Authored by Mark Jeftovic via DollarCollapse.com,

From my monthly Bitcoin Capitalist Letter to subscribers, after a lengthy look at bond yields, and how they’ve been going the wrong direction ever since the Fed’s half-point cut last September, I remarked on the following:

“The US is flooding the bond market with so much supply to fund deficit spending, that bond prices are falling.”

It’s also worth noting that the yields on the US 30-year are also running hot:

Looking like they could crack 5% at some point, and the Treasury’s most recent projections on the next couple quarters of debt issuance might help tip the scales:

The Treasury released their borrowing estimates.

$1.6T in net new debt issuance over the next two quarters. About $500B of it is the TGA refill. pic.twitter.com/3IEBz0mKbc

— Lyn Alden (@LynAldenContact) July 28, 2025

We frequently talk about the global financial system “flashing bright red warning lights” and “slowly coming unglued” – this is exactly what we mean.

Weird divergences between policy rates and bond yields, bizarre mis-pricings in the market (i.e: German 30-year paper trades at the same rate as Japan’s. German interest rate: 2.25%, debt-to-GDP: 62%. Japan? 0.05% interest rate and 250% debt-to-GDP. Both 30-year bonds yield 3.1%).

How can that be possible?

It means the global bond markets are cracking up – and remember something else we’ve always said from the very beginning: our base case thesis for Bitcoin is that it’ll have multi-decade long tailwinds in the form of a secular bond exodus.

How many are aware that US M2 just hit fresh all-time highs, nudging past COVID levels after a brief (not to mention aberrant) period of tightening?

The US government is now adding an extra trillion dollars in debt every 100 days.

As I went on to remark in the letter:

You don’t hear any of this being scrutinized on CNBC or in the Financial Times because it’s just too big to think about, let alone rectify.

The M2 high was posted in the June dataset and there’s been no real acknowledgements of it. It was remarked upon at the time by Rob & Sam Kovacs via Seeking Alpha and Coindesk ran a piece about a week later, which did trickle out via Yahoo Finance. That’s about it.

The “conventional wisdom” around Bitcoin (and for readers of DollarCollapse, who are perhaps more interested in gold) was that these assets required low interest rates and rising money supply to make “number go up”, but the first two years of this cycle saw BTC go practically straight up, against a blistering rate hiking cycle and declining M2.

(When it comes to gold, I also like to point out to those who say it requires lower rates, that the entire second leg of the 1970’s gold super-spike occurred against a backdrop of rising real rates).

What happens now that rates really have one direction to go (yields be damned, more inflation) and M2 is back on track to infinity?

Gold and Bitcoin have been taking turns notching up all-time highs for about the last year, and now M2 is joining the race.

After I put out this month’s issue, the Aug 6th US 10-year auction “tailed”, with the lowest bid-to-cover in a year. This is telling us that US debt, ostensibly the global financial systems “risk free” asset. is increasingly being seen as more risky (“return free risk”, as Lacy Hunt once dubbed bonds).

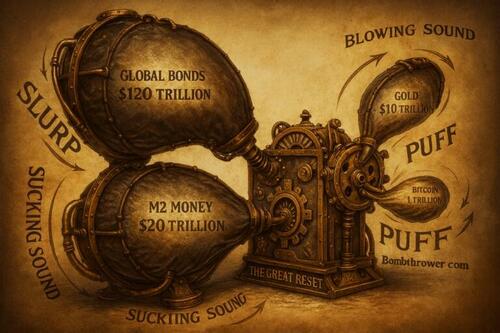

It’s almost as if the illustration I put into my Crypto Capitalist Manifesto back in 2021 is playing out exactly as I foretold: hard assets like gold and Bitcoin were going to experience multi-decade tailwinds from a global bond exodus:

The signals are clear: gold, silver (which is breaking out) – and Bitcoin are all experiencing capital inflows – meanwhile bonds are dead money walking.

The next Fed M2 supply update comes on August 26th – does anybody think it’ll come in lower?

* * *

The Crypto Capitalist Manifesto (my original investment thesis) is available on Amazon, you can also get a free copy here »

Loading recommendations…