Yes. They are going ahead with draining the Exchange Stabilization Fund of its dollar liquidity for purposes that seem to make more sense. &, since this is TrumpWorld, the odds are heavily in favor of the right explanation being the one that is both (a) deeply corrupt, and (b) deeply technocratically incompetent…

This morning:

BeijingPalmer: <https://bsky.app/profile/beijingpalmer.bsky.social/post/3m2rzdqahwk2y>; ‘That Watchmen panel but in every single one the government of Argentina has caused a financial crisis. I think this has happened six times in my lifetime…

And

Peterson Intitute: <https://twitter.com/PIIE/status/1976636100212109533/>: ‘“They can call it what they want, but it’s a bailout,” says Monica de Bolle says of the US-Argentina $20bn financial plan. “It’s a country in crisis, it’s running out of dollars, & the US is giving the country dollars. That’s a bailout by definition”…

Plus:

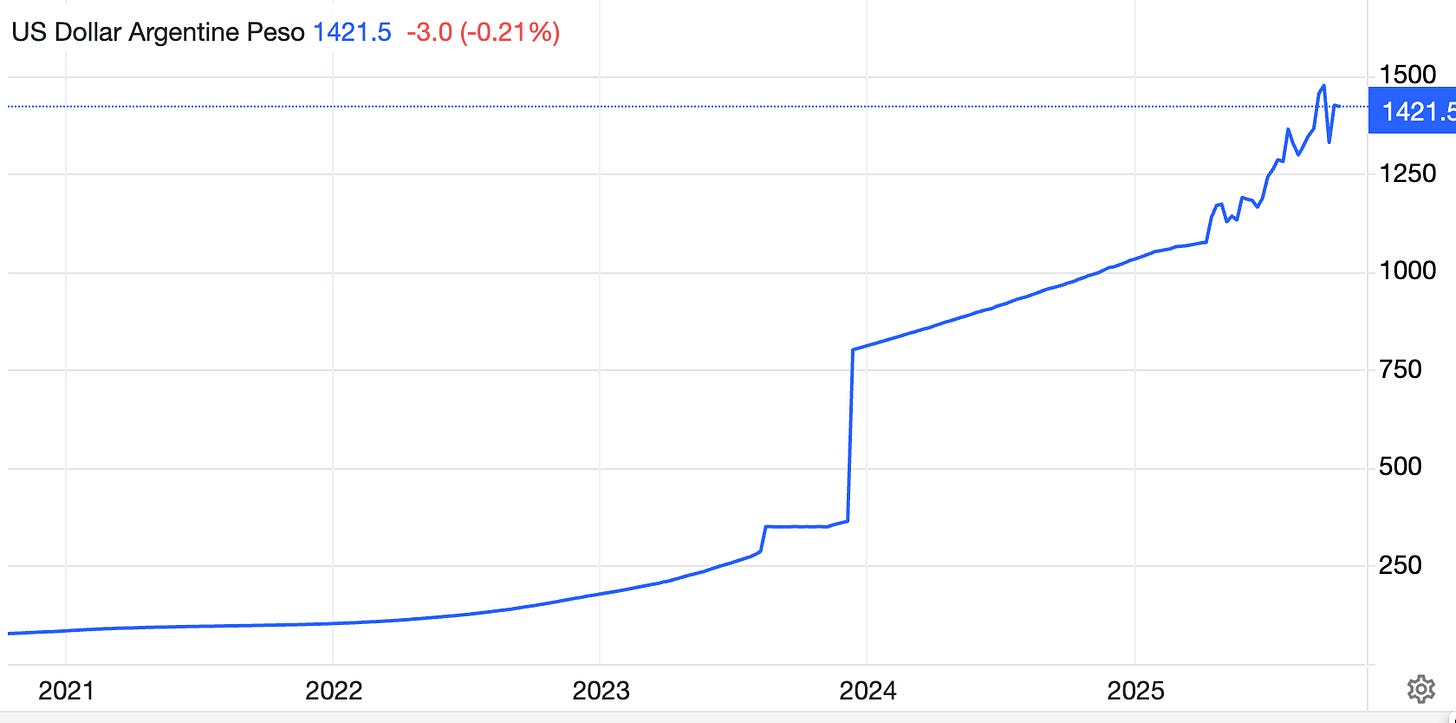

Patrick Chovanec: <https://bsky.app/profile/prchovanec.bsky.social/post/3m2rxlca6g225>: ‘The problem, in Argentina, was utterly predictable. Milei repeated the exact same mistake of the 1990s, stabilizing the peso by tying it to the dollar, without having the political capacity to reign in spending (driven by state governments) enough to make that sustainable. The intentions in both cases were good, and the initial results at least partly positive. But the imbalances build up under a fixed exchange rate until the wheels finally fall off. Short of a real consensus to effect structural change, it doesn’t work. Quite frankly, the solution is actually MORE radical than anything Milei has done. But the reality is that there’s no political consensus in Argentina to support that, so half-measures will keep making things worse without actually making them better. I mean, to be fair, Milei’s plans were more nuanced and a lot more ambitious than what I just described, but it was always clear he was going to be deeply constrained in carrying it out before it could turn into a train wreck first. There is always this notion in Argentina that if you hitch the economy to the US dollar it will force major reforms in its wake, because the alternative would be disaster. But then those reforms prove politically impossible and the disaster happens…

Yes, the U.S. Treasury has approved a $20 billion swap-line lifeline for Argentina to stabilize its currency ahead of elections. Bessent falsely claims that the U.S. “is not putting money into Argentina”, and falsely claims that it it all about Western Hemisphere strategic interests and curbing Argentina’s tilt toward China and securing minerals.

The economics of how you handle a situation like Argentina right now, in which fiscal dominance has arrived and taken its place at the table, is well-known.

So let me vent:

Fiscal dominance is when the government’s financing needs overwhelm monetary policy, so the total government—not the monetary and exchange-rate policies of the central bank—sets inflation and currency outcomes. In Argentina today, large persistent deficits, weak revenue capacity, and politically constrained spending cuts force money creation or external dollar borrowing. Under these conditions, exchange‑rate pegs and swap‑line lifelines can briefly steady markets but cannot deliver durable stability. The cure is a credible primary surplus, an undervalued real exchange rate to spur tradables, and external support that reinforces—not substitutes for—domestic consolidation.

Without that, the “table” is set by fiscal pressure, and monetary instruments serve the meal.

Thus the $20 billion currency swap and direct peso purchases are a form of dollar liquidity injection into a dollar-short system. It is a bailout that temporarily props up the peso, and its primary effect is to de-risk investors planning a quick exit without fixing Argentina’s fiscal-dominance problem.

It supplies dollars to avert collapse, shielding markets without fixing core imbalances. In the best scenario is buys a little time before policy reset, often because the reset cannot be carried out before elections. The effect is transient: reserves get used defending the currency, spreads narrow for a bit, and investors de‑risk, yet the peg or band eventually buckles unless the fiscal anchor flips to sustained primary surplus with credible enforcement. Without conditionality and political capacity, this is price support ahead of elections and an investor‑exposure relief valve, not a cure.

Let me repeat: We do know what to do: (a) budget surplus, (b) devaluation to create a substantially undervalued currency followed by a peg. The sequence matters because causality runs from the fiscal anchor to price stability. A sustained primary surplus—legislated and enforced across provinces—stops the deficit‑monetization loop that drives inflation and currency fear. Only then does a sharp devaluation to a clearly undervalued real exchange rate reboot tradables, rebuild reserves, and reset expectations.

Lock that undervaluation with a simple, rule‑based peg or crawling band, backed by transparent intervention and hard stop‑losses. Absent the surplus, a peg just compresses pressure until it bursts; with it, the peg transmits discipline and credibility rather than fragility.

And then you (c) hope and pray that the export boom is large enough to quickly cushion the unemployment created by the budget cuts and tax increases needed to get the budget surplus. Consolidation hurts fast; exports must surge quickly to soften the blow. The politics are very cruel here. Achieving a credible primary surplus means front‑loaded spending cuts and tax hikes that lift measured unemployment. Hence the prayer for a swift, sizable export boom to absorb displaced labor, rebuild reserves, and rebuild political capital. The mechanics require an undervalued real exchange rate, unclogged import channels for inputs, and working‑capital finance so tradables can expand on short order. Logistics, permitting, and energy reliability matter as much as price signals; otherwise the devaluation’s job loss arrives on time while the export response stalls.

The model is France in the 1920s: the stabilization under Raymond Poincaré.

If the government is not going to do that, then it is too early to offer support. Offer support only after a credible, enacted stabilization program exists. Premature aid misallocates scarce political and financial capital. If a government has not delivered a sustained primary surplus, reset the real exchange rate via devaluation, and locked it with a credible peg, external dollars mask symptoms and invite moral hazard. Support should be contingent, backstopping a domestic program already biting.

If you then offer support anyway, the question is: what are you doing? You’re propping prices, easing exits, and exporting risk without reform. Functionally, it’s price support and time‑buying—useful for market management, useless for cure—unless tied to enforceable conditionality that flips the fiscal anchor first.

So what are they doing?

-

Are they just doing a $20 billion favor to a political ally in the southern hemisphere?

-

Are they bowing to pressure from financier friends, friends whom they convinced to invest in Millei’s Argentina, but who have decided that they need to exit, and the Treasury giving dollars to Argentina provides the liquidity for them to do so?

-

As everything else in TrumpWorld is deeply corrupt, you have to presume that the deeply corrupt explanation is the right one.