Let’s recap what’s unfolded over the past few weeks as America’s space industry prepares to gain momentum:

As we declared at the time:

We’ve highlighted comments from Elon Musk, Jensen Huang, Jeff Bezos, and Sam Altman about space-based data centers, and analyzed a white paper from Nvidia-backed startup Starcloud that makes a compelling case for low Earth orbit data centers operating as a constellation to address Earth’s looming power crunch and land constraints.

Tesla-bull Adam Jonas from Morgan Stanley added more color about the SpaceX IPO and orbital data centers in a recent note to clients.

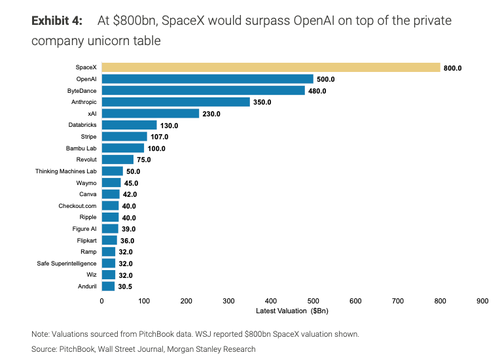

Jonas noted that an $800 billion valuation, if accurate, would make OpenAI the highest-valued private unicorn, according to PitchBook data.

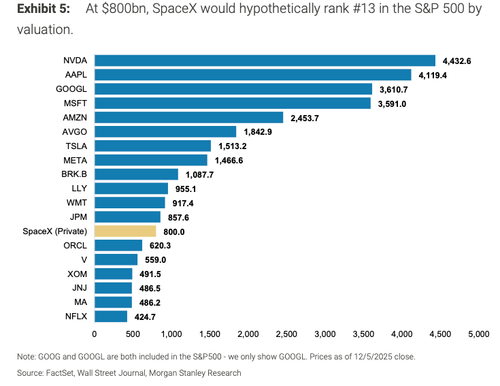

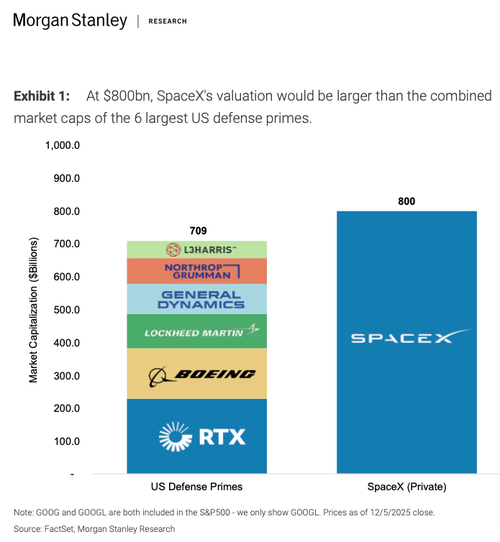

Compared with companies in the S&P 500, SpaceX ranks 13th by valuation, in between JPMorgan Chase and Oracle, Jonas said.

He added that it would be valued at more than the combined market capitalizations of the publicly traded military-industrial complex, including contractors such as RTX (Raytheon), Boeing, Lockheed Martin, General Dynamics, Northrop Grumman, and L3Harris.

On the topic of AI data centers in space, Jonas wrote:

Starlink Orbital Compute? Also this weekend, Musk on X commented on SpaceX’s planned future entry into orbital data centers, describing them as “by far the fastest way to scale [compute] within 4 years, because easy sources of electrical power are already hard to find on Earth. 1 megaton/year of satellites with 100 kW per satellite yields 100GW of AI added next year with no operating costs or maintenance costs, connecting via high-bandwidth lasers to the Starlink constellation.”

Elon Musk recently described the concept as an impending ‘convergence’ of SpaceX and Tesla in an interview with investor Ron Baron. This hypothetical constellation would leverage scaled-up versions of next-gen Starlink V3 connected by high-speed laser links to form an orbital compute cloud of GPU-equipped satellites. He later elaborated that Starship could deliver 100GW/ year within ‘four to five years’ assuming other technical hurdles are solved.

While space-based datacenters face a number of challenges (orbital debris, data governance, etc.), at-scale orbital compute clouds also have a number of benefits vs. traditional datacenters ranging from power (receive full solar constant in space), to cooling (Space is -270°C), and reduced latency for the growing TAM of edge-devices vs. long-haul terrestrial paths.

Why Build Datacenters in Space?

Cooling. Space is rather chilly – at ~2.7 Kelvin of -270°C, providing obvious cooling advantages. Although removing heat generated by GPUs can require very large metal radiators (potentially multiple square kilometers for larger datacenters), the cost of radiating heat from GPUs into deep space is argued by those involved to be much more efficient than chilling the same GPUs in a terrestrial datacenter, where cooling can account for up to 40% of total energy usage. For example, Starcloud (private) projects 10x lower energy costs vs. terrestrial alternative for its datacenter.

Power. Unlike on Earth, solar power in space is effectively uninterrupted and abundant at all times, providing reliable energy without atmospheric losses or weather variability. Space receives a near full solar constant, about 1,361 W/m², roughly 30% more than the best ground-level solar irradiance after atmospheric attenuation.

Global Edge Connectivity. At scale and when positioned in optimal orbits, space-based datacenters can theoretically improve connectivity for distributed users and edge-compute workloads. By leveraging LEO or mixed-orbit constellations, they can theoretically keep compute resources within milliseconds of most population centers, reducing latency compared to long-haul terrestrial paths.

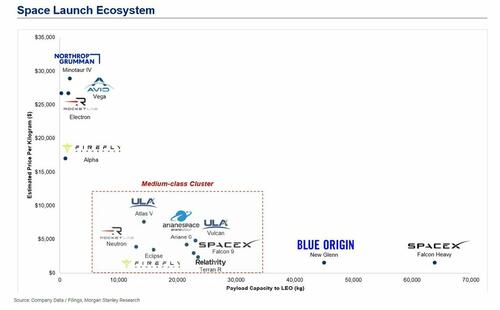

Scalability. SpaceX today is 90% of mass-to-orbit capacity per Elon Musk. However, as use of re-usable rockets becomes more widespread and competitors like Blue Origin, Rocket Lab, and other emerging launch providers (including China) ramp up cadence, the falling cost per kilogram to orbit and rising total mass-to-orbit capacity is likely to enable larger, more modular deployments of space-based infrastructure.

Obstacles: We note that space-based datacenters still face significant challenges, including harsh radiation environments that demand specialized hardened hardware, difficulty of in-orbit maintenance or repair, and orbital debris hazards given the size and scale of currently theorized space-based datacenters. Additionally, regulatory complexities around spectrum, space traffic management, and multinational data governance could pose as substantial hurdles.

Who Else is Involved?

Starcloud (Private): Starcloud is a Redmond, Washington–based startup founded in 2024 by Philip Johnston (CEO), Ezra Feilden (CTO), and Adi Oltean (Chief Engineer). The company’s mission is to deploy orbital data- centers that leverage abundant solar power, passive radiative cooling and space-scale infrastructure to serve AI and cloud-compute workloads. Backed by accelerator and seed investors such as Y Combinator, NFX, FUSE VC, and major funds from Andreessen Horowitz and Sequoia Capital, they have raised over $20 million in seed funding according to PitchBook.

Axiom Space (Private): Axiom Space is a Houston-based commercial space infrastructure company founded in 2016 by Michael T. Suffredini and Kam Ghaffarian. The company is developing an “Orbital Data Center” (ODC) product line, with plans to launch its first two free-flying ODC nodes into low Earth orbit by the end of 2025. These nodes aim to provide secure, cloud-enabled data storage and processing for commercial, civil, and national security customers, leveraging partnerships with companies such as Kepler Communications and Spacebilt Inc. for optical inter-satellite links and in- space server systems. According to PitchBook, the company has raised over $700 million to date from investors including Type One Ventures and Deep Tech Fund Advisors.

Lonestar Data Holdings (Private): Lonestar Data Holdings is a St. Petersburg, Florida-based company founded around 2018 (incorporated in 2021) and led by CEO Christopher Stott. The firm is developing lunar and space-based data center infrastructure (e.g., its “Freedom” payload was launched aboard Intuitive Machines’ Athena lunar lander via a Falcon 9 rocket) to create the first commercial lunar data center.

Google: Google is actively working on an ambitious “moonshot” initiative called Project Suncatcher, which aims to build constellations of solar- powered satellites carrying its custom TPU hardware to serve as space-based AI/computing data centers. The company plans to launch two prototype satellites by early 2027 to test the feasibility of the system and projects that falling launch costs could bring space-based computing close to cost parity with terrestrial data centers by the mid-2030s.

NVIDIA: NVIDIA is actively positioning itself for the space / orbital datacenter frontier by supplying high-performance GPUs and other critical infrastructure. Starcloud is a member of NVIDIA’s Inception program with NVIDIA and Starcloud launching an H100 GPU into orbit earlier this month aboard a Starcloud test satellite to validate the feasibility of operating terrestrial-class AI-data-center hardware in space.

Making spaceflight affordable has been SpaceX’s focus with its reusable rockets, and once Starship becomes commercialized, costs should drop even further. This is great news, not just for SpaceX but also for tech startups building container-sized data centers for space.

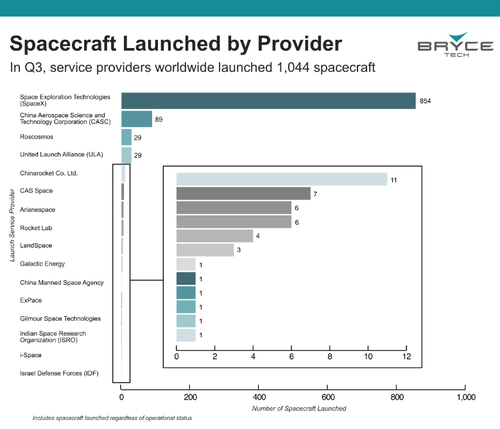

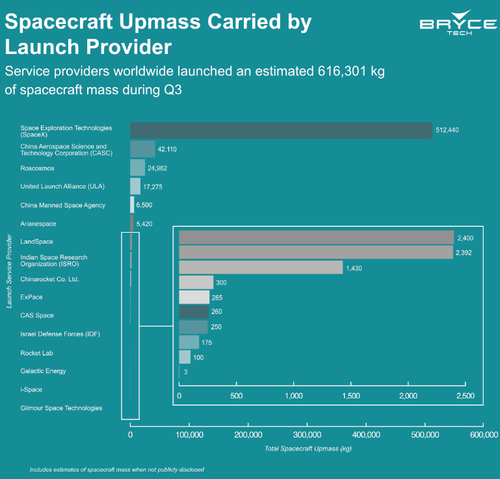

Let’s remind readers that SpaceX is effectively America’s rocket program – and it leads the world by light-years.

We must add, Musk is uniquely positioned, with SpaceX and xAI…

SpaceX also leads in terms of spacecraft upmass…

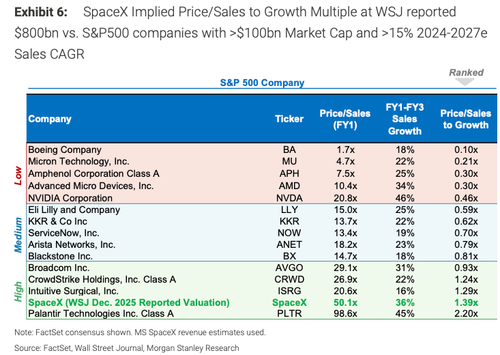

Jonas touched on SpaceX’s valuation:

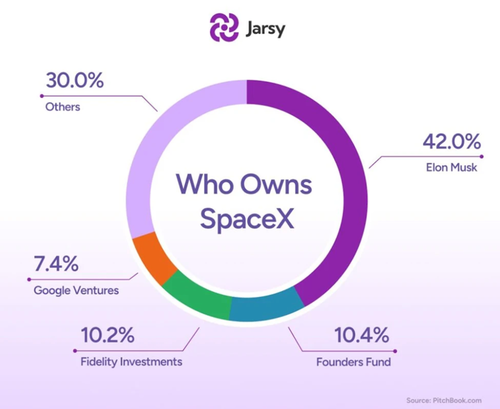

Who owns SpaceX?

So data centers in low-Earth orbit first, then land on the Moon (again?), then explore Mars with Starship? It appears SpaceX’s Starlink will provide communications for the booming space industry.

Loading recommendations…