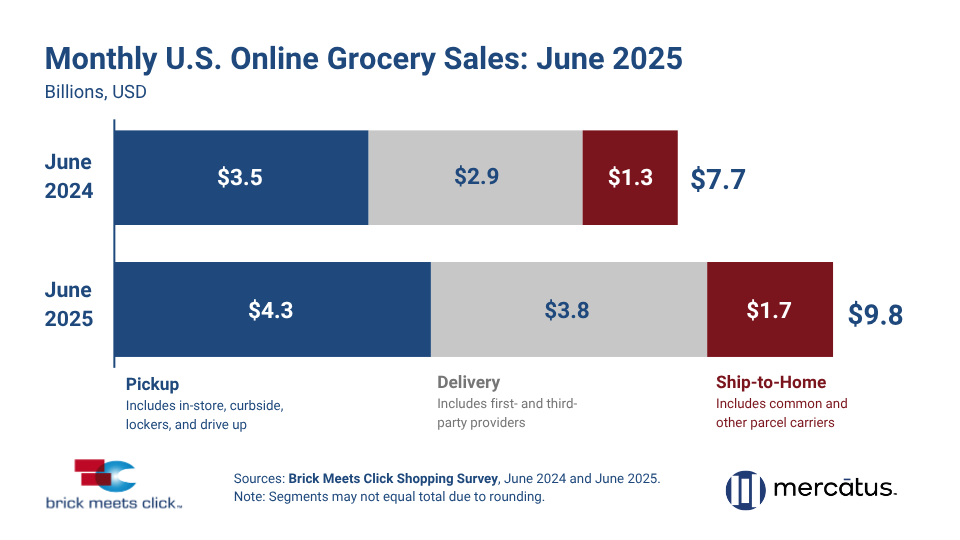

In June, the online grocery market reached $9.8 billion, growing at an impressive 27.6% year-over-year, thanks to gains across delivery, pickup, and ship-to-home purchases, according to a report from Brick Meets Click/Mercatus.

Despite the attractive growth trajectory, a recent report from e-commerce platform VTEX found retailers could do more to support the segment’s growth (and profitability).

“The modern grocery shopper expects the same ease, clarity, and control online that they’ve always experienced in-store,” said Daniela Jurado, EVP of North America at VTEX, in a statement.

Key report findings underscore this desire to connect with the retailer itself: 52% shop via grocers’ first-party apps or websites, compared to 27% who leverage national third-party apps.

Additional takeaways for retailers include:

- Consumers have a commitment problem (and opportunity): although 69% of consumers shop online for groceries at least occasionally, only 30% do up to a quarter of their grocery purchases online.

- Personalization is table stakes: 65% of consumers want personalization that reflects the needs of themselves and their households.

- Higher relative prices and delivery fees are a major barrier: 49% of shoppers tend to be discouraged by unexpected costs when checking out, and 54% note that service fees greatly discourage purchases.

- Loyalty must go digital: 79% of shoppers use a loyalty program when shopping, with nearly 50% preferring these programs to be digital.

A successful online grocery strategy considers these need states to improve services. Where appropriate, retailers will likely see returns on strategies that increase payment transparency (without necessarily lowering prices), investing in AI or other personalization capabilities to inspire purchases, and double down on app functionality and rewards programs to recognize loyal shoppers.

“Grocers can’t afford to treat e-commerce as an add-on,” Jurado said.

He explained that, when consumers prefer first-party services because of the expectation of higher personalization and deeper engagement with the grocer, it’s up to the grocer to reward those interactions with high-functioning, efficient, and optimized services.

The goal: increase online grocery sales and convert more e-commerce-curious consumers.

The challenge: making these ventures possible in a sector where many operators treat these services as a loss.

What’s Fueling Online Grocery Growth

Nevertheless, 27.6% YOY growth is still sexy. It proves that retailers are doing something right, as technology becomes more accessible, and obvious consumer needs prioritize this shopping method.

Broken down by shopping methods, ship-to-home is the biggest mover, outpacing overall online grocery growth by 5.4 percentage points. This is only half of the story, however, as it still represents the smallest market share at only $1.7 billion vs $4.3 billion for pickup.

The lower market share of the ship-to-home method is likely attributable to its inefficient supply chain, as it requires dealing with higher shipping fees.

On the other hand, the big swing in delivery prices is bolstered by what the report calls the “free delivery factor” — the notion that many delivery options from first- and third-party services are “free” for many users who’ve been onboarded onto subscription programs or other services that keep prices low.

The removal of this barrier is crucial to the future of the sector’s success.

Across retailers, Walmart still reigns supreme; however, hard discounters like Aldi are giving these giants a fair shake. Supermarkets, conversely, are losing share to these other services, which boast a larger footprint and lower costs.

Mark Fairhurst, chief growth marketing officer at Mercatus, noted that this news should incite regional grocers to improve their services, as data shows the opportunity for these smaller retailers to grow, but investments are required.

“If you’re a regional grocer, these results should be a wake-up call: Take control of your customer data and put it to work to stay competitive,” he said.

A separate report from the Bank of America Institute uncovered larger forces at play affecting online grocery sales: online retail spending is outpacing overall retail spending throughout the first half of the year. On a 28-day moving average, online purchases are more than 3.5% higher year-over-year, compared to in-store sales.

The report noted that buy now, pay later (BNPL) services may be contributing to this boom, with lower-end purchases above the $50 range increasing steadily in the past two years, akin to the standard online grocery basket.

The Food Institute Podcast

It’s a big world out there – what trends are percolating on the global scene? JP Hartmann, director of Anuga, joined The Food Institute Podcast to discuss the intersection of U.S. and international trends and how the Anuga show is one not to miss.