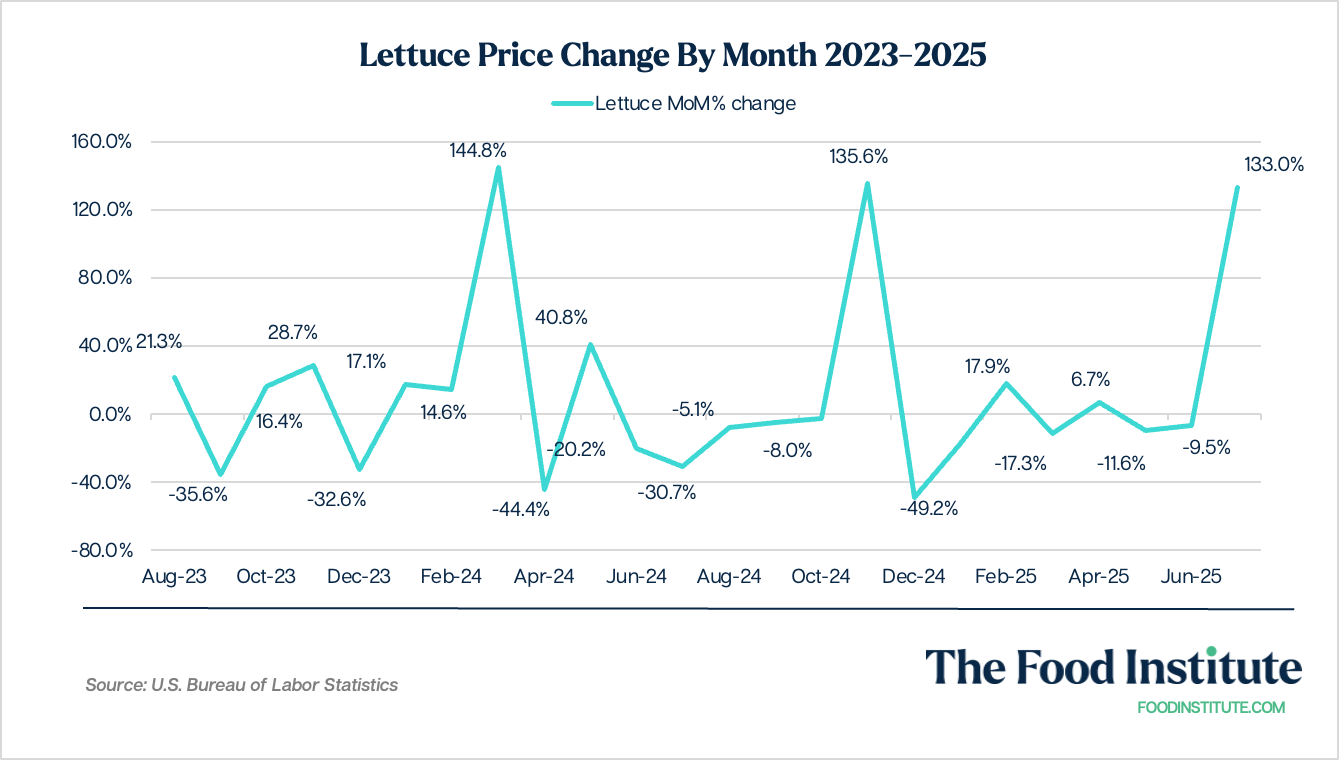

The already volatile vegetable market hit new heights, with lettuce prices up a shocking 133% month over month (MoM) for producers, according to The Food Institute analysis of Bureau of Labor Statistics data.

The producer price index (PPI), a marker for selling price inflation (rather than consumer prices), increased by 0.9% in July, the highest rate since June 2022 and a shock to industry analysts. Further, as a slate of reciprocal tariffs came into effect in August, these prices are not likely to come down in the short term.

Food inflation was a major contributor to the PPI’s recent 1.3% MoM spike. The fresh and dry vegetables category entered the fray in June with a 16.4% YoY surge, and a 38.9% MoM spike, the highest monthly price increase from the finished consumer goods FI tracks.

Additional movers include the usual suspects, such as eggs (+36.3% year-over-year. +7.3% MoM) and coffee (+29.2% YoY, +1.1% MoM). On the other hand, although beef prices are starting to mediate, up only 0.3% MoM in July after a nearly 5% jump in June, meats in general are hit hard, with processed turkey prices up 5.1% MoM (+37.7% YoY).

The results portend a grocery price spike in these categories, as PPI results often indicate how manufacturers and producers will respond to higher prices, eventually making its way to the end consumer. High prices for meat may also drive consumers towards more stable plant-forward protein alternatives.

The Vegetable Dilemma

The fresh and dry vegetables category hit 39.8% MoM, the highest increase since March 2022. More surprising, this swing is the largest monthly increase recorded in a summer month since the BLS started recording these prices in 1947.

Vegetable prices are among the most volatile categories in the PPI, and supply shifts resulting from increased demand, growing problems, climate shocks, trade and tariff terms, and food safety measures all affect the end prices.

Summer, however, tends to be a time when prices stabilize. Note that, in the graph above, previous price spikes have centered around late fall and early spring.

Moreover, the market’s tendency to make these large month-to-month swings may suggest that buyers may overcorrect for supply chain shortages, then settle on a more realistic number as the threat wanes. Therefore, recent spikes may indicate more about anticipatory fears of tariffs rather than its fiscal impact. The U.S. sources roughly 15% of its lettuce from abroad.

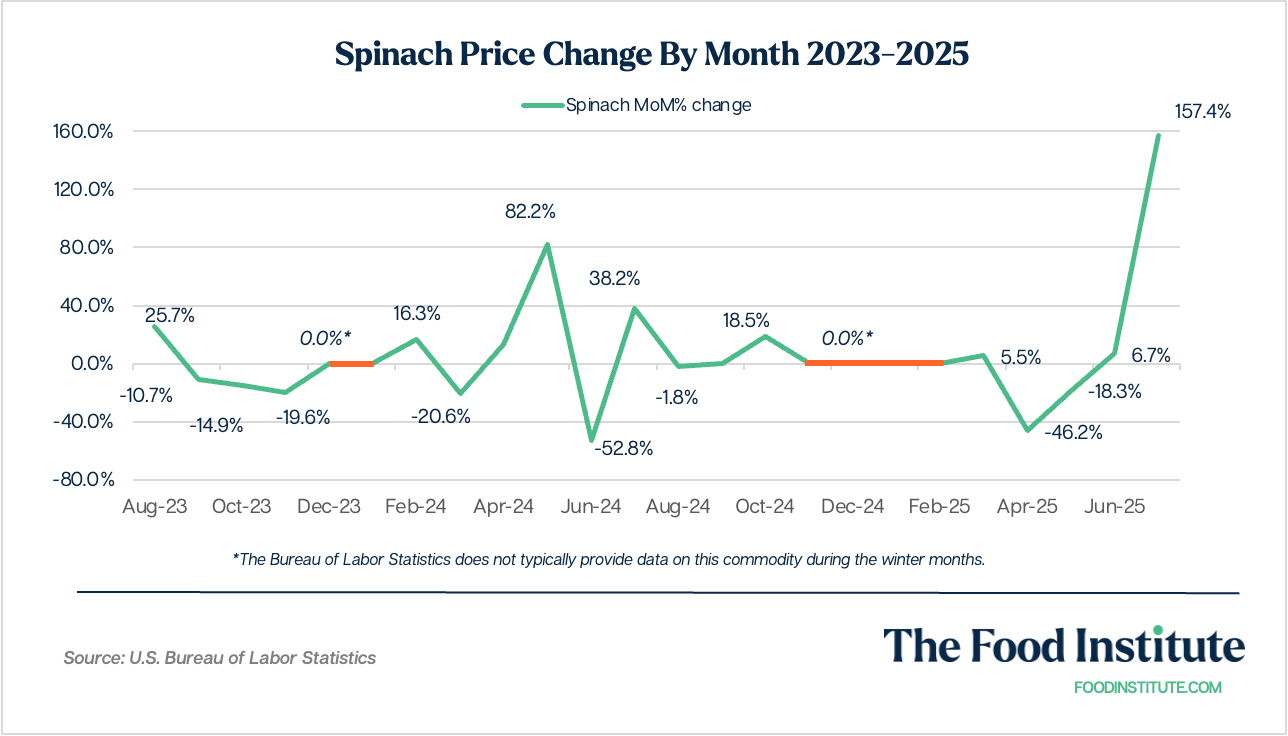

Although generally more stable than lettuce, spinach’s recent spike further indicates deeper supply chain problems underpinning the industry, having undergone a 157% increase in producer prices in July. Historically, spinach prices tend to spike in summer months.

Although the nation’s spinach supply is largely produced locally, most of the U.S.’s imports come from Canada and Mexico, two neighboring countries that have been the contentious subject of tariff discussions since President Donald Trump took office. Currently, Mexico faces a 25% tariff on most goods, while Canada faces a higher 35% duty.

Both crops are also likely bearing the weight of reduced labor workforce. FI recently reported that an estimated 70% of the workforce is made up of migrant workers, 40% of whom are undocumented. Recent crackdowns from the current administration have kept these workers away for fears of being detained by ICE.

“Nobody feels safe when they hear the word ICE, even the documented people,” central California farmer Greg Tesch told Reuters.

To learn more about the food-related inflation indicators, become an FI member to gain access to the Economic Benchmarking section of the website with actionable analysis of major data sources.

The Food Institute Podcast

How will the One Big Beautiful Bill Act (OBBBA) impact your food business? Unraveling the implications of new legislation is never easy, but Patrick O’Reilly and Jeff Pera of CBIZ explain how provisions of the bill related to no tax on tips, depreciation and expensing of capital purchases, and research and development will impact the industry.