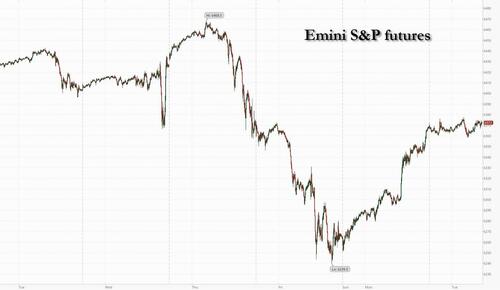

Risk is mostly higher again this morning, last Friday’s selloff long forgotten, with equity futures and macro credit opening stronger while the yield curve is bear flattening as rates sell off across the curve, and the USD is higher. As of 8:00am ET, S&P futures are up 0.3%, led by small caps, pointing to further squeeze potential from shorts put on as recently as Friday; Nasdaq futures gained 0.4% as Palantir’s blowout earnings beat and commentary added more fuel to the AI trade. Pre-market, semis are standing out with Mag7 names higher; Industrials are leading Cyclicals over Defensives. Staples are in the red as the market continues to buy most dips/anything AI related along with squeezing shorts (GS Most Short Rolling +3.9% yday). Trade tensions ratchet higher as geopolitics enter the debate. According to Goldman, along with rising rate-cut bets, there are enough positive drivers to outweigh lingering concerns about tariffs, with India becoming the latest target in Trump’s trade war. Overnight, Fed non-voter Daly said that she would “lean to thinking that every meeting going forward is a live meeting” given the softness in the labor market and no signs of persistent tariff-driven inflation. On the trade front, Swiss President Keller-Sutter and other Swiss officials, in addition to Japan’s trade chief, will travel to the US for separate trade talks. Looking ahead today, the President will speak on CNBC “Squawk Box” at 8am ET. Data wise, we have trade balance, and ISM services. We got better S&P Global Services PMIs out of China (52.6 vs cons 50.4) and Japan (53.6 vs cons 53.5) while Europe was more mixed as UK, Germany, Spain beat but France and Italy missed. There are no scheduled Fed speakers.

In premarket trading, Mag 7 stocks are higher (Amazon +0.5%, Tesla +0.4%, Nvidia +0.6%, Microsoft +0.5%, Apple +0.4%, Meta Platforms +0.3%, Alphabet +0.2%). Here are the other notable premarket movers:

- Agilon Health (AGL) sinks 33% after the company, which runs a platform for primary-care physicians treating Medicare patients, suspended its 2025 guidance and said CEO Steven Sell has stepped down.

- Ameresco (AMRC) climbs 21% after the electric energy company reported second-quarter revenue that beat the average analyst estimate as business in Europe drove growth.

- Caterpillar (CAT) falls 3% after reporting lower-than-expected quarterly profit as the cost of tariffs and slightly lower prices eroded margins for the company’s iconic yellow diggers and bulldozers.

- Hims & Hers Health (HIMS) slumps 13% after the telehealth company reported second-quarter revenue that disappointed, with analysts noting weak sales trends for its weight-loss drugs.

- Inspire Medical (INSP) tumbles 28% after the medical-device maker cut its revenue guidance for the full year and said the US commercial launch for its Inspire V system is going slower than expected. The news spurred at least four analysts downgrades.

- Kyndryl (KD) falls 8% after the IT firm reported a 2.6% drop in sales on constant currency terms, missing analyst estimates. That marked a slowdown versus the 1% growth that the company reported a quarter earlier.

- MercadoLibre (MELI) drops 5.5% after the e-commerce firm posted earnings that missed estimates, as it ramps up marketing spending to recruit more users.

- Oddity Tech (ODD) falls 7% after the consumer technology company posted second-quarter results that failed to meet investors’ high hopes.

- Palantir Technologies (PLTR) rises 6% after reporting a 48% increase in revenue for the second quarter, citing the “astonishing impact” of artificial intelligence technology on its business.

- Pfizer Inc (PFE) shares jumped more than 3% in premarket trading after the drugmaker beat analysts’ estimates for revenue and raised it earnings guidance.

- ThredUp (TDUP) rallies 12% after the clothing exchange and recycling company forecast revenue for the third quarter that beat the average analyst estimate.

- Vertex Pharmaceuticals (VRTX) falls 13% after the biotech firm said it won’t advance Journavx to a phase-3 trial, as the FDA doesn’t see a path forward for broad use of the drug to treat peripheral neuropathic pain. Another experimental drug, dubbed VX-993, failed a phase-2 trial for treating acute pain.

- Vimeo (VMEO) rises 15% after the video software company raised its 2025 forecast for adjusted Ebitda.

- Zoetis (ZTS) climbs 7% after the animal-health firm boosted its adjusted profit and revenue guidance for the full year, following better-than-expected results for the second quarter.

Traders are increasingly pricing in Fed rate cuts after Friday’s weak jobs report, which dragged down stocks and sent bond prices sharply higher. Equities have rebounded from their April lows, driven by growing conviction that corporate America can absorb the impact from tariffs and that the Fed will step in to stave off a recession.

“It seems like this is a bull market that you just can’t keep down for especially long, even if my conviction in the bull case has been shaken somewhat,” said Michael Brown, senior research strategist at Pepperstone Group Ltd. “It seems that all the equity bulls needed was a break over the weekend to think up a reason as to why they should be buying the dip.”

Fed San Francisco President Mary Daly said the time is nearing for rate cuts given mounting evidence that the job market is softening and there are no signs of persistent tariff-driven inflation, Reuters reported. Money markets are pricing in a more-than-80% chance of a 25-basis-point Fed rate cut next month, and a one-in-three probability of another by year-end.

Still, a growing number of strategists at some of Wall Street’s biggest firms is warning clients to prepare for a pullback as sky-high equity valuations slam into souring economic data. On Monday, Morgan Stanley, Deutsche Bank AG and Evercore ISI all cautioned that the S&P 500 Index is due for a near-term drop in the weeks and months ahead. The predictions come after a furious rally from April’s lows that propelled the gauge to levels it has never seen before.

“The question is whether bad news is bad news (economy slowing down) or good news (Fed moving toward rate cuts),” said Mohit Kumar, chief economist at Jefferies. “A modest weakening of the economy would be good news as it should be more easing from the Fed. However, a sustained and sharp rise in unemployment rates would be a negative as it would raise concerns over growth and earnings.”

Swiss President Karin Keller-Sutter and Economy Minister Guy Parmelin will fly to the US on Tuesday to present a more attractive trade offer in a bid to lower a 39% tariff imposed by Washington. The country’s benchmark stock index rose.

“There’s a lot of TACO thinking,” said Michael Kelly, global head of multi-asset at PineBridge Investments, using the acronym for “Trump Always Chickens Out.” “People have got used to the idea that every time a deadline comes on tariffs, it will be either delayed or diminished in some fashion. And to date, that’s been the right call.”

In Europe, the Stoxx 600 rose 0.3%, boosted by optimism over a September interest-rate cut from the Federal Reserve and strong earnings from BP and Diageo, among the day’s biggest gainers alongside DHL and Infineon. Naturgy is one of the biggest decliners after placing shares at a discount and Fresenius Medical Care falls following earnings. Swiss stocks also gain as traders appear willing to look past the threat of a 39% tariff on exports to America. Here are the biggest movers Tuesday:

- Smith & Nephew shares gain as much as 17%, the most since November 2020, after first-half earnings blew past estimates and the UK medical-device maker announced a $500 million buyback

- Diageo gains as much as 7% after the UK spirits maker reported results that included an increase in organic volume, beating estimates for a small decline. Analysts also took positives from better-than-expected overall earnings

- Deutsche Post gains as much 5.3%, the most since April, after the German logistics giant posted a strong second-quarter earnings beat against somewhat muted expectations, with analysts citing its cost control as a key positive

- Infineon gains as much as 5% after the German semiconductor maker posted reassuring earnings which were in line with expectations, analysts say. It shows that the firm is executing well in a difficult macroeconomic environment

- Hugo Boss shares gain as much as 4.3% after the luxury branded clothes retailer reported second-quarter Ebit that beat the average analyst estimate. Analysts at RBC note strong cost control even as the outlook remains challenging

- Rotork shares rise as much as 5.8% after the maker of mission-critical flow control systems and instruments reported results that met expectations. The update was accompanied by good order growth, analysts say

- Interroll shares rise as much as 6.5% after analysts at Jefferies upgraded the stock to buy, saying “the tide is turning” in the warehouse automation sector. The analysts also set a new Street-high price target on Kardex

- Gerresheimer shares gain as much as 4.8% after the German cosmetics and medical-packaging maker said it’s planning to sell its moulded glass business as part of an effort to focus on pharma and biotech customers

- Naturgy falls as much as 8.2%, making it the worst performing stock on Spain’s IBEX-35, after a share placement at a discount; company says sale is to improve liquidity and facilitate inclusion in main stock market indexes

- Fresenius Medical Care shares drop as much as 7% to the lowest since April after the German provider of dialysis care and equipment reported flat growth for US same-market treatment in the second quarter

- Continental shares fall as much as 2.8% after the German firm reported adjusted Ebit for the second quarter that missed the average analyst estimate, with brokers citing tariff and FX-led tire division weakness

- Oerlikon declines as much as 14%, the most in four months, after the Swiss industrial technology company lowered its full-year guidance. Vontobel cut its price target and estimates to reflect the continued tough business environment

- Domino’s Pizza slumps as much as 20%, with the stock dropping to its lowest since Oct. 2014, as the firm cut its full-year guidance. Analysts note a continued tough trading environment and the lower target for new openings

The stock market is meting out the harshest punishment in decades to companies that fall short of earnings estimates in Europe this quarter, according to Goldman Sachs Group Inc.

Earlier in the session, Asian stocks rose, helped by a jump in technology shares, as risk sentiment rebounded amid increasing bets on easier monetary policy from the Federal Reserve. The MSCI Asia Pacific Index rose as much as 0.8%. TSMC, Tencent and SoftBank were among the biggest boosts, with sentiment aided by gains in US tech megacaps Monday. Major equity gauges rose more than 1% in South Korea, Taiwan and Australia, while Vietnam’s benchmark jumped as much as 3.7% before paring the advance. Momentum is returning to Asian markets this week after Friday’s tepid US jobs data prompted investors to bake in a September Fed cut. Meanwhile, Indian stocks dipped slightly after US President Donald Trump said he would “substantially” raise tariffs on the South Asian nation’s exports over its purchases of Russian oil.

In FX, the Bloomberg Dollar Spot Index rises 0.2%. The Swiss franc and Japanese yen are the weakest of the G-10 currencies, falling 0.3% each.

- USD/JPY +0.1% to 147.60

- EUR/USD -01% at 1.1536

- GBP/USD little changed at 1.3292

In rates, Treasuries decline in the early US session as investors set up for the start of this week’s Treasury auctions. US yields cheaper by 3bp to 1bp across the curve in a bear flattening move, as front-end leads losses ahead of $58 billion 3-year note sale. US 10-year yields trade around 4.215%, higher by 2.5bp on the day with bunds and gilts outperforming by 0.5bp and 1.5bp in the sector following debt sales out of both Germany and UK.

In commodities, oil extended declines as investors weighed the impact of risks to Russian supplies, with US President Donald Trump stepping up his threat to penalize India for buying Moscow’s crude. Oil prices fall for a fourth day, with WTI crude futures down 1.2% near $65.50 a barrel. Spot gold also drops $10 to around $3,363/oz.

Looking ahead today, the President speaks on CNBC “Squawk Box” at 8am ET. Data wise, we have trade balance, and ISM services. We got better S&P Global Services PMIs out of China (52.6 vs cons 50.4) and Japan (53.6 vs cons 53.5) while Europe was more mixed as UK, Germany, Spain beat but France and Italy missed. There are no scheduled Fed speakers.

Market Snapshot

- S&P 500 mini +0.3%

- Nasdaq 100 mini +0.4%,

- Russell 2000 mini +0.4%

- Stoxx Europe 600 +0.4%

- DAX +0.4%

- CAC 40 +0.1%

- 10-year Treasury yield +2 basis points at 4.21%

- VIX -0.1 points at 17.44

- Bloomberg Dollar Index +0.1% at 1212.32

- euro -0.2% at $1.1543

- WTI crude -1% at $65.61/barrel

Top Overnight News

- Texas Governor Greg Abbott ordered the arrest of Democratic lawmakers who left the state to block a vote on new congressional maps, saying “Texas House Democrats abandoned their duty to Texans”.

- White House is preparing an executive order that would fine banks for dropping customers for political reasons: WSJ.

- Federal Reserve Bank President Mary Daly on Monday said that given mounting evidence that the U.S. job market is softening and no signs of persistent tariff-driven inflation, the time is nearing for interest rate cuts and that we may need more than two cuts this year. RTRS

- A private gauge of China’s services sector showed activity expanded at the fastest pace in more than a year in July, as demand improved during the summer travel rush. Caixin services PMI for Jul comes in very strong at 52.6, up from 50.6 in June and above the consensus forecast of 50.4. WSJ

- Taiwan prosecutors arrested six people suspected of stealing trade secrets from Taiwan Semiconductor Manufacturing: Nikkei

- Japan’s trade chief heads to the US to push for a promised car tariff cut. BBG

- Japan’s 10-year auction drew weak demand, which signals discontent at BOJ’s delay in rate hikes. Meanwhile, board members said cutting back the BOJ’s buying of JGBs too quickly might have an unforeseen impact on markets, June meeting minutes showed. BBG

- Swiss President Karin Keller-Sutter and Economy Minister Guy Parmelin will fly to the US on Tuesday in order to present a more attractive trade offer in a bid to lower the 39% tariff Washington put on Switzerland. BBG

- When the House and Senate return from their month-long August recess, lawmakers will have just four weeks to avert a government shutdown — and some kind of kick-the-can funding patch is all but guaranteed. Politico

- The White House may issue an executive order as soon as this week, penalizing banks for dropping customers over political views amid perceived discrimination against conservatives and crypto companies. BBG

- Palantir shares gained premarket (PLTR +6.5% pre) after it reported a 48% jump in revenue last quarter, citing the “astonishing impact” of AI. The stock has surged more than 500% over the past year. BBG

- The US is exploring ways to equip AI chips with better location-tracking capabilities, as it tries to stop smuggling and the flow of semiconductors made by the likes of Nvidia to China. BBG

- Pfizer raised its profit forecast for the year with the drugmaker’s ongoing cost cuts helping to make up for a lack of sales growth: BBG

- S&P 500 year/year EPS growth is tracking at 9% so far for 2Q. The bottom-up consensus of analyst estimates expected 4% growth at the start of the earnings season. Both revenues and margins have contributed the positive earnings surprise, with the average earnings surprise tracking at +8% and the average sales surprise tracking at +3%. Goldman

Trade/Tariffs

- EU official says already seeing implementation of EU-US framework trade deal, says in the US executive order, seeing all-including tariff rate of 15%. Means most favored nation rate is included within the US 15% rate. 15% rate on section 232 such as Pharma will kick in once US investigation is complete. 15% rate applies on cars. Steel discussions taking longer, need to discuss volumes. Talks are “pretty advanced” on a deal. Joint statement “pretty much ready”; “waiting for US to get back to us”. Cannot say when statement will be released. The joint statement is not legally binding (reiteration). Alternative to a US deal would be an escalation of tariffs.

- EU Trade Chief Sefcovic says he is in contact with US Commerce Secretary Lutnick and USTR Greer; talks continue in a “constructive spirit”.

- US is exploring better location trackers for AI chips to curtail flows to China, according to Bloomberg.

- Canada said Canadian ministers Anand and Champagne are to travel to Mexico this week.

- Brazil’s Supreme Court Justice ordered a house arrest of former Brazilian President Bolsonaro, while the US State Department later condemned the order imposing house arrest on Bolsonaro and said it will hold accountable all those aiding and abetting sanctioned conduct.

- Russian Kremlin, on US pressure against India, says that the US’ attempt to stop nations from trading with Russia is illegal.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were mostly higher following the rally on Wall St where the major indices clawed back post-NFP losses amid rate cut hopes. ASX 200 ascended with every sector in the green and outperformance in real estate, tech, and consumer discretionary. Nikkei 225 took impetus from global peers and shrugged off a firmer currency with earnings releases remaining a driver for individual stocks. Hang Seng and Shanghai Comp were ultimately kept afloat after the latest S&P Global PMI figures which showed a strong acceleration in Services PMI, while Composite PMI cooled but remained in expansionary territory.

Top Asian News

- BoJ Minutes from the June Meeting stated many members said inflation is somewhat overshooting forecasts, but must scrutinise economic developments due to downside risk to growth from US tariff policy and members shared the view that the BoJ is expected to continue raising the policy rate if the economy and prices move in line with its forecast. Furthermore, one member said must support economy with current rate level as underlying inflation likely to stagnate temporarily and a member said the rate hike phase may be on pause for time being, but the BoJ must respond nimbly and resume hiking rates depending on US policy development.

- Japanese Cabinet Office lowered its FY25 GDP forecast amid the impact of the US tariff policy, according to Nikkei.

- Foxconn (2317 TT) July revenue +7.25% Y/Y (vs. +10.09% Y/Y in June).

- China’s Auto Industry CPCA revises up 2025 car sales forecast by 300k units to 24.35mln units; revises up China car exports forecast by 160k to 5.46mln units

European bourses (STOXX 600 +0.2%) opened broadly in modest positive territory, but have marginally slipped off best levels as the morning progressed. News flow recently has been very light, and we are still awaiting details regarding who US President Trump’s new Fed/BLS appointees will be, after one walked and the other got the boot. Trump is due to speak on CNBC at 13:00 BST / 08:00 EDT. European sectors hold a strong positive bias, with only a handful of sectors residing in marginal negative territory. Food Beverage and Tobacco tops the pile, with Diageo (the third largest weighting in the sector), popping at the open. Energy follows closely behind, as heavyweight BP benefits from strong results and as it initiates further cost reviews.

Top European News

- UK FCA head warned UK lenders must stop “haggling” over a planned multibillion-pound redress scheme for consumers mis-sold car finance, according to FT.

FX

- DXY has mildly extended on Monday’s attempted recovery, albeit, upside is modest in comparison to the hefty sell-off seen post-NFP on Friday. The rally in the USD remains tempered by the recent downside in the US rates space as markets continue to price in the likelihood of a September rate cut. Note, markets still await Trump’s replacement for Fed’s Kugler and the head of the BLS. On the Fed, non-voter Daly stated that she is of the view that the FOMC cannot wait to be certain there is no inflation persistence and need to make a call based on what’s most likely. For today’s docket, the main highlight is the July ISM services report with the headline expected to rise to 51.5 from 50.8. DXY has ran into resistance at the 99.0 mark. If breached, there is clean air until the 100 level.

- EUR/USD is lower with the pair continued to primarily be led by fluctuations in the USD. Incremental macro drivers for the Eurozone remain on the light side asides from commentary by an EU official that it is already seeing the implementation of the EU-US framework trade deal, which is providing an all-including tariff rate of 15%. As a caveat, the official reiterated the EU’s line that the joint statement is not legally binding. EUR/USD remains on a 1.15 handle with the pair currently capped by its 200DMA at 1.1586.

- JPY softer vs. the broadly firmer USD and back on a 147 handle after USD/JPY delved as low as 146.63 overnight. On the trade front, Japanese trade negotiator Akazawa is to leave for Washington today, looking to press US President Trump into signing of an executive order that would bring an agreed cut to tariffs on Japanese auto imports into effect, according to Reuters. BoJ minutes passed with little in the way of fanfare given they were from the June meeting.

- GBP steady vs. the USD as newsflow surrounding the UK remains light with an upward revision to services and composite PMI data unable to stoke a reaction in GBP. That will change on Thursday with the latest BoE policy announcement and MPR, which is 82% priced for a 25bps reduction. Cable remains tucked within Monday’s 1.3254-3331 range.

- Antipodeans are both are on the backfoot vs. the USD after an indecisive session yesterday. The USD is providing the greatest source of traction for AUD/USD and NZD/USD amid the absence of tier-1 data from Australia and New Zealand, while the latest Chinese PMI data was somewhat mixed.

- PBoC set USD/CNY mid-point at 7.1366 vs exp. 7.1667 (Prev. 7.1395)

Fixed Income

- A modestly softer start to the day for USTs. Newsflow thus far has been light and the morning’s price action is seemingly just a slight pullback from the marginal extension above post-NFP highs seen on Monday, rather than any overt bearish move. Thus far, USTs are down to a 112-07+ low, pulling back from Monday’s 112-14 peak but still clear of the WTD 111-31+ base. Ahead, a busy US docket with ISM Services, RCM TIPP, Atlanta Fed’s GDPNow and a 3yr Note auction all scheduled. Additionally, POTUS will be appearing on CNBC at 13:00BST. From Trump, we are attentive to any clues as to who the Fed board, and by extension Chair, nominees will be after Trump said on the weekend that he would be making an announcement on it this week, in addition to the new BLS head.

- Bunds began the morning on the front foot, with Bunds up to a 130.60 peak with gains in excess of 30 ticks at one point. However, this has been gradually paring across the morning with the benchmark down to a 130.16 trough with downside of just over 10 ticks at most. Initial upside was seemingly an extension of the strength seen on Monday, with the benchmark picking up into the European cash equity open. Thereafter, a modest pullback began into the morning’s Final PMIs. Though, to be clear, the PMIs do not appear to have driven the action. In brief, the final releases have been subject to two-way revisions. For the bloc as a whole, both Composite and Services were subject to modest revisions lower. PPI printed in-line with consensus, no sustained reaction scene on the release though the subsequent UK auction result (strong, see below) appears to have lifted the fixed complex from lows across the board. German auction was also fairly decent, but sparked no move.

- UK specific newsflow a little light once again as we count down to the BoE later in the week. Markets currently almost fully price in a rate cut, though the actual decision is unlikely to be that simple with a three-way split very possible. UK PMIs were revised a little higher but had limited impact on UK paper. In terms of today’s action, Gilts opened a tick lower at 92.64 before extending to a 92.84 peak acknowledging the initial upward bias seen in EGBs. Thereafter, gradually drifted across the morning to a 92.48 low with downside of just under 20 ticks at most. Supply this morning was strong, with a 3.33x b/c (prev. 2.89x), helping lift the benchmark from the above low by around 15 ticks and back to essentially unchanged on the session

- UK sells GBP 4.5bln 4.5% 2035 Gilt: b/c 3.33x (prev. 2.89x), average yield 4.522% (prev. 4.635%) & tail 0.1bps (prev. 0.2bps

- Germany sells EUR 3.916bln vs exp. EUR 5bln 1.90% 2027 Schatz: b/c 2.50x (prev. 2.3x), average yield 1.90% (prev. 1.87%) and retention 21.68% (prev. 22.02%

Commodities

- Initial choppy trade in the crude complex, but has recently traded with a downward bias; currently trading at lows. WTI resides in a 65.50-66.39/bbl range while Brent sits in a USD 68.205-69.87/bbl range.

- Precious metals are mostly lower trade as the dollar regains some composure with DXY back on a 99.00 handle. Price action this morning has been contained for the yellow metal, with support found on Monday near its 50 DMA (USD 3,344.59/oz today), as spot gold resides in a USD 3,365.79-3,382.37/oz range at the time of writing.

- Mostly softer trade across base metals amid the firmer dollar, although macro newsflow this morning has been rather light. Overnight, copper was kept afloat alongside the mostly positive risk environment and after the latest PMI data from China, which was somewhat mixed but showed an acceleration in China’s services industry. 3M LME copper prices reside in a USD 9,659.95-9,751.00/t range.

- Libya’s National Oil Corporation signed an MoU with Exxon (XOM) following a decade-long halt in activity.

- Saudi Aramco says it anticipates oil demand in H2 to be over 2mln BPD above H1 levels; continue to invest in various initiatives, incl. new energies and digital innovation focused on AI.

Geopolitics

- Russia’s Medvedev blamed NATO countries for the end of the moratorium on short and medium-range missiles, while he stated that Moscow will take further steps.

- Russia’s Kremlin says Russia no longer considers itself bound by any limits on intermediate-range missile deployment.

- Israel PM Netanyahu will convene a meeting on Gaza and the hostage deal, via journalist Stein citing an Israeli official; official adds, US Envoy Witkoff returned to the US with “a broad consensus that a deal must include all of the hostages”.

US Event Calendar

- 8:30 am: Jun Trade Balance, est. -61b, prior -71.52b

- 9:45 am: Jul F S&P Global U.S. Services PMI, est. 55.2, prior 55.2

- 9:45 am: Jul F S&P Global U.S. Composite PMI, est. 54.6, prior 54.6

- 10:00 am: Jul ISM Services Index, est. 51.5, prior 50.8

DB’s Jim Reid concludes the overnight wrap

Markets have stabilised over the last 24 hours, with the S&P 500 (+1.47%) reversing the majority of Friday’s losses after the disappointing labour data and the news of two important people leaving their posts. This came as investors further increased their speculation that the Federal Reserve would ease policy in September. The mood has been helped by a decent Q2 earnings season so far.

While US rates initially saw a moderate sell-off in the European morning, this reversed later in the day with 10yr Treasuries yields lower by -2.4bps by the close to 4.192%, and the 30yr down -3.1bps to 4.79%. This came as the probability of a rate cut for the September meeting grew to 97%, after having finished last week at 87% (40% before payrolls), as investors expect the Fed to shift their view on the state of the labour market after last week’s payrolls. This was given further credence when San Francisco Federal Reserve Bank President Daly (non-voter) said that two rate cuts this year was “an appropriate amount of recalibration,” and that the FOMC “should be prepared in my judgment to do more if the labor market looks to be entering that period of weakness and we still haven’t seen spillovers to inflation.”

Elsewhere in Europe, fixed income bonds saw a large rally on the back off strong real money demand with 10yr Bunds -5.5bps, and 10yr OATs -6.5bps lower, however the largest gains were in BTPs, where 10yr yields were -7.9bps lower.

Ahead of the new August 7th trade deadline for implementing US tariffs there were some headlines out of Europe and the White House. First regarding the 39% tariff levied against Switzerland, the Swiss government put out a statement yesterday saying that they are “ready to present a more attractive offer, taking US concerns into account and seeking to ease the current tariff situation.” This comes after reports that most Swiss officials were anticipating a similar deal to the UK or EU and were taken by surprise by the significant tariff increase. The surprise hike seemingly stems from the large trade surplus the country has with the US, mostly due to Switzerland’s outsized gold exports as well as pharmaceuticals. The country noted yesterday that the trade balance “is not the result of any ‘unfair trade practices’.” Due to the public holiday last Friday, yesterday was the first day the Swiss market reacted to the tariff news with the SMI index initially down -1.9% after trading opened, before paring those loses to close down -0.15% on the day. So, we will see what Switzerland has to offer.

Later on in the day, President Trump said he will substantially raise tariffs on Indian exports as the country continues to purchase oil from Russia. President Trump stated that “India is not only buying massive amounts of Russian oil, they are then selling it on the Open Market for big profits”, and that “they don’t care how many people in Ukraine are being killed by the Russian War Machine.” The President did not say to what level the tariff rate could go, which currently sits at 25% following last week’s announcement. The threats came as reports appeared that Prime Minister Modi has urged the population to buy locally produced goods in a bid to deter people from imported products, and that the Indian government hasn’t given India’s oil refiners instructions to stop buying Russian oil. Bloomberg reported last week that refiners were told to come up with plans for buying non-Russian crude, but the story stated one of the people said the instruction amounted to scenario planning in case Russian crude were to become unavailable. Indian Foreign Ministry spokesperson Randhir Jaiswal said yesterday that their relationship with Russia is a “steady and time-tested partnership.”

There was greater focus on Crude yesterday following the announcement over the weekend that OPEC+ would increase production by 547,000 barrels per day in September. This increase will fully unwind the 2.2 million barrels per day production cuts that were announced back in November of 2023 about a year ahead of time. This is notable given ongoing concerns about how US tariffs can affect global growth, and so the group will now monitor how demand progress ahead of a follow-up meeting in early September. Between the increase in production and expectations that more could be put back online as well as the news on India’s use of Russian crude, oil markets whipsawed a bit yesterday, before settling lower. Brent crude closed down -1.31% at $68.76/bbl and are a couple of tenths of a percent lower again this morning.

The fall in oil prices caused the S&P 500 Energy subsector to lag (-0.44%), even as the S&P 500 as a whole gained +1.47% in its best single trading session since late-May. Technology and Media led the way as the Nasdaq was up +1.95%, and the Magnificent 7 up +2.04%. This rally came ahead of Palantir’s earnings after the close where the company announced a 48% rise in revenues on the back of an “astonishing impact” of AI on its business, with the company’s shares trading +4.6% higher in post-market trading after gaining +4.1% during yesterday’s session. The beat is an ongoing trend so far, as 82% of S&P 500 companies have beat earnings expectations this season, which is well above the historical average as our Equity Strategists highlighted in their note yesterday here. On the other side of the Atlantic, markets gained as well with Stoxx 600 up +0.90%, and DAX up by +1.42% on the day.

In other news, Tesla’s board of directors awarded Elon Musk a package of 94m additional shares, worth about $30bn, sending Tesla shares +2.20% higher.This was done to retain the CEO within the company, citing that Musk has been a “leader who is a magnet for hiring and retaining talent at Tesla”, even though Tesla shares have been down -25% since the beginning of the year.

Yesterday saw a continued reversal of the recent dollar strength. The dollar index fell by -0.36% after a -0.83% fall Friday, as traders are assessing the value of the greenback in anticipation of more uncertainty following the firing of the head of the Bureau of Labor Statistics. Investors will be keeping an eye on who the White House puts forward for both the head of the BLS as well as the potential replacement of Fed Governor Kugler.

We are mostly edging higher this morning in Asia, led by the Kospi (+1.41%) , buoyed by better-than-expected PMI data, with the S&P/ASX200 (+1.14%) continuing to extend its gains this week. In China, the June services PMI data was stronger than expected at 52.6 (vs. 50.4 expected), which led to a rally in both the CSI (+0.34%) and the Shanghai Composite (+0.53%). Meanwhile, the Nikkei (+0.77%) has recovered some of yesterday’s declines, following a slight improvement in PMI services that increased to 51.6 (vs. 51.5 prior). Japanese rates have also experienced another rally, with 10yr JGB yields lower by -4.6bps, and 30yr yields down -2.2bps. S&P 500 (+0.18%) and NASDAQ 100 (+0.22%) futures are slightly higher.

Looking at yesterday’s data releases, the main prints in a quiet day came out from the US where new factory orders printed in line with expectations at -4.8%, and durable goods orders came in slightly below consensus at -9.4% (vs. -9.3% expected). There was a slight downward revision to core shipments which would imply about a tenth or two downgrade to Q2 GDP, which was initially reported at 3.0% last week.

To the day ahead now, the main highlights will be the US July ISM services, and June trade balances, while in Europe we will receive a fresh batch of PPI data. In terms of earnings, the focus will be on AMD, after last week’s disappointing releases from Qualcomm and ARM.

Loading recommendations…