3pm.

Market Snapshot

- S&P 500 mini -0.1%

- Nasdaq 100 mini -0.2%

- Russell 2000 mini little changed

- Stoxx Europe 600 little changed

- DAX -0.3%

- CAC 40 little changed

- 10-year Treasury yield little changed at 4.3%

- VIX +0.4 points at 15.94

- Bloomberg Dollar Index little changed at 1207.67

- euro little changed at $1.1637

- WTI crude +1% at $63/barrel

Top Overnight News

- McDonald’s is lowering the cost of its combo meals, after consumers were left sticker-shocked by Big Mac meals that climbed to $18 in some places: WSJ

- Trump posted “Could somebody please inform Jerome “Too Late” Powell that he is hurting the Housing Industry, very badly? People can’t get a Mortgage because of him. There is no Inflation, and every sign is pointing to a major Rate Cut. “Too Late” is a disaster!”

- Secretary Bessent is reportedly betting the crypto industry will become a crucial buyer of Treasuries in the coming years as Washington seeks to shore up demand for a deluge of new US government debt: FT.

- US is looking into taking equity stakes in chip makers in exchange for CHIPS Act funding, similar to the Intel plan: RTRS

- Estée Lauder Cos. issued a weak profit outlook for its fiscal year, dragged down in part by tariff costs.

- Xiaomi Corp. intends to sell its first electric vehicle in Europe by 2027, declaring plans to take on Tesla Inc. and BYD Co. globally after gaining traction with its year-old Chinese EV business.

- Novo Nordisk A/S implemented a global hiring freeze as the Danish drugmaker seeks to cut costs and regain its footing in the competitive market for weight-loss treatments.

- Baidu Inc.’s revenue fell, hurt by an economic downturn that’s capping its ability to fight bigger rivals in AI and make inroads in new growth areas.

- Temasek Holdings Pte is mulling one of its biggest overhauls in years, potentially reorganizing the firm into three investment vehicles in a bid to boost returns and efficiencies, according to people familiar with the matter.

- Shares of Chinese pop toy maker Pop Mart International Group Ltd. rose to a record after founder and Chief Executive Officer Wang Ning said the company could easily surpass its annual sales projection and announced plans to launch a new mini Labubu.

Shipments of phones within China -9.3% Y/Y at 22.6mln handsets in June (prev. -21.8% Y/Y at 23.72mln in May), via CAICT; shipments of foreign phones incl. Apple (AAPL) iPhones within China -31.3% at 1.97mln (prev. 9.7% at 4.54mln in May).

Trade/Tariffs

- US Treasury Secretary Bessent said the US has had very good talks with China and that China is the biggest revenue line in terms of tariff income, while he added that the status quo on China is working very well.

- Mexico will propose reinstating a North American Steel Committee to improve trade ties with the US, according to Bloomberg.

- Russian Embassy in India said INR payments being accepted by all Russian businesses; open to doing all oil trade INR too.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded mixed after a lacklustre performance stateside, where mega-cap tech led the declines amid AI-related concerns, while the region digested earnings and central bank updates including the RBNZ’s dovish rate cut. ASX 200 was led higher by outperformance in the top-weighted financials sector and with strength also seen in defensives, while participants also reflected on a slew of earnings updates. Nikkei 225 retreated beneath the 43,000 level amid continued profit taking from recent record highs and after mixed data in which Machinery Tools topped forecasts but trade data mostly disappointed and showed Japanese Exports suffered the largest decline in four years. Hang Seng and Shanghai Comp were varied as participants digested earnings releases including from Xiaomi and XPeng, while there was a lack of surprises from China’s benchmark Loan Prime Rates which were maintained at the current levels, although the PBoC continued with its firm liquidity efforts via 7-day reverse repo operations.

Top Asian News

- Chinese Foreign Minister Wang Yi said regarding a meeting with Indian PM Modi that after comprehensive and in-depth communication, China and India reached an agreement to restart dialogue mechanisms in various fields.

- India’s Foreign Ministry said India and China agreed to resume direct flight connectivity between the Chinese mainland and India at the earliest, while they agreed to the re-opening of border trade through the three designated trading points. Furthermore, they agreed to facilitate trade and investment flows between the two countries through concrete measures.

- RBNZ cut the OCR by 25bps to 3.00%, as expected, while it lowered OCR projections and stated if medium-term inflation pressures continue to ease as expected, there is scope to lower the OCR further. RBNZ stated that with spare capacity in the economy and declining domestic inflation pressure, headline inflation is expected to return to around the 2% target midpoint by mid-2026, and further data on the speed of New Zealand’s economic recovery will influence the future path of the OCR. RBNZ lowered the Official Cash Rate projection for December 2025 to 2.71% (prev. 2.92%) and to 2.59% in September 2026 (prev. 2.90%). The RBNZ Minutes revealed that the rate decision was made by a majority of 4 votes to 2 and the committee discussed three policy options: keeping the OCR on hold at 3.25%, cutting the OCR by 25bps to 3% or cutting by 50bps to 2.75%, but voted on the options of either reducing the OCR by 25bps or reducing the OCR by 50bps, while the case for lowering the OCR by 25bps was based on the upside and downside risks around the central projection being broadly balanced. Furthermore, RBNZ Governor Hawkesby said during the Q&A that the next two meetings are live but no decisions have been made, as well as stated that the OCR projection troughs at 2.5% and is consistent with further cuts, while whether they go faster or slower on cuts is up to the data.

- Baidu (9888 HK) Q2 (USD): EPS 1.90 (exp. 1.74), Revenue 4.57bln (exp. 4.60bln); AI cloud business continued to deliver robust growth.

European bourses (STOXX 600 -0.2%) are trading on the backfoot in a reversal of some of Tuesday’s upside and following on from the tech-led selling pressure seen Stateside. Stocks have been attempting to clamber higher as the morning progressed, with a few indices now holding around the unchanged mark. European sectors are overall mixed with a slightly defensive tilt given the current risk environment. Food, Beverage and Tobacco sits at the top of the leaderboard with Nestle (+1.2%) leading some of the upside, other sectors outperforming include Utilities, Telecoms and Insurance. To the downside, Basic Resource names lag.

Top European News

- ECB’s Lagarde said recent trade deals have alleviated but not eliminated uncertainty; EZ economy has proven resilient in the face of challenging global environment. Notes that projections show growth is expected to slow in Q3. ECB will factor the implications of the EU-US trade deal for the Euro area economy into the September projections, will guide decisions over the coming months. Europe should aim to deepen its trade ties with other jurisdictions outside of the US, leveraging the strengths of its export-oriented economy.

- UK Chancellor Reeves is drawing up plans to hit owners of high-value properties with capital gains tax when they sell their homes as she seeks to fill a GBP 40bln hole in the public finances, according to The Times.

- UK ONS said average UK House Prices increased 3.7% in the 12 months to June 2025 (vs 3.3% Y/Y).

- Riksbank maintains its rate at 2.00% as expected; still some probability of a further interest rate cut this year, in line with the June forecast. COMMENTARY: Developments in inflation and economic activity during the summer have deviated somewhat from the forecast in June, the Executive Board assesses that the outlook remains largely the same. Economic activity is weak. New information indicates that growth is still low. Households are still cautious with regard to their spending, and the labour market is not yet showing any clear sign of improving. Uncertainty regarding international developments also remains high, not least given US economic policy, the war in Ukraine and developments in the Middle East.

- Riksbank Governor Thedeen said it is far from certain that central bank will cut going forward, but there is a certain likelihood.

FX

- After two sessions of gains, the USD rally has paused for breath. There hasn’t been a clear driver for the upside seen at the start of the week with the macro narrative relatively unaltered heading into Powell’s Jackson Hole speech on Friday. FOMC minutes are due later today. However, they will likely be deemed as stale in some quarters given the aforementioned August jobs report hit just a few days after the meeting. Fed’s Bostic and Waller are due on today’s speaker slate. Note, the subject matter for the latter is on Blockchain payments. DXY has ventured as high as 98.44 with the next upside target coming via the 12th August peak at 98.62.

- EUR is marginally softer vs. the USD with it remaining the case that there has not been a great deal of incremental macro newsflow from the Eurozone. Remarks from ECB President Lagarde failed to engineer a move in the EUR today with the policy chief noting that recent trade deals have alleviated but not eliminated uncertainty. EUR/USD sits in close proximity to its 50DMA at 1.1644 and towards the bottom end of Tuesday’s 1.1639-93 range.

- JPY is flat vs. the USD with no material follow-through from mixed data in which Machinery Tools topped forecasts but trade data mostly disappointed and showed Japanese Exports suffered the largest decline in four years. That being said, the drop-off in exports could prompt some concern from those on the BoJ who expect a negative growth hit from the trade conflict with the US. USD/JPY currently sits towards the mid-point of yesterday’s 147.44-148.11 range.

- GBP is mildly firmer vs. the USD in the wake of hotter-than-expected UK inflation metrics, which saw headline Y/Y CPI advance to 3.8% from 3.6% (Exp. 3.7%) and services jump to 5.0% from 4.7% (Exp. 4.7%). The ONS has attributed some of this to the timing of school holidays, which has triggered a surge in airfares. However, given the outcome of the most recent BoE rate decision, which saw a higher-than-expected level of hawkish dissent, markets will likely further cement expectations that the BoE will slow down the current quarterly cadence of rate cuts. Cable has hit a 1.3509 peak but is still some way off Tuesday’s best at 1.3519.

- NZD is the standout laggard across the majors following the RBNZ rate decision, which saw the Bank cut the OCR by 25bps to 3.00%, as widely expected, while it also lowered its OCR forecasts across the projection horizon and revealed it had voted on the options of either a 25bps or 50bps cut at the meeting; 2 members backed a 50bps move.

- SEK is a touch softer vs. the EUR in the wake of the Riksbank rate decision, which saw policymakers stand pat on policy as expected. The decision to do so was predicated on the board’s balancing act in managing weak growth vs. above target inflation. That being said, the Bank still judges that there is still some probability of a further interest rate cut this year, in line with the June forecast. EUR/SEK is currently above its 200DMA at 11.1771 with upside capped by the 11.20 mark.

Fixed Income

- USTs are flat and underperforming vs peers, after trading with a slight downward bias overnight. Nothing specifically driving the underperformance, but perhaps some cooling from the upside seen in the prior session, where stocks took a beating. Some of the pressure could also be in part due to some positioning heading into a 20yr supply later. In terms of price action today, USTs were initially on the backfoot but global fixed income has caught a slight bid to trade in a 111-20 to 111-24 range. Auction aside, focus will be on commentary from the Fed’s Waller, Bostic and the reported Fed Chair candidate Zervos, who is to speak on CNBC.

- Bunds are outperforming vs peers today, with the bulk of the day’s action occurring at 07:00 BST. On that, there was some significant two-way movement in Bund futures as traders reacted to the UK CPI report (hotter-than-expected; details in Gilt section) and German Producer Prices (softer-than-expected). Elsewhere, no real move to commentary via ECB President Lagarde, who noted that projections show growth is expected to slow in Q3. Bunds traded towards highs at 129.35 into a dual tranche German auction, which had little follow through to price action.

- Gilts are firmer today, initially gapping higher at the cash open in catch-up to the strength seen in USTs in the prior session, but then saw some two-way action as traders digested the UK’s hot inflation report. Delving into the UK CPI report, it held a hawkish skew, with both Core and Headline figures incrementally higher, edging higher than the prior, more than expected. The accompanying commentary provided some reasoning, pinning the uptick on the “timing of this year’s school holidays”. Gilts are currently trading towards the upper end of a 90.43 to 90.88 range.

- Germany sells EUR 0.747bln vs exp. EUR 1.0bln 2.50% 2046 and EUR 1.15bln vs exp. EUR 1.5bln 2.50% 2054 Bund

Commodities

- Crude is firmer today as the complex attempts to trim some of the prior day’s losses, induced by geopolitics as renewed efforts are made to temper down the Russia-Ukraine conflict. This morning, the Russian Embassy in India said despite political situation, approximately same level of oil will be imported by India. As a reminder, Washington slapped India with a 25% penalty linked to oil purchases. Brent sits in a USD 65.81-66.57/bbl range.

- Spot gold languishes just above the prior day’s trough as participants await Fed policy clues from the incoming FOMC Minutes and Fed Chair Powell’s speech at Jackson Hole. Price action this morning sees the precious metals complex eking mild gains, with spot gold still trading under its 50 DMA (~3,348/oz) in a USD 3,311.56-3,327.61/oz range.

- Flat/mixed trade across base metals amid quiet newsflow and ahead of FOMC minutes. Copper futures lacked demand following the recent selling pressure and amid the mixed overnight risk appetite. 3M LME copper prices reside in a USD 9,684.75-9,729.00/t range.

- US Private Inventory Data (bbls): Crude -2.4mln (exp. -1.8mln), Distillate +0.5mln (exp. +0.9mln), Gasoline +1.0mln (exp. -0.9mln), Cushing -0.1mln.

- Norway Prelim July Production: oil 1.958mln BPD (prev. 1.675mln BPD in June); gas 10.2bcm (prev. 8.8bcm).

Geopolitics: Middle East

- “Israel’s Defense Minister Israel Katz has approved the IDF’s operational plan for an assault on Gaza City”; “As part of the new plan, the necessary reserve call-up orders will be issued to carry out the offensive.”, via Stein on X.

- Syrian Foreign Affairs Minister Al-Shaibani discussed de-escalation talks in Paris with the Israeli delegation and discussed “Strengthening stability in southern Syria”, according to Al-Hadath citing SANA.

- Iranian Foreign Minister said Tehran cannot completely cut ties with the IAEA, according to IRNA.

Geopolitics: Ukraine

- US President Trump said he wants to see what goes on when Zelensky and Putin meet, while he added they are in the process of setting the meeting up. Trump also said he gets along with Russian President Putin which is a good thing and commented that two nuclear powers getting along is a good thing.

- White House official said US President Trump and Hungarian PM Orban discussed on Monday Ukraine’s EU accession talks and Budapest as a potential venue for the Zelensky-Putin meeting.

- US Special Envoy Witkoff said progress was made on how to achieve a peace deal, according to a Fox News Interview.

- There was no violation of Polish airspace overnight, according to local press.

Geopolitics: Other

- North Korean leader Kim’s sister said South Korea cannot be a diplomatic counterpart to North Korea and South Korean President Lee cannot turn the tide of history, while she also stated that relations between the two Koreas will never return to the way South Korea wants, according to Yonhap and KCNA.

- Russian Embassy in India said Russian President Putin and Indian PM Modi are to meet in Delhi by year-end, no date finalised.

US Event Calendar

- 7:00 am: Aug 15 MBA Mortgage Applications, prior 10.9%

Central Bank speakers

- 11:00 am: Fed’s Waller Speaks on Payment at Wyoming Blockchain Symposium

- 2:00 pm: Fed Releases FOMC Minutes

- 3:00 pm: Fed’s Bostic in Moderated Conversation on Economic Outlook

DB’s Jim Reid concludes the overnight wrap

Markets have put in a divergent performance over the last 24 hours, with a pretty big contrast on either side of the Atlantic. In Europe, there was a fairly positive tone as speculation grew about some kind of breakthrough on a peace deal in Ukraine, with the STOXX 600 (+0.69%) reaching a 5-month high. But in the US, a sharp tech selloff gathered pace through the session, with the S&P 500 (-0.59%) posting its biggest decline since the underwhelming jobs report at the start of the month. And there’s been little sign of that relenting overnight, with nearly all the major indices in Asia moving lower this morning, whilst S&P 500 futures are down another -0.28%.

We’ll start with Europe, where markets saw a clear reaction amidst the latest developments about Ukraine. In part, that was a reaction to the White House meeting on Monday, which occurred after European markets had closed. But yesterday also saw Trump suggest that the US could be involved in security guarantees, and he said that “We’re willing to help them with things, especially, probably you could talk about by air, because there’s nobody that has the kind of stuff we have” though he again ruled out sending US troops to Ukraine. Trump also continued to encourage a deal, saying that “I hope President Putin is going to be good, and if he’s not, it’s going to be a rough situation”, and that Zelenskiy “has to show some flexibility also.” Meanwhile, Moscow remained non-committal on a potential Putin-Zelenskiy meeting that has been proposed by Trump, with Russia’s Foreign Minister Lavrov saying that such a meeting would have to be prepared “gradually… starting with the expert level and then going through all the required steps”.

This speculation about a diplomatic breakthrough meant that European assets saw some sizeable moves, particularly those most affected by the conflict. Indeed, it was notable that defence stocks really struggled yesterday, and Rheinmetall (-4.85%) posted the worst performance in the German DAX (+0.45%) yesterday, despite being the strongest performer over 2025 as a whole given the wider ramp up in defence spending. There was a positive reaction from Ukraine’s dollar bonds, with the 10yr yield down -8.4bps yesterday to a 4-month low, though the move partially reversed as the day went on with yields having been over -30bps lower intra-day. And the reaction was also clear among oil prices, with Brent crude (-1.22%) falling back to $65.79/bbl, having risen the previous day after investors viewed a ceasefire as increasingly unlikely.

Despite that weakness among defence stocks, the more positive sentiment meant European equities did very well more broadly. For instance, the STOXX 600 (+0.69%) was up to a five-month high, in a broad-based advance that saw almost every sector group move higher on the day. That was evident across the continent, and the UK’s FTSE 100 (+0.34%) hit a new record, whilst both Italy’s FTSE MIB (+0.89%) and Spain’s IBEX 35 (+0.34%) hit a post-2007 high as well.

But even as European markets had a strong performance, it was a different story in the US, where the S&P 500 (-0.59%) fell back for a third consecutive session. Indeed, it was the worst daily performance since August 1, back when the underwhelming jobs report meant investors grew more fearful about a US slowdown. That was driven by a slump among tech stocks, with the NASDAQ (-1.46%) seeing a larger fall, whilst the Magnificent 7 declined -1.67% with Nvidia (-3.50%) leading the moves lower. That said, apart from tech stocks, it was still a decent day for most US equities, with 70% of the S&P 500’s constituents still moving higher on the day. There was also a boost from Intel (+6.97%), which was the strongest performer in the S&P after the news that SoftBank had agreed to buy $2bn of Intel stock. Meanwhile, Home Depot (+3.17%) was the 7th-best performer after its own earnings release. So the equal-weighted S&P 500 was actually up +0.45% yesterday, even as the market-cap weighted index was down by a similar amount.

For sovereign bonds, the story was generally more positive as well, and 10yr US Treasury yields fell -2.7bps on the day to 4.31%. The move got support from the decision by S&P Global Ratings to keep the US’ AA+ credit rating, particularly after the Moody’s downgrade back in May. We also heard a bit more on the appointment of a new Fed Chair, as Treasury Secretary Bessent said he’d be meeting with the candidates “probably right before, right after Labor Day”, which is on September 1. He said the meeting would help “start bringing down the list” which is presented to President Trump. As a reminder, Powell’s term as Chair ends in late-May, and the new chair is usually announced in the months beforehand, pending confirmation by the Senate.

Elsewhere, Canada’s government bonds saw a particular outperformance after their CPI inflation data was softer than expected. Specifically, headline inflation came down to +1.7% (vs. +1.8% expected), which meant investors dialled up the probability of another rate cut from the Bank of Canada this year. Indeed, the probability of a rate cut at the next meeting in September went up from 26% on Monday to 35% by the close last night. By contrast, UK gilts underperformed ahead of their own CPI release this morning, with the 10yr yield up +0.3bps on the day to 4.74%. At one point, the 30yr gilt yield was on track for another post-1998 high as well, but it ultimately ended the session down -0.9bps at 5.60%. Elsewhere in Europe, 10yr yields moved slightly lower, with those on bunds (-1.3bps), OATs (-1.1bps) and BTPs (-0.1bps) all falling back a bit.

Overnight in Asia, the risk-off tone has continued with pretty much all the major indices moving lower. The Nikkei (-1.59%) has led the declines, which follows worse-than-expected export data for Japan showing the negative tariff impact. Specifically, export growth posted its biggest year-on-year decline since February 2021, with a -2.6% fall (vs. -2.1% expected). And exports to the US were down -10.1% year-on-year, so it’s clear the tariffs are having an impact. But there’ve been losses across the region, with the KOSPI (-1.36%), the Hang Seng (-0.57%), the CSI 300 (-0.12%) and the Shanghai Comp (-0.06%) all losing ground. The main exception to this has been in New Zealand, where the NZX 50 index (+1.44%) has surged after a dovish decision from the RBNZ overnight. They cut rates by 25bps, in line with expectations, but their forward guidance pointed to more rate cuts than before, with the Official Cash Rate seen falling to a low of 2.55% in early 2026, down from 2.85% back in May. So that’s led to a big reaction overnight, with their 10yr yields down -10.7bps, whilst the New Zealand dollar is down -1.05% against the US dollar.

Finally, there wasn’t much data yesterday, but we did get some US housing numbers. That included housing starts, which moved up to an annualised rate of 1.428m in July (vs. 1.297m expected), their highest in 5 months. However, building permits fell to an annualised 1.354m (vs. 1.386m expected), which is their lowest level since June 2020 as the economy was recovering from the initial wave of the pandemic.

To the day ahead now, and data releases include the UK CPI print for July. From central banks, we’ll hear from ECB President Lagarde, and the Fed’s Waller and Bostic. We’ll also get the minutes from the FOMC’s July meeting. Finally, earnings releases include Target, TJX and Lowe’s.

Loading recommendations…