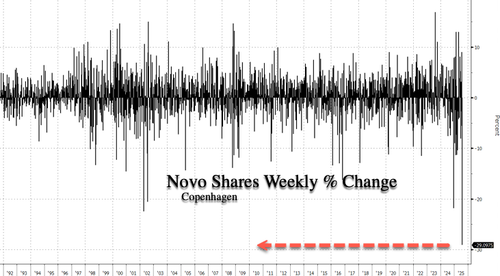

Shares of Danish pharmaceutical giant Novo Nordisk have experienced a sharp sell-off this week after slashing its full-year sales and profit guidance, citing softening Wegovy demand driven by compounded GLP-1 headwinds. If losses hold through Friday, the magnitude of the drawdown will mark the largest weekly decline ever for the stock trading in Copenhagen.

A key question right now among some institutional investors: Has the correction created a compelling entry point in Novo?

Let’s start with the technicals: Shares on the week are down about 29%, the largest weekly decline ever for shares trading in Copenhagen. This followed the surprise sales and profit warning earlier this week.

Novo shares peaked in early June 2024 and have since tumbled 69%. Much of the GLP-1 hype cycle has now unwound, with the stock trading back at January 2022 levels.

Much of the downturn in Novo shares was accompanied by Goldman analysts repeatedly telling clients how compelling the stock was at every dead-cat bounce. Now, with the stock back at 2022 levels, we ask the same question, this time, with patience … for the first time.

A new note from UBS analysts led by Matthew Weston outlines what’s next after the profit warning earlier this week.

“Following a surprise sales and profit warning for 2025, we place our Rating and Price Target for Novo Nordisk under review,” Weston told clients.

Here’s more from the analyst:

We were previously at the bottom end of the FY25 guidance range and had cautioned that a significant inflection in US GLP-1 growth was needed to meet guidance expectations. But the magnitude of the FY25 cuts was well ahead of UBS and market expectations. Novo now targets 8-14% CER sales growth (from 13-21%) versus UBSe 13.4%, cons c.15.8%. For EBIT, new guidance is 10-16% CER growth (from 16-24%) versus UBSe 18.9% and cons c.19.5%.

The debate between Weston and his fellow analysts centers on the issue of unapproved GLP-1 compounds on the market. He estimates that at least one million Americans are currently using these compounded versions.

Here are some of those key questions:

-

How can Novo address the threat of U.S. compounding? Novo’s market intelligence estimates 1 million U.S. patients still take unapproved compounded sema. Compounded product acts as a drain on the potential patient pool at a price point well below branded levels ($150 vs $499/month). We have been assuming compounding would wind down over 3Q25, returning to a normal branded competitive market. If widespread compounding remains, the outlook for US Wegovy would seem uncertain.

-

What is a reasonable exit rate for sales growth into 2026? 2026 will balance the impact of compounding & LLY competition vs launch opportunities from MASH & oral Wegovy 25mg obesity. What is the valuation baseline and blue/grey sky scenarios?

-

What is the long-term NPV impact of compounding threats and IRA price cuts versus the significant potential of the global obesity patient population?

What’s critical from Novo’s earnings report is this line:

“Novo Nordisk is pursuing multiple strategies, including litigation, to protect patients from knockoff ‘semaglutide’ drugs. Novo Nordisk is deeply concerned that, without aggressive intervention by federal and state regulators and law enforcement, patients will continue to be exposed to the significant risks posed by knockoff ‘semaglutide’ drugs made with illicit or inauthentic foreign active pharmaceutical ingredients.”

A resolution to the widespread availability of compounded GLP-1 products in the U.S. marketplace could mark a potential bottom for Novo shares. This could occur through “multiple strategies,” as outlined by Novo above. Such a development would help lift the clouded outlook for Wegovy sales and potentially slow the ongoing erosion of U.S. market share to unapproved alternatives. This has yet to occur.

Loading recommendations…