Arkham Intelligence, a leading blockchain data analytics firm, has recently uncovered one of the largest Bitcoin heists in history. According to their latest investigation, on-chain data reveals that 127,426 BTC were stolen from LuBian, a Chinese mining pool with operations in China and Iran, back in December 2020. At the time, the stolen assets were valued at approximately $3.5 billion. However, with Bitcoin’s price surge over the past few years, the stolen funds are now worth an estimated $14.5 billion.

LuBian, once a major player in the global Bitcoin mining ecosystem, never publicly acknowledged the hack, nor has the hacker come forward. The stolen funds remained dormant and hidden from public attention until Arkham’s investigation brought them back into the spotlight. This revelation has sparked intense discussion within the crypto community about the ongoing security risks within the industry, particularly in mining and custodial operations.

The sheer scale of this theft makes it the largest documented Bitcoin heist to date, surpassing even the infamous Mt. Gox incident (25,000 BTC stolen). As Arkham continues to track the movements of these funds, the incident raises pressing questions about transparency, cybersecurity, and the lingering vulnerabilities within the global crypto infrastructure.

How LuBian Lost Over 127,000 BTC To A Key Vulnerability

LuBian, once one of the world’s largest Bitcoin mining pools, controlled nearly 6% of the network’s total hash-rate as of May 2020. However, their prominence was shattered by a catastrophic security breach that Arkham Intelligence recently exposed. According to Arkham’s analysis, LuBian was first hacked on December 28, 2020, losing over 90% of their BTC reserves in a single exploit. Just a day later, on December 29, an additional $6 million in BTC and USDT was stolen from a LuBian address active on Bitcoin’s Omni layer.

In a desperate attempt to recover their funds, LuBian rotated the remaining assets to recovery wallets on December 31. Notably, LuBian attempted to communicate with the hacker directly through the blockchain, sending OP_RETURN messages embedded in transactions. They spent 1.4 BTC across 1,516 transactions to broadcast these pleas, a clear indication that these were legitimate recovery attempts and not the result of another malicious actor brute-forcing their keys.

Arkham’s investigation points to a critical flaw in LuBian’s private key generation process. It appears that LuBian employed an algorithm vulnerable to brute-force attacks, a weakness that hackers exploited to siphon away 127,426 BTC. Despite the massive theft, LuBian managed to preserve 11,886 BTC—currently valued at $1.35 billion—which remains in their control.

As for the stolen BTC, Arkham reports that the hacker’s last known activity was a wallet consolidation in July 2024. The stolen coins have yet to be laundered or cashed out, keeping the crypto community on high alert. This breach not only highlights the ongoing risks in blockchain security but also underscores the need for rigorous key management practices across the industry.

Bitcoin Weekly Close Will Set The Tone For August

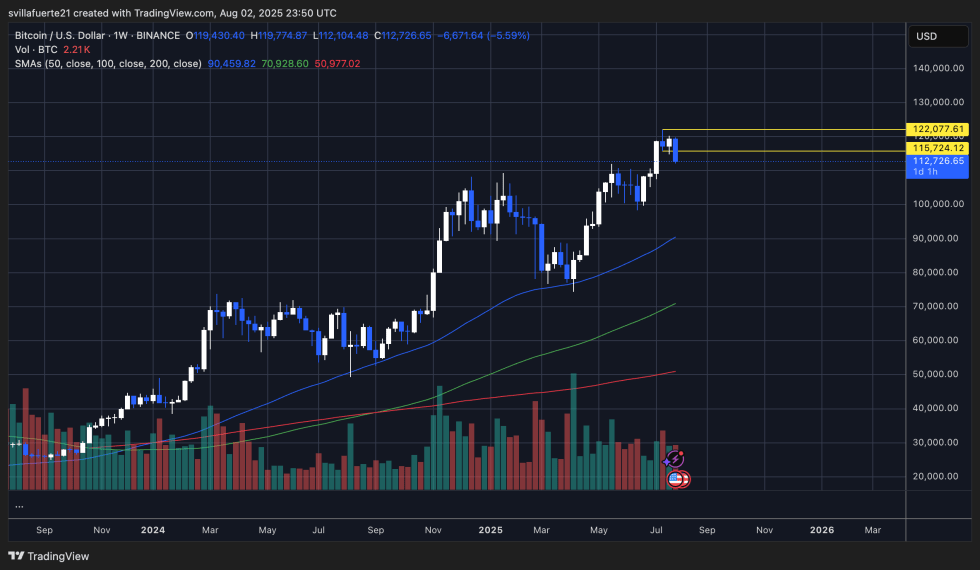

Bitcoin is approaching a critical weekly close after experiencing a breakdown from its consolidation range. The price dropped below the $115,724 key support level, reaching a local low of $112,104. Currently, BTC is trading around $112,726, just above the weekly 50-day moving average at $90,459, with the 100-day and 200-day moving averages well below the current price, indicating a strong long-term uptrend.

However, the rejection near the $122,000 resistance highlights a potential shift in momentum as selling pressure mounts. A weekly close below the $115,724 mark would confirm a breakdown from the two-week range, potentially opening the door for further downside towards the $110K-$112K region. This level, which previously acted as a breakout zone in late June, could now serve as critical demand support.

On the other hand, if bulls manage to reclaim $115,724 before Sunday’s close, it would signal strength and resilience, invalidating the breakdown and keeping the bullish structure intact. Volume has been moderate during this decline, suggesting the move is more corrective than a trend reversal. The next 48 hours will be crucial, as the weekly close will likely define Bitcoin’s direction for the coming weeks.

Featured image from Dall-E, chart from TradingView

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.