As futures indicate this morning, and as DB’s Jim Reid writes overnight, the mood music on tariffs has sounded much more positive in recent days. As it stands, President Trump has threatened additional 100% tariffs on China from November 1, but Treasury Secretary Bessent said that he’d be meeting with China’s Vice Premier He Lifeng in person this week. And on Friday, President Trump said he thought that a meeting with Chinese President Xi in South Korea would still go ahead, and said “I think we’re getting along with China”. So that’s added to investor expectations that those 100% tariffs won’t come into force, and if we look at Polymarket, it’s currently pointing to just a 7% chance they come into effect by November 1.

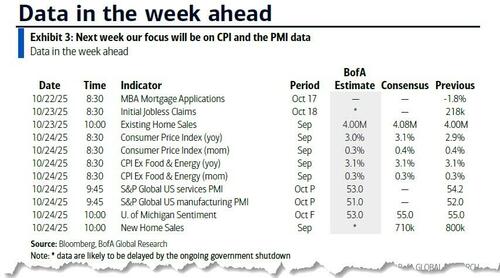

As all that’s happening, we still have the ongoing government shutdown in the US, which is now on day 20. Bear in mind that only two shutdowns have been longer than this one, which were the 35-day shutdown in 2018-19, and the 21-day shutdown in 1995-96. And as it stands, there’s still no sign of a compromise between Republicans and Democrats that would see the government re-open. In terms of the market implications, this is still affecting the flow of economic data, so we’re not getting regular releases like the weekly initial jobless claims, and we don’t have the payrolls number for September either. However, this week we will get the postponed CPI release for September, which is coming out on Friday, just in time for the FOMC meeting the week after.

In terms of what to expect, DB’s economists are looking for headline CPI to come in at a monthly +0.42% pace, which would push up the year-on-year rate to +3.1%, and be the strongest monthly print since January. Meanwhile for core CPI, they expect that to come in at +0.32%, with the year-on-year print remaining at +3.1%. Within the data, they’re still looking for signs of tariff impacts in core goods, with a focus on categories like apparel and new vehicles that haven’t yet seen a meaningful tariff pass-through.

Otherwise this week, another key data highlight will be the October flash PMIs on Friday, which will give us an initial indication as to how the global economy has fared at the start of Q4. We also have a few CPI prints elsewhere, including from Japan, the UK and Canada.

There are no speaking engagements by Fed officials this week, reflecting the FOMC’s blackout period.

On the earnings side, we’ve got more than 80 companies in the S&P 500 reporting this week – accounting for some 20% of S&P market cap – including Tesla and Netflix, along with more than 80 from the STOXX 600, including Barclays, NatWest and SAP.

Here is a day day-by-day calendar of events

Monday October 20

- Data: Germany September PPI, Italy August current account balance, Eurozone August construction output, Canada September industrial and raw materials price index

- Central banks: ECB’s Schnabel, Nagel and Vujcic speak, BoC Q3 business outlook survey

- Earnings: Zions Bancorp

- Other: China’s Fourth Plenum (through October 23rd)

Tuesday October 21

- Data: US October Philadelphia Fed non-manufacturing activity, UK September public finances, Canada September CPI

- Central banks: ECB’s Lagarde, Escriva, Nagel, Lane and Kocher speak

- Earnings: Western Alliance Bancorp, Netflix, General Electric, Coca-Cola, Philip Morris, RTX, Texas Instruments, Capital One Financial, Lockheed Martin, 3M, General Motors

Wednesday October 22

- Data: UK September CPI, RPI, PPI, August house price index, Japan September trade balance

- Central banks: ECB’s Lagarde and de Guindos speak

- Earnings: Tesla, SAP, IBM, Thermo Fisher Scientific, AT&T, UniCredit, Barclays, Hilton, Heineken, Southwest Airlines, Alcoa

- Auctions: US 20-yr Bond

Thursday October 23

- Data: US September existing home sales, October Kansas City Fed manufacturing activity, France October business confidence, Eurozone October consumer confidence, Canada August retail sales

- Central banks: ECB’s Lane speaks

- Earnings: T-Mobile US, Blackstone, Intel, Union Pacific, Honeywell, Newmont, Lloyds, Ford Motor

- Auctions: US 5-yr TIPS

- Other: European Council summit of EU leaders in Brussels

Friday October 24

- Data: Global October flash PMIs, US September CPI, October Kansas City Fed services activity, UK October GfK consumer confidence, September retail sales, Japan September national CPI, France October consumer confidence, Sweden September PPI

- Central banks: ECB’s Nagel, Cipollone and Villeroy speak

- Earnings: Procter & Gamble, Sanofi, NatWest, Porsche

- Other: Moody’s review France’s credit rating, Ireland presidential election

Looking at just the US, Goldman writes that the September CPI report—originally scheduled for release last week—will be released on Friday. The new home sales report on Thursday will be postponed if the federal government shutdown continues until then. The Department of Labor will also postpone the official release of the jobless claims report if the government shutdown continues through Thursday, but preliminary state-level claims data will likely be available. There are no speaking engagements by Fed officials this week, reflecting the FOMC’s blackout period.

Monday, October 20

- There are no major economic data releases scheduled.

Tuesday, October 21

- 08:30 AM Philadelphia Fed non-manufacturing index, October (last -12.3)

Wednesday, October 22

- There are no major economic data releases scheduled.

Thursday, October 23

- 08:30 AM Initial jobless claims, week ended October 18 (GS 225k, consensus 226k, GS estimate of last 219k); Continuing jobless claims, week ended October 11 (GS estimate of last 1,912k): We forecast that initial jobless claims edged up to 225k in the week ended October 18th. Using state-level data from the Department of Labor (DOL), we now estimate that initial claims declined to 219k in the week ended October 11th (with a likely range between 216k and 222k; vs. our estimate of 217k on Thursday) reflecting new data uploaded by Massachusetts and Tennessee on Friday that were missing in DOL’s Thursday upload. We estimate that continuing claims declined to 1,912k in the week ended October 4th (with a likely range between 1,903k and 1,920k; vs. our previous estimate of 1,917k), also reflecting new data uploaded by Massachusetts and Tennessee.

- 10:00 AM Existing home sales, September (GS -1.5%, consensus +1.5%, last -0.2%)

- 11:00 AM Kansas City Fed manufacturing index, October (last +4)

Friday, October 24

- 08:30 AM CPI (MoM), September (GS +0.33%, consensus +0.4%, last +0.4%); Core CPI (MoM), September (GS +0.25%, consensus +0.3%, last +0.3%); CPI (YoY), September (GS +3.02%, consensus +3.1%, last +2.92%); Core CPI (YoY), September (GS +3.05%, consensus +3.1%, last +3.11%): We estimate a 0.25% increase in September core CPI (month-over-month SA), which would leave the year-over-year rate unchanged at 3.1% on a rounded basis. Our forecast reflects unchanged used car prices reflecting the signal from auction prices, a slight increase in new car prices (+0.2%) reflecting an increase in dealer incentives, and an increase in car insurance prices (+0.3%) based on premiums in our online dataset. We forecast a decline in airfares in September (-1.5%), reflecting a fading boost from seasonal distortions and a decline in underlying airfares based on our equity analysts’ tracking of online price data. We have penciled in upward pressure from tariffs on categories that are particularly exposed (such as communication, household furnishings, and recreation) worth +0.07pp on core inflation. We expect moderation in the shelter components on net after a jump in the prior month (primary rent +0.25% in September vs. +0.30% in August; OER +0.26% vs. +0.38%). We estimate a 0.33% rise in headline CPI, reflecting higher food (+0.25%) and energy (+1.5%) prices. Our forecast is consistent with a 0.21% increase in core PCE in September. We will update our core PCE forecast after the CPI is released.

- 08:30 AM New home sales, September (GS -11.6%, consensus -11.6%, last +20.5%)

- 09:45 AM S&P Global US manufacturing PMI, October final (consensus 51.8, last 52.0): S&P Global US services PMI, October final (consensus 53.5, last 54.2)

- 10:00 AM University of Michigan consumer sentiment, October final (GS 54.0, consensus 55.0, last 55.0): University of Michigan 5-10-year inflation expectations, October final (GS 3.8%, last 3.7%)

Source: DB, Goldman

Loading recommendations…