As a Native Hawaiian teenager growing up in West Maui, Mikey Burke couldn’t wait to leave. “All my life, I thought I was bigger than this town, bigger than the village, and I was going to go somewhere and make something of myself,” she said.

Then she went to college in Los Angeles, where she was just one person among millions navigating the city’s crowded freeways and squinting through its smog. She would go entire days without anyone looking her in the eye, even if she held a door open for them or perused fruit next to them at the grocery store. Burke began to dream of returning home to Maui, where relationships felt authentic and she didn’t feel pressure to impress anyone. “Everything that I thought that I wanted, I had already had at home,” Burke realized.

The summer after she graduated from college, in 2006, Burke flew home to visit before starting a new job in public accounting in L.A. On the flight, she noticed the man sitting next to her with salt-and-pepper hair was preoccupied with a videogame device. She had just finished her free mai tai and was feeling chatty and emboldened. “Are you going to put that thing away and talk to me?” she asked brazenly. He met her gaze with piercing blue eyes and set the device down.

His name was Rob, and he was a commercial painter. They fell in love, and when he proposed a year and a half later, Burke had just one condition: She wanted to raise their future kids at home, to give her children the same upbringing and connection to family and the aina, or land, that she now couldn’t imagine growing up without.

When their son was a year old, Burke took a huge pay cut from her L.A. job to work as an accountant at Maui’s local power utility. She thought she’d get back to her old salary in a couple of years, and that her husband would find work quickly. Instead, her pay stagnated, and Rob spent months struggling to find a job in construction before accepting a role as a host at Bubba Gump, a bustling tourist restaurant.

Everything on Maui was more expensive: Their first water and electric bill was twice as much as their old bill in L.A., and Burke’s commute cost at least $100 in gas per week. “I could get maybe two or three meals for the price of a whole week’s groceries in L.A.,” Burke said.

Even after her husband finally got hired in commercial painting and her parents helped the family buy a condo, their living expenses ballooned. After their first son, the couple had twins, who were just 10 months old when Burke unexpectedly became pregnant again. Then a hostile malahini haole, Hawaiian for white foreigner, on their condo board commented on their growing family size, and Burke realized with panic that their soon-to-be six-person family exceeded the occupancy limits for their two-bedroom unit.

The four-bedroom house they found in Lāhainā felt like the answer to their prayers. It was a brand-new, two story-home in a new development with two-and-a-half bathrooms and a two-car garage. It was closer to the center of town than Burke preferred, but she wasn’t in a position to be picky. They had spent a year getting outbid by cash offers, and had come close to bidding on a termite-infested home that would’ve required the whole family to bunk in the same room for months while they spent thousands on renovations. “The housing market for local people here was nonexistent,” Burke said. “When we did find a house to look at, we were outbid by somebody every time.”

But this house in Lāhainā was $761,645 with a $3,300 monthly mortgage payment — affordable by Maui standards — and only available to them because they qualified through a workforce housing program that aimed to help local families like theirs.

The first time they walked through the house, Burke was incredulous. “We were looking out at Lāhainā town and just in awe and disbelief that this was our life, and this was actually possible for us,” she said. It wasn’t until the day they got the keys and her two-year-old twins wobbled through the rooms in their tank tops and diapers that it felt real: Burke and her family were in Maui to stay. “We did this for them,” she thought. “Their future is secure.” Her boys would know what it was like to grow up Hawaiian in Hawaiʻi.

That certainty crumbled the afternoon of August 8, 2023, when their home, and the town of Lāhainā, burned.

The wildfire incinerated more than 2,000 acres, killed more than 100 people, and instantly made headlines as the worst wildfire in the U.S. in more than a century. In Hawaiʻi, the community was in shock: No natural disaster had been so deadly since before statehood, and the fire had ripped through the town so quickly that thousands of buildings and structures became ash, altering the landscape irrevocably. Burke was among more than 800 homeowners who were suddenly rendered homeless and are now grappling with whether, or how, to rebuild. For her, it’s about more than just her house — it’s her ability to raise her family in their ancestral homelands, and avoid joining a growing number of Indigenous people forced to leave and priced out of returning.

A local nonprofit, Hawaiʻi Community Lending, surveyed 257 Lāhainā homeowners with mortgages affected by the fire and found their average balance was $696,983, more than twice the national average. That disparity reflects the sky-high real estate prices on Maui, where the median home price was $1.3 million in July. After the fire, the homeowners were able to delay paying their mortgage payments for months or years — but Jeff Gilbreath, the nonprofit’s executive director, said those forbearance periods are now ending, and for many, tens of thousands of dollars in back payments and interest are now coming due. As of early August, 78 of those 257 homeowners had missed mortgage payments and were at risk of foreclosure, largely because they are trying to pay rent while waiting to reconstruct their homes.

“Ninety-eight percent of the homeowners who are enrolled in our program have lost income in the fire,” said Gilbreath. “Now their existing mortgage is greater than 31 percent of their income. They can’t afford the existing mortgage. They need help with the rebuild and the gaps they’re facing.”

Two years after the Maui wildfires, Burke and other homeowners are experiencing an uptick in texts from investors wanting to buy their properties. A third of residents who were homeowners before the fire no longer own their homes, and more people are listing their properties for sale. “Whether you’re a visionary investor, a legacy builder, or someone who simply wants to be part of rebuilding one of Hawaiʻi’s most beloved communities, this lot is more than dirt and square footage,” says the description of an 8,000-square foot burned-out lot listed on Redfin for $1.8 million.

But the post-disaster property ownership shift isn’t limited to Maui. It happened in New York and New Jersey after Superstorm Sandy hit in 2012. It’s happening in Altadena in the wake of the L.A. wildfire. A May analysis by the research firm First Street found that bank losses from mortgage foreclosures related to disasters — mainly flooding — are expected to nearly quadruple over the next decade, with climate change driving nearly 30 percent of all foreclosure losses by 2035. Foreclosures often don’t spike in the immediate aftermath of wildfires because homeowners have fire insurance, but that silver lining could disappear as insurance premiums spike to cover the growing cost of losses from natural disasters — just $4.6 billion in 2000 and now approaching $100 billion annually — as climate change drives stronger hurricanes, heavier flooding, and more frequent wildfires.

In Lāhainā, homeowners are still short nearly $140 million in insurance payouts. There, as in many other places, climate change is colliding with a housing affordability crisis, said Carlos Martín, vice president for research and policy engagement at the think tank Resources for the Future. “If you can’t afford to rebuild, if you can’t afford your mortgage because of all the other financial bills that you have, where are you going to go?” he said. “We don’t have the spare housing that’s affordable to absorb all the people that are going to be affected by these twin crises.”

The day that Lāhainā burned, a storm passed south of the island and heavy winds knocked over more than two dozen power poles, prompting widespread electric outages and school cancelations. “I was working the storm, but I could do it from home,” said Burke, who was still employed with Hawaiian Electric but working with commercial customers by then.

She had a walkie-talkie in one hand, her phone in another, and was talking to her clients — hotels and local businesses — to triage the outage while juggling four children and her nephew who were home from school.

In the mid-afternoon, she glanced outside and she noticed black smoke, which she knew meant homes were burning. She ordered her kids to pack four changes of clothes as a precaution. Then her husband ran into the house. “There’s a fire and it’s moving really fast,” he yelled up the stairs. “We got to go.” The smell of smoke filled the house through the open front door.

Burke loaded her 6-year-old, her twin 8-year-olds, and her 13-year-old in the car, along with her 9-year-old nephew and their dog Nalu. She grabbed an envelope of cash, and then hesitated, her hand on her beloved Tahitian pearls. “This is going to be OK,” she thought. “We’re not losing the house,” and released them. Her husband got into his work truck, carrying their pet tortoise Flash and three other dogs, Blue, Murphy, and Toby.

But when Burke turned the ignition, she realized she couldn’t pull out of the driveway. “Our street was already full of cars trying to evacuate,” she said.

For a few, painstaking minutes, Burke’s family sat in the driveway as the fire approached, unable to leave. Then, a woman she didn’t recognize waved her and her husband into the line. “Typical Hawaiʻi,” Burke said. “We’re all running for our lives, and she’s like, ʻNo, come in,’ and she lets my husband and I get in line.” Similarly, every car sat in the right lane. The left lane was empty. “It’s crazy that none of us thought to just take that and cram the whole thing,” she said. “We were so orderly.”

With traffic at a standstill, Burke watched embers fly into her yard through her rearview mirror and flames engulf the home of her next-door neighbor. If they didn’t move soon, she knew the fire would be all around them. She suggested as calmly as she could to the children, “Why don’t you guys unbuckle?”

“Why?” the kids asked, alarmed. “Why are you telling us to unbuckle?”

“No, nothing’s wrong,” she lied. “I just want you guys to be ready in case we have to leave the car.”

Burke told the boys that if they needed to run, they should climb over a nearby fence and head straight into the ocean. “You’re not going to stop, you’re not going to look back,” she said, trying to speak as calmly as possible. “We’re all going to get to the ocean. That’s not going to happen, but if we have to, that’s what we’re going to do.”

Unprompted, her sons turned to one another and began to say, “I love you.”

Then a bicyclist with a T-shirt wrapped around his face rode up and knocked on the passenger window, motioning her to get into the opposite lane and drive ahead. She did, and others followed. When she got to the next major intersection, she saw a police officer was directing traffic and had finally started to allow the line of cars she’d been waiting in to go ahead.

Their family survived thanks to the kindness of others: the unknown neighbor that waved her in, the masked bicyclist, even the random dirt bike riders who broke through a locked gate on an old sugar cane road to allow drivers to escape. An hour and a half later, the Burkes found their way into a gated community on a hill overlooking Lāhainā.

“It was a little bit surreal, because nothing was happening there,” Burke said. “They were literally standing on their lanais or in their driveways looking towards Lāhainā, untouched, and here we are in our cars that are just full of silt.” Wealthy homeowners stared at their ash-covered caravan as they slowly drove through. Even though Burke was born and raised in West Maui, she had never seen the luxury estates with their ocean views, golf courses, and private clubhouse.

Hawaiʻi has a low homeownership rate — 61 percent, 47th of all states and Washington, D.C. — in part because land is so pricey. The rate for Native Hawaiians is even lower, 57 percent, as families like the Burkes are forced to compete with insatiable global demand for their land. After the U.S.-backed overthrow of the Hawaiian monarchy in 1893, the U.S. took 1.8 million acres of land — more than a third of the main archipelago — formerly owned by the Hawaiian Kingdom, and the Hawaiian people were never compensated. Lāhainā was once the royal capital, but the colonial transformation of the community into an American tourism destination meant that Lāhainā’s Indigenous population shrank considerably.

“Across Hawaiʻi, it’s getting increasingly difficult to remain there, especially towns like this where the local population and the Hawaiian population have been marginalized and pushed to the sides so that the tourists can be center stage,” Burke said. “So to have infiltrated that system and been able to purchase something is like winning at the monopoly of life.”

Before the fire, just 8.5 percent of Lāhainā residents identified as Native Hawaiian or another Pacific Islander identity. That figure could keep dropping if families like Burke’s are forced to leave in the wake of the fire. “Often the people who have been on the land the longest are the first to get displaced,” said Jeff Gilbreath from Hawaiʻi Community Lending.

Most Pacific island nations have restrictions on who can own land, in part to protect Indigenous peoples from displacement. Some U.S. Pacific territories do, too. That’s not the case in Hawaiʻi, where most land is at the mercy of American capitalism.

Some Native Hawaiians are eligible for property on land designated as “Hawaiian home lands,” a federal program set up by the U.S. Congress at the urging of Prince Kūhiō, a member of the Royal Family, in the aftermath of the overthrow. The prince wanted every Hawaiian to be eligible to own land, but was forced to accept a compromise to get the bill passed by limiting who could qualify by blood quantum. The program has fallen far short of his vision: More than 23,000 Hawaiians are still waiting for homes, and at least 2,000 have died while waiting for a homestead. The current process of building infrastructure, constructing homes, and finding homeowners who are qualified to obtain a mortgage is estimated to take 182 years for everyone currently on the waiting list to receive a home.

Burke’s mom has been on the list for more than 25 years. When Burke was a teenager, her mom was offered a plot of land in East Maui with no electrical or sewer hookups, and so decided to wait for an actual house where she could raise her family. She’s now in her 70s and still waiting. Burke isn’t hopeful; even if her mom gets off the waitlist, she is retired and would have a hard time qualifying for a mortgage. Burke, meanwhile, doesn’t have enough Hawaiian blood by federal standards to qualify to get on the list herself. “Like almost any Indigenous community, we still get the crumbs, and if you happen to not be 50 percent Hawaiian, it’s like you get the crumbs of the crumbs,” Burke said. “We’re just left to figure it out ourselves.”

The weeks and months immediately after the fire were a blur of moving and grief. For days there was no cell service, and Burke’s name was among more than a thousand people feared missing. No one knew exactly how many had died, and the U.S. Department of Health and Human Services flew in cadaver dogs to identify human remains. Burke had to figure out how to explain the destruction to her children while processing her own grief and continuing to work full-time. Work was exhausting, but she still had her job when thousands of her neighbors had lost theirs. For a while, her family of six crowded in with her mom and sister in their two-bedroom condo, then they moved in with a friend, then moved into a Red Cross shelter at the Hyatt, then a rental home, and then another.

Burke began to make a list: Call her mortgage company. Cancel her internet and cable. Call her insurance company. Cancel her water and electric services. Apply for disaster assistance. In two weeks, their mortgage bill would be due, but they also needed to find new housing and pay rent there, too.

“You qualify to be on forbearance for up to 12 months,” Burke recalls a customer service representative for her mortgage servicer told her in an initial call.

“What happens after that?” she asked. She couldn’t get a straight answer.

“That scared the crap out of me because I didn’t know if after 12 months I was going to have to pay that 12 months back in full, or if they were going to put me on a payment plan, or if they were going to just tack it on to the back of my loan,” she said. Two years later, she still doesn’t know what the answer is — and has been trying to save money in case she’s required to pay everything upfront. As of July of this year, she owes $71,000.

In the U.S., keeping up with your mortgage payments in the wake of a disaster is largely up to each individual homeowner. Mortgage companies might allow you to suspend your monthly payments for a few months, or years, during forbearance, but interest still accrues, and eventually every bill comes due. Mortgage lenders and banks have different rules about how lenient to be with homeowners and when to force them to repay their bills. Some will let homeowners add the bill to the end of their mortgage, delaying the payments until the end of their loan or until they sell the property. But other banks require homeowners to pay upfront, which can saddle them with a sudden bill of tens of thousands of dollars.

Autumn Ness, executive director of the Lāhainā Community Land Trust, a nonprofit established after the fires, is already seeing a handful of attempted foreclosures as banks resume collecting mortgage payments that they temporarily suspended after the fire. The community land trust has already spent more than $1.1 million to purchase homes from homeowners whose houses would otherwise have been auctioned off by banks.

With the average mortgage for fire-affected Lāhainā homeowners approaching $700,000, Ness knows that it’s unlikely her nonprofit will be able to help everyone who wants to save their home from investors. “We don’t have enough money for it,” she said.

It’s also challenging to communicate with big mortgage lenders and servicers. According to data that Gilbreath from Hawaiʻi Community Lending has collected, the bulk of Lāhainā’s mortgage debt, more than $46 million, is held by Rocket Mortgage, a multibillion-dollar company based in Michigan. However, even this is an undercount, as Gilbreath surveyed just 257 Lāhainā homeowners with mortgages who lost their homes, out of more than 800. The second-largest mortgage servicer, Mr. Cooper, is based in Texas. Both Gilbreath and Ness have struggled to get in touch with real people at out-of-state mortgage companies to advocate on behalf of homeowners. Ness has had trouble even getting statements estimating how much homeowners owe so that the land trust can help them pay it off. “It’s just been extremely tough,” Gilbreath said.

A local analysis predicted that more than 20 percent of Lāhainā properties will have new owners within three years after the fire, or by next summer. That’s due to financial stressors and other factors like inconsistent employment, uncertain home rebuilding timelines, and emotional and mental health stress.

“The entire system is set up so that, after disaster, we see an increase in distress-driven land sales and foreclosures, and that leads to gentrification and mass displacement of the community,” Ness said. “And then we wonder why people like us are left scraping in our worst moments to try to swim against this current.”

One proposal in Congress would guarantee that disaster-affected homeowners with mortgages backed by federal agencies like Fannie Mae or Freddie Mac could delay their payments for up to a year. But not everyone has a federally backed mortgage, and that doesn’t solve the problem of what happens after the forbearance period runs out.

“Forbearance is good as far as it goes, but it’s a temporary Band-Aid and it does kick the can down the road,” said Lisa Sitkin, a senior staff attorney at the National Housing Law Project. “It has to be coupled with long-term solutions.”

The most straightforward solution, Sitkin said, is government funding to help homeowners catch up with their payments. California started such a program in June to give disaster-affected homeowners $20,000. Just this week, Maui County launched a federal program to help Lāhainā homeowners rebuild their homes. Demand for such programs is expected to increase as climate change fuels more extreme weather events.

But every program has limited funding and specific criteria that may limit who can access it. And for disaster survivors struggling with post-traumatic stress disorder and other disaster-induced health problems while frequently moving between temporary rental homes, staying on top of the patchwork of assistance programs is yet another burden.

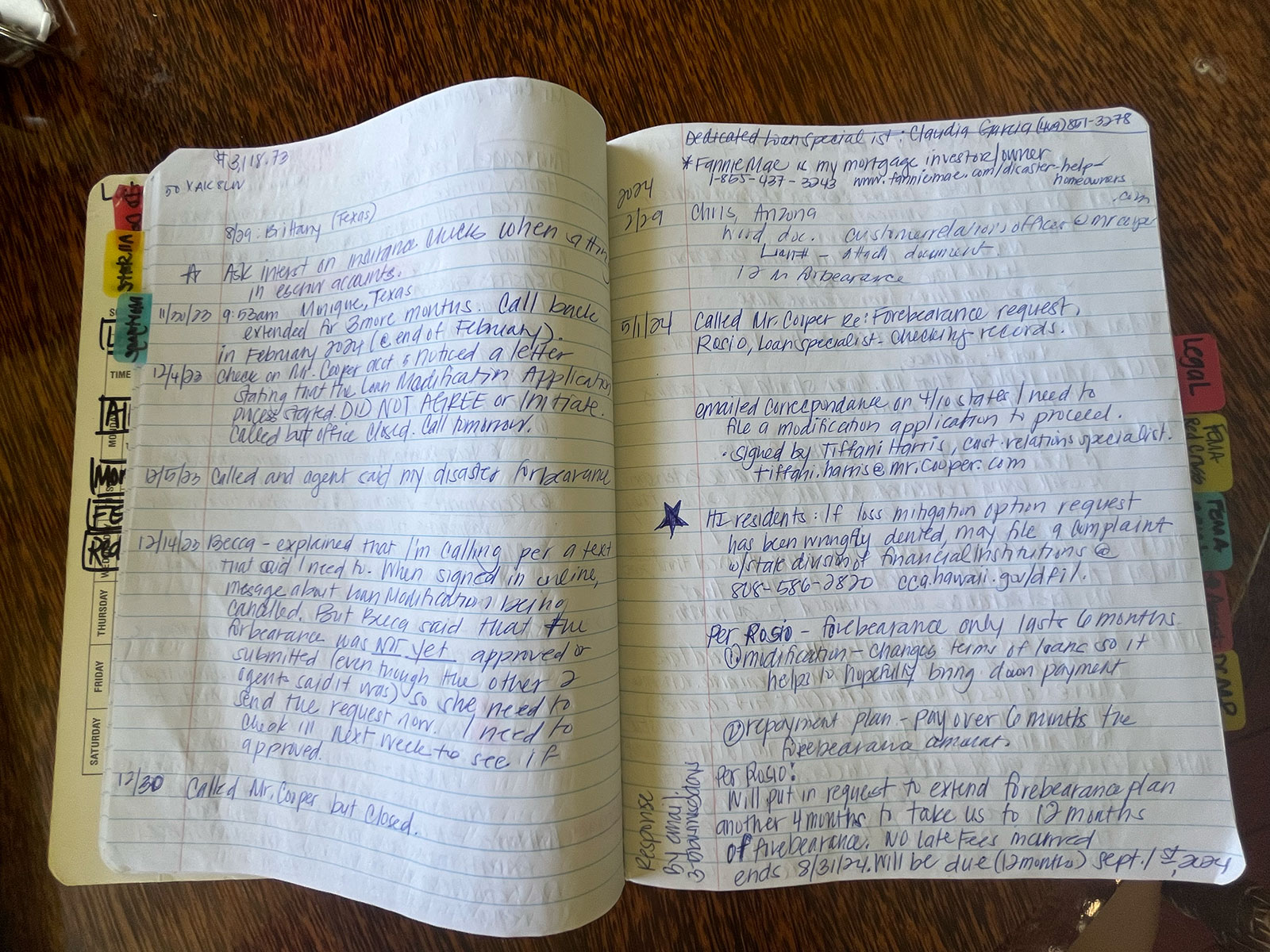

Even Burke — who keeps a notebook filled with dozens of pages and multicolored tabs documenting nearly every effort she has made to advocate for her family over the past two years — overlooked an email from a housing assistance program that gave her five days to respond and missed the chance to receive $30,000. “That is a huge amount that could be lifted off our shoulders,” she said. “I was really bummed about missing that.”

Before the fire, like a lot of working moms, Burke was the CEO of her family, juggling her kids’ school performances and extracurricular activities and sports games and medical appointments. Now she’s doing all of that while remembering to call her mortgage servicer every few months to have the same conversation over and over.

“I’m calling to extend my forbearance,” Burke will say.

“Disaster forbearance is only up to 12 months,” the person at the other end of the line will usually respond. “We have other options available to you.”

“Actually, my mortgage is owned by Fannie Mae and that’s not what Fannie Mae told me,” Burke will tell them, reminding them of the government-owned entity that owns her loan. “Fannie Mae said that I can be on disaster forbearance for as long as I’m not in my home and we haven’t rebuilt; we’re still in temporary housing.”

“OK, let me do some research,” they’ll say. They’ll put her on hold, and then: “We’re not seeing anywhere that Fannie Mae has extended the disaster forbearance.”

That’s when Burke will request to speak with a supervisor, who will agree to do more research and often tell Burke she’ll get a call back. Sometimes that happens, sometimes it doesn’t. In July, Burke found out her forbearance was extended because she just happened to check the website — nobody called her with the news.

Even then, she’s still on high alert. Last summer, she found out she was briefly in foreclosure from a random conversation with a Mr. Cooper representative who looked up her file — again, she said, the company hadn’t notified her. Michala Oestereich, a company spokeswoman, declined to comment on Burke’s case, but said that the servicer is required to comply with loan requirements that are set by investors. Some allow forbearance periods to last as long as 24 months, but others don’t.

It will cost hundreds of thousands of dollars to rebuild the Burkes’ house, and insurance money will only cover a portion of that. But she is just as determined as she was 20 years ago when she decided to move home to Maui. To Burke, she’s fighting for more than just a house.

“It doesn’t just anchor me,” she said. “It anchors my children and grandchildren. Because at the end of the day, whatever they choose in life, they will always have that piece of aina.”