President Trump’s letter to eighteen of the world’s largest pharmaceutical companies, including AbbVie, Amgen, AstraZeneca, Boehringer Ingelheim, Bristol Myers Squibb, Eli Lilly, EMD Serono, Genentech, Gilead, GSK, Johnson & Johnson, Merck, Novartis, Novo Nordisk, Pfizer, Regeneron, and Sanofi, demanding drug price cuts for Americans, sent a jolt through pharma stocks in Europe.

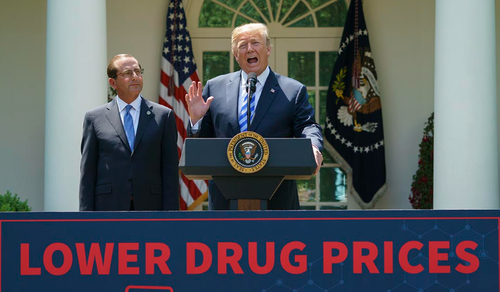

Trump’s formal letters to major big pharma, demanding immediate action to reduce U.S. drug prices to Most-Favored-Nation (MFN) levels — i.e., the lowest prices offered in any other developed nation, represent a move by his administration to stop what he calls “global freeloading” on U.S. pharma innovation, as well as for the adminstration to lower costs for all Americans – a campaign pledge he made in 2024.

Here are the key demands Trump made in the letter to drugmakers:

-

Provide MFN prices to all Medicaid patients.

-

Pledge not to offer lower prices abroad for new drugs than those offered in the U.S.

-

Sell drugs directly to consumers at MFN prices, bypassing middlemen.

-

Raise prices abroad (via trade policy support), but reinvest those gains into lowering prices for Americans.

The letters state that if the pharma companies “refuse to step up” and comply with the federal government, Trump “will deploy every tool in our arsenal to protect American families from continued abusive drug pricing practices.”

In markets, the letters sparked selling with Novo Nordisk in Europe down 4.4%, AstraZeneca slid 3%, GSK fell 1.9%, and Sanofi decreased by about 1.5%. Novo is set to close down more than 30% this week (read why), the largest weekly decline ever.

This follows Trump’s May 12 Executive Order: “Delivering Most-Favored-Nation Prescription Drug Pricing to American Patients.” The Trump administration has made it clear to the American people that the days of consumers paying 3 times more for brand-name drugs than other OECD nations will be over.

The most shocking stat: The U.S. comprises <5% of the global population but funds about 75% of global pharma profits.

“In case after case, our citizens pay massively higher prices than other nations pay for the same exact pill, from the same factory, effectively subsidizing socialism aboard [abroad] with skyrocketing prices at home. So we would spend tremendous amounts of money in order to provide inexpensive drugs to another country. And when I say the price is different, you can see some examples where the price is beyond anything — four times, five times different,” Trump wrote in the White House press release.

Here’s Goldman Sachs European pharma expert Seth James’s first take in a note to clients titled “Pharm to Table”:

Shall we just all go to the pub instead? Trump sent out letters to Pharma CEO’s last night further demanding price cuts to innovative medicines. Demands included: i) MFN pricing for all drugs offered in Medicaid. ii) MFN pricing for any new drug launched in Medicare, Medicaid and Commercial channels. iii) DTC and/or DTB distribution at MFN pricing for high volume/high-rebate prescription medicines. Administration asking for binding commitments here in the next 60 days. ADRs were weak last night trading down 1-2% from the EU close – feedback pretty mixed but leant relaxed among the specialists, most pointing to a lack of detail on mechanism of implementation which for points ii and iii is likely to need a legislative fix to enforce. Also the 60 day ‘deadline’ seen by many as an exercise in can kicking. On the details MFN pricing in Medicaid is likely most easy to implement but least impactful given the lower pricing in that channel, point ii on new drug launches would be most nefarious given the inclusion of the commercial channel which wasn’t in many scenarios I’d seen run and would likely weigh heavily on the medium term growth outlook for the industry though imagine most see as unlikely to be implemented. Am in two minds as to how this plays out – Pharma (ex-Novo) has had a little bounce of late and can see that being given back –Novo for one not helpful for perceptions of the sector this week and letters could add to the capitulation here. On the other side think the lack of detail on implementation here is oddly reassuring – part of me wants to say that this helps put at least some pressure on getting this issue resolved more quickly than the 6+ months that Novartis’ CEO outlined but given the legislative fixes required perhaps these letters only introduce another 60 day no go period for generalists in the space – with the above context would you be involved if you didn’t have to?

Moves in reaction this morning feel much more a function of positioning than exposure – AZN has among the least Medicaid exposure of all EU Pharma yet most impacted this morning, ARGX closest to pricing parity globally yet also one of the hardest hit – on the other side GSK largest Medicaid exposure of EU names yet is outperforming, though I guess valuation is also an important component in all this. What a week to be a deep value investor….. Novo warning, Bayer pre-releasing and Philips moving onto our conviction list. Richard thinks that the 2Q print marked a turning point in the story as material headwinds from China come to and end while the U.S. strength persists as we saw in the order book which we think can carry the stock to 5-6% growth in the second half o this year and beyond with a CMD on the horizon to anchor too. Once the dust settles here I think its worth spending some time with Richard and going through it all. Deeper into medtech results next week – still astounded by how weak some of the discretionary exposed names have been but even the higher quality buckets are taking a beating – GE Healthcare had to take a lot of pain and Stryker down 6% overnight on a weaker quarter for knees despite efforts to reassure on the end market.

Not 100% doom and gloom with a better quarter for NVST with premium implants growing for the 3rd straight quarter and calling out stable dental market fundamentals which encouragingly continued through July which is an exact 180 of what we heard from ALGN – certainly ups the stakes for the STMN report in a few weeks. They say its always darkest before the dawn and I don’t want to be too bearish given where we are on valuations – especially in the likes of Novo but I think the pain can always last longer than you think and stuff can stay cheap for a long time without a catalyst which is maybe a better question to end on rather than the one in the paragraph above – what’s the catalyst to turn it around for healthcare in the second half.

In a separate note, BMO Capital Markets analyst Evan David Seigerman told clients the White House has sparked some “headline shock,” but emphasized that it’s unlikely the Trump administration will be able to implement the MFN successfully. In some cases, the analyst believes the administration may even lack the legal standing to enforce these policies. More or less, he believes the MFN threat is a negotiating strategy.

Loading recommendations…