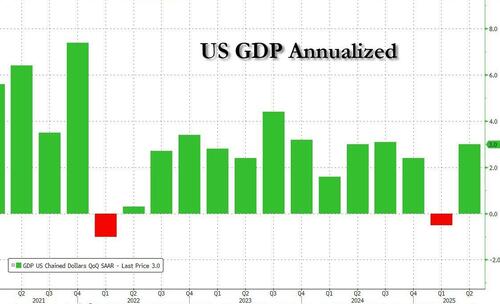

So much for that imports-driven mini recession in Q1.

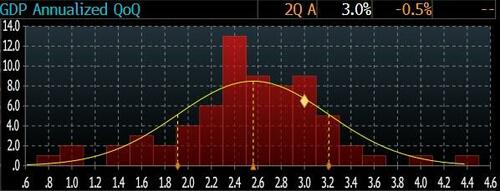

One quarter after liberal economists cried with delight when the US economy contracted as a result of a surge in imports (even as consumption remained solid) and which they said was the definitive confirmation Trump is the antichrist and the US economy is headed for another Great Depression, moments ago the Bureau of Econ Analysis reported that the first estimate of Q2 GDP came in at an unexpectedly brisk 3.0%, a complete reversal of the -0.5% decline in Q1…

… and well above the 2.6% estimate, if inside the 1-sigma upper distribution band.

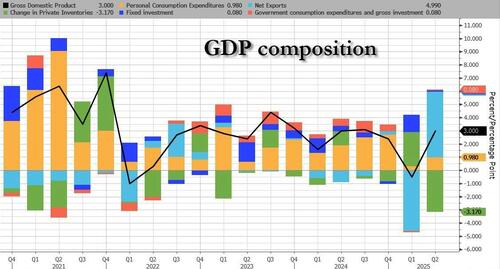

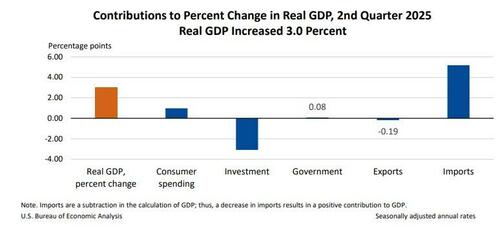

The increase in real GDP in the second quarter reflected a decrease in imports, which are a subtraction in the calculation of GDP (and thus boosted bottom-line GDP), and an increase in consumer spending. These movements were partly offset by decreases in investment and exports.

Compared to the first quarter, the upturn in real GDP in the second quarter reflected a downturn in imports and an acceleration in consumer spending that were partly offset by a downturn in investment. Looking at the contribution of various components, we find the following:

- Personal Consumption added 0.98% to the bottom line GDP, up from 0.31% in Q1.

- Fixed Investment came at 0.08%, a big drop from the 1.31%, and perhaps the only concerning point in today’s report: was there really no major data center investments in the second quarter… and if so what are the hyperscalers doing?

- The change in private inventories was a big drop, printing at -3.17% in the first estimate, up from 2.59% in the first quarter, and an expected reversal as retailers unloaded all that inventory they piled up ahead of tariffs.

- Trade or net exports (exports less imports), came at a whopping 4.99% – the biggest addition to the bottom line GDP number – as imports collapsed and added 5.18% to GDP, a stark reversal to the -4.66% contraction in Q1.

- Finally, government added just 0.08% to GDP, a reversal of the 0.10% subtraction in Q1.

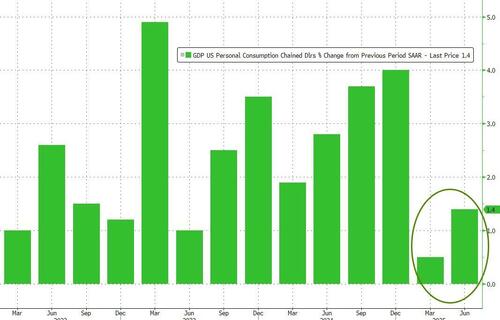

While Personal Consumption was a tad weaker than expected, printing at an annualized 1.4%, below the 1.5% estimate, but above the 0.5% in Q1…

… it was the fixed investment print of just 0.1% that was concerning: why were no Data Centers counted?

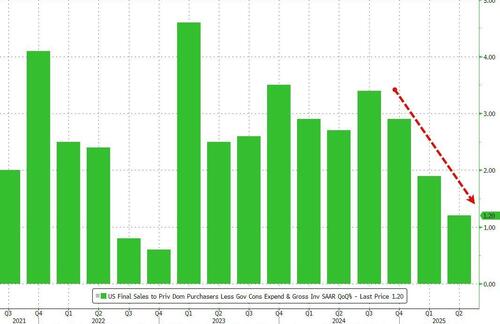

And another somewhat troubling update: real final sales to private domestic purchasers, the sum of consumer spending and gross private fixed investment, increased 1.2% in the second quarter, compared with an increase of 1.9% in the first quarter.

On the inflation side, the data came in mixed, with the GDP price index printing 2.0%, down from 3.8% in Q1 and below the 2.2% expected, while core PCE printed 2.5%, down from 3.5% but above the 2.3% expected. It is now up to the Fed to decide what to do with this data later today.

Commetning on the data, TradeStation head of market strategy David Russell said that “the economy rebounded as trade normalized in Q2. Investors will be happy to see the stronger growth, but core PCE is still running on the high side. This is an inconclusive number for the market overall, with continued red flags on inflation – especially with companies citing the impact of tariffs on earnings. The Fed could remain on guard against rising price pressures.”

Overall, this was a stronger than expected print, yet one which merely normalizes for all the trade/tariff noise from Q1, and one which should probably be looked at as an average between the Q1 and Q2 prints, in which case the US economy is probably growing somewhere around 1.3-1.4%, similar to what the (slowing) Real Final Sales indicate.

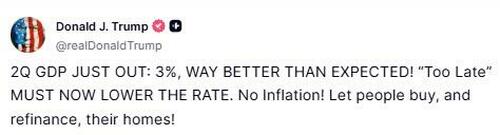

Moments after the report, Trump blasted on Truth Social that 2Q GDP was “WAY BETTER THAN EXPECTED! “Too Late” MUST NOW LOWER THE RATE.”

Actually, GDP coming in hot means the Fed should not cut rates, and instead what Trump should be focusing on is the slow down in Real Final Sales.

In any case, since the Fed will not cut today, expect some very angry Double Bolded, Underlined and ALL CAPS tweets at exactly 2:01pm today.

Loading recommendations…