Unsurprisingly, crypto people have been selling up in droves. For crypto investors to cash out their extraordinary gains, there must be real money in the system – dollars, euros, yen, pounds. But the crypto system, unlike the traditional finance system, is unable to create real money. It can create tokens that represent dollars, euros, yen etc, but these aren’t accepted for real-world transactions such as purchasing condos in the Bahamas. So the crypto system needs inflows of real money. The more it grows, the more real money it must attract.

But attractive though these slick high-yield bank-like deposit accounts were, they struggled to attract the quantity of new depositors that the system needed. Many retail customers were wary of crypto because of its reputation as a vehicle for illegal activities, and suspicious of high returns from bank-like things that don’t have deposit insurance. They worried that they might lose their money. So platforms needed to convince retail depositors that these accounts were as safe or safer than bank accounts.

Other platforms found another way of persuading people that it was safe to put their money into crypto. Fiat money in banks has FDICinsurance (or the equivalent in other countries). So crypto platforms such as Voyager entered into relationships with FDIC-insured banks and then marketed fiat deposits on the platform as FDIC insured. This was, strictly speaking, true – but depositors were only covered if the bank failed, not if the platform did. Not that Voyager cared. It cheerfully told its customers that their deposits were insured if either the bank or the platform failed. When the platform failed in June 2022, customers understandably demanded their FDIC insurance payout. But there was no payout. Voyager had lied. FDIC was not liable for losses arising from failure of the platform.

And it was not just lending platforms that claimed their deposits were FDIC insured. Crypto exchanges, notably Coinbase and Gemini, told their customers that fiat deposits qualified for FDIC “pass-through” insurance. FDIC has to my knowledge never confirmed that fiat deposits on any crypto exchange or platform qualify for either direct or pass-through insurance. But for well over two years, crypto exchanges and platforms got away with marketing themselves as FDIC-insured. It wasn’t until the summer of 2022 that FDIC made a serious attempt to end mis-selling of FDIC insurance by crypto companies.

Why did it take FDIC so long to act? Partly, I suspect, because crypto wasn’t seen as posing a serious risk to the mainstream financial system. And perhaps also because crypto has never been eligible for FDIC insurance, so there was no particular reason for FDIC to take an interest in it. Whatever the reason, FDIC did not act until after Voyager’s failure revealed systematic mis-selling of FDIC insurance to retail customers.

Quite why FTX decided to advertise its deposits as FDIC insured is unclear. But we now know that FTX had a whopping hole in its balance sheet because of Alameda’s losses. So perhaps it was desperately trying to trawl in new depositors to keep itself afloat. Not that new deposits were ever going to fill the hole. Pouring more water into a leaky bucket doesn’t stop it leaking.

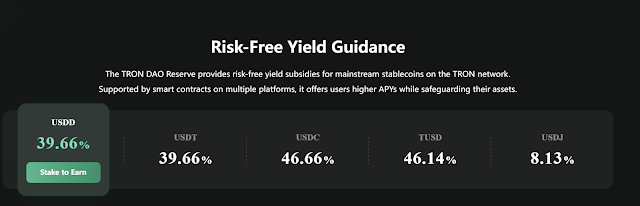

FTX is the latest in a very long line of crypto platforms that have gone down taking their depositors’ money with them. It will probably not be the last. You’d think, given how much money retail depositors have already lost and are still to lose, that the remaining platforms would refrain from offering obviously unsustainable returns. But no. They are still offering insanely high yields on dollar or dollar-equivalent deposits. Here, for example, is Justin Sun’s Tron DAO Reserve promising risk-free returns of 39.66% on USDT, 46.66% on USDC and 46.14% on TUSD:

And here is FTX’s nemesis, Binance, offering yields in excess of 65% on stablecoin deposits:

These are the crypto ecosystem’s main stablecoins, readily obtained from crypto exchanges. All you have to do is deposit some real dollars. Then you trade them for stablecoins, feed the stablecoins into the thirsty maw of Tron DAO Reserve or Binance, sit back and collect your returns, which are of course far better than anything you can get in a conventional bank or fund. And it’s all entirely risk free, because these stablecoins are dollars, really – aren’t they?

This is of course far too good to be true. But no doubt some suckers will believe it and hand over their dollar stablecoins. And that is exactly what the platform wants. Dollar liquidity, to preserve the illusion that there are enough dollars in the system for everyone to withdraw not only what they have deposited, but also what they have earned.

There’s already substantial evidence that the crypto space is infested with frauds, scams and ponzis. But I would go further. The entire crypto ecosystem is ponzi. The whole thing depends on ever more people parting with their savings and wages to pay the lunatic returns promised by the platforms to people who can provide the liquidity they so desperately need. No wonder platforms like FTX chase market share and insist that any problems are just “liquidity crises”. The more people they can attract, the more liquidity they have and thus the longer they can survive.

The crypto system’s need to persudade more and more people to part with their savings to maintain the ponzi makes false promises and mis-selling endemic. Nor has a swathe of high-profile failures, culminating in the recent collapse of Sam Bankman-Fried’s empire, in any way deterred the survivors. Indeed it makes it even more imperative that they attract new deposits. If they don’t, the whole thing will implode.

Related reading:

Image: Great Pyramid of Cheops. Nina at the Norwegian bokmål language Wikipedia, CC BY-SA 3.0