On-chain analytics firm Glassnode has revealed the Tron (TRX) cohort that has been responsible for the latest profit-taking event on the network.

Tron Has Just Seen Its Largest Profit-Taking Wave In Months

In a new thread on X, Glassnode has discussed about the profit-taking spree that has just occurred on the Tron network. Over the last 24 hours, the Realized Profit has hit $1.4 billion, which is the second largest amount for 2025 so far.

How Tron compares in Realized Profit against the other top assets in the sector | Source: Glassnode on X

The “Realized Profit” here naturally refers to an on-chain indicator that measures the total amount of gain that TRX investors are realizing through their transactions.

It works by going through the transfer history of each coin being sold to check what price it was moved at prior to this. If this previous value was less than the latest spot price for any token, then that particular token’s sale is leading to a profit realization equal to the difference between the two prices.

The Realized Profit sums up this profit involved in all transfers occurring on the blockchain during a given day. An indicator known as the Realized Loss keeps track of the sales of the opposite type. From the above table, it’s visible that this metric’s value has remained low for TRX, suggesting no capitulation has accompanied the profit-taking.

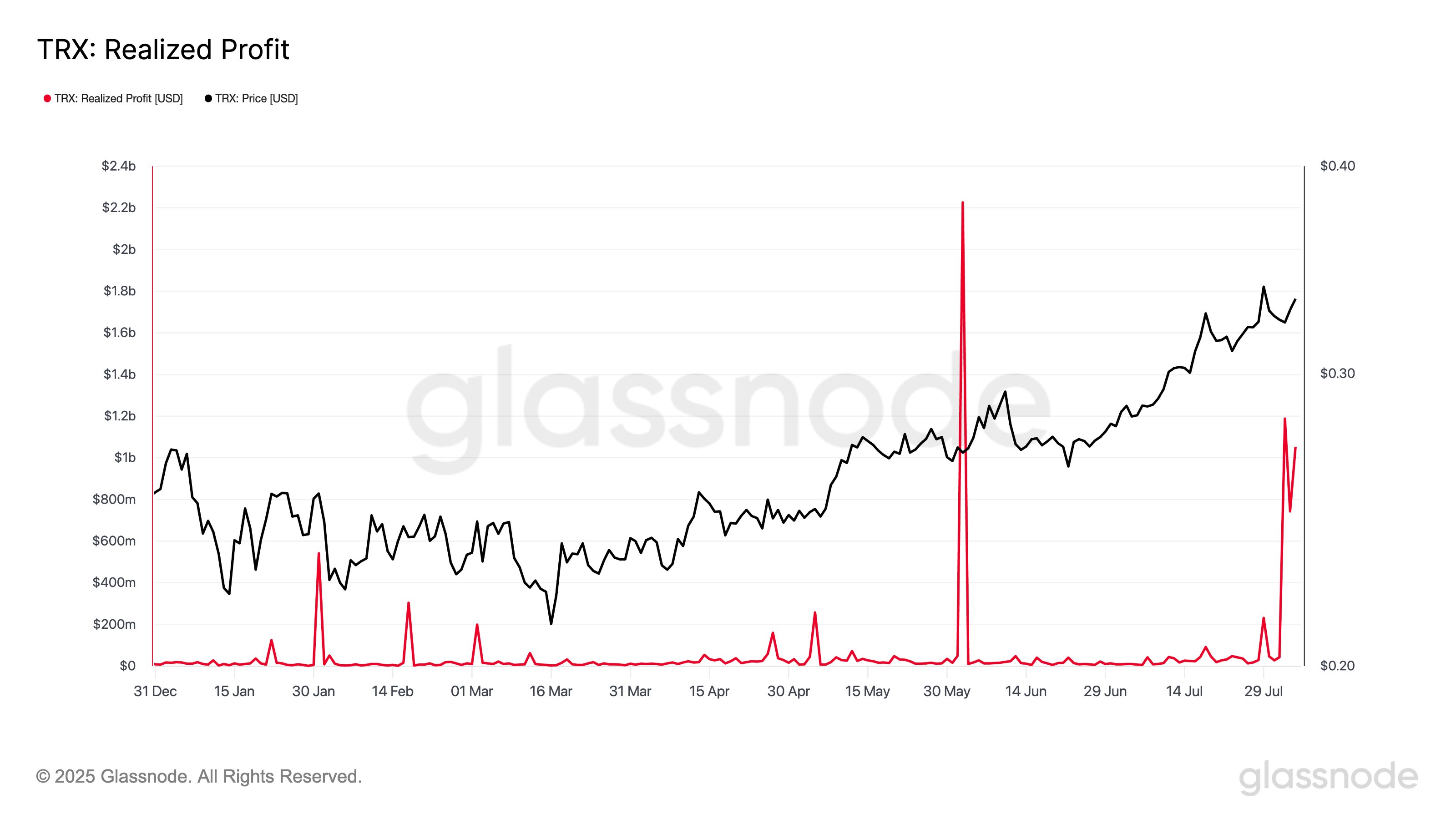

While the latest spike in the Realized Profit is massive, it hasn’t come in isolation. As the below chart shows, the metric’s value has been elevated for Tron in the past few days.

The trend in the TRX Realized Profit over the past few months | Source: Glassnode on X

Since Saturday, the network has been seeing nearly $1 billion in profit-taking every day. “This marks the most sustained wave of realized profit for TRON in months,” notes the analytics firm.

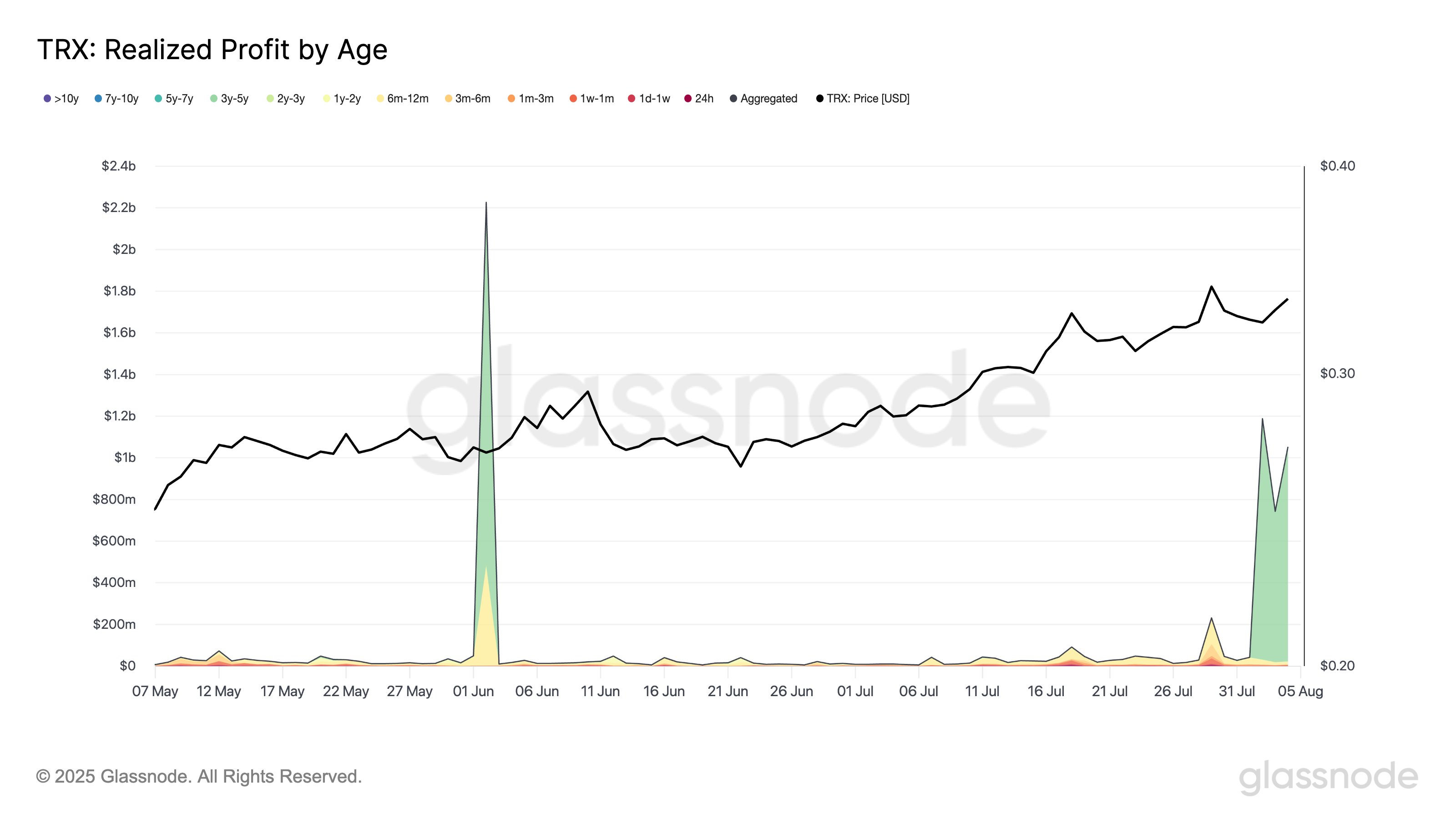

Now, the main question is, who are the investors responsible for this profit realization wave? The below chart answers the question, breaking down the Realized Profit for the various holder groups.

Looks like one cohort in particular has been responsible for the event | Source: Glassnode on X

The cohorts displayed here have been divided based on coin age. For example, investors who have been holding since between 1 week and 1 month ago are put in the 1w-1m band.

It would appear that the 3y-5y band, corresponding to addresses holding since at least three years and at most five years ago, have made up for the majority of the recent Realized Profit spike.

“This suggests participants from the 2020–2021 cycle are exiting into strength – a notable shift in behavior that could influence short-term market dynamics,” says Glassnode.

TRX Price

While most of the cryptocurrency sector has taken a hit during the past week, Tron is relatively unscathed as its price is still trading around $0.33.

The price of the coin has been climbing up during the last few weeks | Source: TRXUSDT on TradingView

Featured image from Dall-E, Glassnode.com, chart from TradingView.com

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.