Authors: Vivek Salunkhe, Anand Surana, and Sudeshna Guhaneogi

After a car accident, the last thing anyone wants is to wait weeks—or even months—for an insurance check. So why does it take so long? And more importantly, what if that frustrating wait could be slashed dramatically—for both customers and insurers?

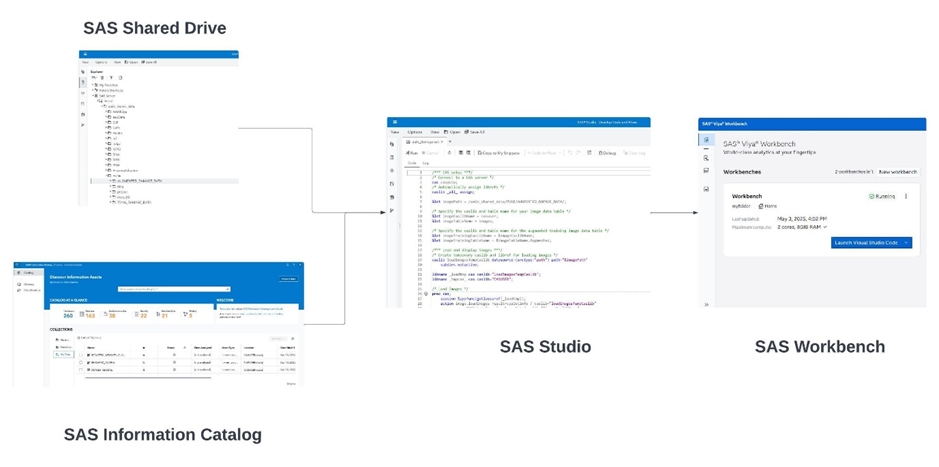

In this post, we examine how SAS is transforming the motor insurance claims process from manual and slow to smart and seamless. It starts with centralized asset storage in the SAS Shared Drive and continues with organized, searchable data through the SAS Information Catalog. Claims models are trained efficiently in SAS Studio. At the same time, SAS Viya Workbench provides a sleek, interactive interface that enables users to upload accident images, predict damage types, and instantly access policy details.

This end-to-end solution doesn’t just simplify claims—it showcases the powerful integration of SAS tools, blending data management, machine learning, and user experience into one seamless, high-performance system.

Industry overview: Market size and financial implications

The motor insurance industry is a critical component of the broader financial sector. It provides essential coverage and peace of mind to vehicle owners worldwide. The global motor insurance market is vast, with billions of dollars in premiums collected annually. According to a report by Precedence Research, the global vehicle insurance market size is projected to reach USD 973.33 billion by 2025. It’s estimated to reach approximately USD 1,796.61 billion by 2034, growing at a Compound Annual Growth Rate (CAGR) of 7.03% from 2025 to 2034. This immense market size underscores the importance of optimizing the claims process to serve policyholders better and improve profitability.

Consequently, insurance companies often incur significant losses due to inefficiencies in the claims assessment process, particularly from fraud, human error, and processing delays. These issues not only increase costs but also slow down the delivery of services. By adopting an automated model, insurers can reduce these risks, streamline operations, and improve the overall customer experience.

Problem statement: The inefficiencies of manual claims assessment

The current process of assessing motor insurance claims is both time-consuming and inefficient. This often results in delays and increased costs. The problem lies in the manual assessment of claims. Manual claims assessment requires significant human intervention. An assessor often must physically visit the accident site and inspect the vehicle for damage. Then, they must verify the claimant’s credentials and determine the extent of the damage, as well as the corresponding payout. This process is not only labor-intensive but also prone to human error and subjectivity. Additionally, the time taken to complete these assessments can lead to delays in claim processing. This, in turn, affects customer satisfaction and increases operational costs for insurance companies. The traditional method is fraught with challenges and inefficiencies, making it ripe for innovation.

The need for an automated model

To address these inefficiencies, there is a pressing need for an automated model that can streamline the claims assessment process. Such a model would leverage advanced technologies like artificial intelligence (AI), machine learning (ML), and computer vision (CV) to accurately identify the type of damage and determine the appropriate payout based on the locality and car make. This automated approach promises to revolutionize the industry by enhancing efficiency, reducing costs, and improving customer satisfaction.

In our proposed model, CV techniques play a crucial role. The model requires images of the damaged vehicle as input and classifies the type of damage. For example, it can detect glass damage, body dents, minor scratches, and other similar issues. This classification enables a precise assessment and accurate determination of repair costs.

Key benefits of an automated claims assessment model

The key benefits of automation include:

- Speed: Automated systems can process claims in a matter of hours, significantly reducing the turnaround time and enhancing customer experience.

- Accuracy: AI and ML algorithms can analyze damage and predict costs with high precision, minimizing errors and ensuring fair payouts.

- Cost-effectiveness: By reducing the need for human intervention, insurance companies can lower operational costs and allocate resources more efficiently.

SAS process flow for automating a motor insurance model

We leveraged the power of SAS to streamline motor insurance claim assessments, as illustrated in our process flow in Figure 1. This structured workflow highlights SAS’s powerful role in automating and optimizing motor insurance claim assessments.

- Storing assets in SAS Shared Drive: We initiated the process by storing all necessary assets, including images, the model, pretrained weights, and supporting files for training the motor insurance model, in the SAS Shared Drive within SAS Studio. This ensures centralized and efficient access to resources.

- Organizing data in SAS Information Catalog: For streamlined data management, we maintained all training and augmented image tables, along with the ResNet50 model tables, in the SAS Information Catalog, enabling easy access and organization of critical data sets.

- Training the model in SAS Studio: The training phase leveraged SAS Studio with the dlTrain action set to develop the motor insurance model. This involved several key steps:

- Loading and displaying images to verify data integrity.

- Exploring and processing images through resizing, shuffling, and partitioning to prepare them for training.

- Augmenting the training images to enhance model robustness.

- Training the ResNet50 model specifically for damage classification.

- Scoring the model on test images to evaluate performance.

- Saving the trained model as an ASTORE file for deployment readiness.

Optional steps for user interface (UI) integration

- Deploying on SAS Viya Workbench with Streamlit Integration: The model can be deployed on the SAS Viya Workbench Platform to demonstrate SAS’s integration capabilities with the open-source Streamlit framework. This interface allows users to upload multiple images, with the pretrained model running in the background to predict damage types and retrieve corresponding policy details from the database—showcasing a seamless end-to-end solution.

- If the customer is using SAS Viya, they can directly access the pretrained model and integrate it into their workflows. This approach enhances robustness, security, and ease of use.

Conclusion

The motor insurance sector stands at a crossroads, where traditional methods of claims assessment are no longer sufficient to meet the demands of a rapidly evolving market. The adoption of an automated model for claims assessment is not just a technological upgrade; it is a necessity to ensure efficiency, accuracy, and customer satisfaction. As the industry embraces this innovation, insurers position themselves to reduce losses, boost profitability, and deliver superior service to policyholders. The future of motor insurance lies in automation, and the time to act is now.

Future Insights

Automating the claims assessment process might encourage more fraudulent claims to slip through. However, we have developed sophisticated methods to counter fraud effectively. Stay tuned for our upcoming blog posts, where we will delve deeper into these anti-fraud techniques and their implementation.

Anand Surana

Anand Surana is a Senior Associate Data Scientist in the SAS Pune Applied AI and Modeling Division. His areas of expertise include forecasting, generative AI, and computer vision. He has contributed to several models, prototypes, and solutions across diverse industries, including insurance, retail, and supply chain. Anand holds an M.Sc. from Savitribai Phule Pune University, India.

Sudeshna Guhaneogi

Sudeshna Guhaneogi is a Senior Manager in the SAS Pune Applied AI and Modeling Division. She brings over 21 years of experience driving data-driven innovation across various industries, including investment banking, insurance, healthcare, supply chain, retail, CPG, manufacturing, IoT, and energy. She holds an MSc in Statistics from Calcutta University and specializes in advanced AI/ML, including generative and agentic AI, forecasting, optimization, and stochastic modeling. Sudeshna leads a team of data scientists in India, developing cutting-edge analytical models for diverse sectors.