By Peter Tchir of Academy Securities

Fed Week? Animal Spirits?

While many are assuming the July 30th FOMC meeting is a “no-go” and the first rate cut isn’t likely until the September 17th meeting, that could be wrong. We will also touch on “Animal Spirts” in this report, as that will be the next driver for the economy, even more than the markets.

But first, let’s revisit Academy’s Geopolitical content this week.

- We start with Saturday night’s rapid assessment of the U.S. Strikes on Iran.

- This dovetailed into our weekend T-Report – A LOT of Moving Parts.

- While that incorporated an update on the Middle East, it also highlighted other “moving parts” the market is dealing with – tariffs, who the President is being advised by, the Big Beautiful Bill, Russia and Ukraine, Questioning the Fed, and the Art of the Deal.

- These topics remain front and center for the economy and markets.

- On Tuesday we published Peace Through Strength.

- We cannot emphasize this report enough, as it consolidates our take on the attacks and the various paths forward. While a week might not seem like a long time (it does, though, lately), it has stood the test of time. Whatever competing narratives are playing out in the media, we believe this gets to the heart of the matter.

- Not only was serious damage done, but an incredibly powerful message was sent not just to Iran, but also to all of America’s adversaries.

- We cannot emphasize this report enough, as it consolidates our take on the attacks and the various paths forward. While a week might not seem like a long time (it does, though, lately), it has stood the test of time. Whatever competing narratives are playing out in the media, we believe this gets to the heart of the matter.

- Finally, we also published our latest Around the World, which has grown in size and scope commensurate with the expansion of our Geopolitical Intelligence Group, and the importance of geopolitical risks in today’s world.

Digesting that information is enough, and we could almost stop here, but we want to reiterate our views on the Fed/rates and introduce our take on Animal Spirits.

Could This Week Re-Shape the Fed Narrative?

We get a LOT of jobs data this week. In Getting The Fed to Get Ahead we argued that any “good” data had elements that went against the “good” narrative and that “bad” and even “ugly” data abounded.

Nothing since we wrote that piece gives us any reason to assume the jobs data is better. Sure, the Establishment Survey Headline Number might beat again. This would defy statistical probability that so many economists with vast resources who forecast the number are wrong (only to be proven correct down the road when all the revisions hit). However, there is a real risk that the data is very disappointing (including our ongoing concerns about how seasonal adjustments are calculated).

Spending disappointed and even with relatively tame “whisper numbers,” the risk remains to the disappointing side on jobs data.

We also mentioned why we think the Fed’s inflation concerns related to tariffs are overstated in that report.

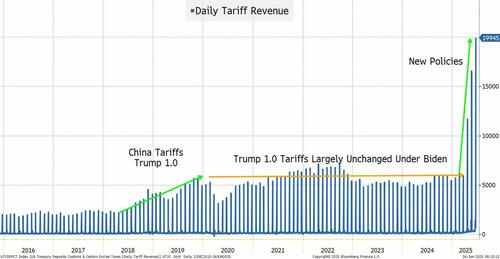

On Thursday, we added more arguments against the Fed’s overly cautious tariff inflation concerns in the Tariff Revenue Chart.

- The tariffs collected so far are a drop in the bucket compared to the size of the economy.

- Tariff mitigation strategies are being employed in many ways, which will reduce the cost of many tariffs and certainly delay the timing of anything that might be passed on to the consumer, well past the next few weeks (or even months).

We fully expect the market to agree with our take by the end of this week’s data and news cycle.

Own Duration

We continue to like owning duration. Clearly everything we describe above (and our outlook of 3 to 4 cuts this year, potentially starting in July) supports that trade. In the aforementioned tariff chart, we highlight the revenue being generated by tariffs and why this is good for lowering bond yields.

There was recently some discussion about “dramatically scaling back the issuance of notes and bonds issued by the Treasury Department.”

While we paraphrase a bit here (maybe a lot) there are some signs the administration may decide the Fed is wrong, yields are too high, and that they will issue only short-dated obligations!

- Go For It.

- The T-Report has been advising companies to hold/manage their current debt issuance because we think rates can go lower.

- The T-Report is advising asset managers to get long duration because we think rates should go lower.

- If the government asked for our opinion, we would support this decision.

- We NEVER understood why the only borrower who didn’t take advantage of ZIRP was the U.S. government. Corporations locked in low yields for as long as possible. Individuals locked in low yields for as long as possible (it is why Fed cuts and hikes don’t translate to the consumer the way they once did, because most of America has mortgages under 3%).

If this idea gains traction, look for curves to flatten and duration to outperform (and this is only in addition to all the other reasons why we have liked it).

Sure, at 4.27%, 10s are not the “screaming buy” they were a few weeks ago, but they should drift toward 4.1%, with a lot of catalysts out there that could force any remaining shorts to cover.

Animal Spirits

With U.S. stocks at all-time highs, we have seen animal spirits impact investors. It is unclear how much they have hit corporate America, or even the American consumer.

- Corporations seem content to invest heavily in AI. But how much is the average company investing away from that?

- Small and midsize companies seem particularly constrained.

- The consumer data, while generally still strong, seems to be exhibiting some fault lines (not cracks, but fault lines).

- With little pushback, we have discussed the concept that no matter what you think the current economy and policies do for your business, there is a bias to act slightly more conservatively.

- One company’s expenses are another company’s revenue. Simplistic and trite, but real.

The market can continue to do well if the administration can unlock animal spirits in the economy. We seem to be on the cusp of that.

- The attack on Iran gives a degree of confidence about the power of America. This can generate positive “vibes” and can undo some of the damage that has been done to the American Brand.

- The success of NATO getting more spending fits this narrative well.

- The Big Beautiful Bill. We’ve argued that what actually gets passed is less important than getting something passed through “normal” legislation. Not executive order. The House and the Senate approving a bill and turning it into law is a big deal (heck, even a big, beautiful deal). There will be plenty of time to argue about the costs, the winners, the losers, etc., but getting this passed should help animal spirits.

- National Production for National Security. Deregulation. We will once again focus on this later in the week, but that could be the massive accelerant the economy needs.

- Tariffs are a wildcard. More pauses and even a few deals – all good. More threats, escalations, etc., and we could undo some of the good.

Markets will need the “Animal Spirts” they have already exhibited to be picked up by the economy. There are plenty of reasons to believe that could occur, with tariff policy probably being the biggest threat (it shouldn’t be, but as we saw on Friday afternoon, it could be).

Bottom Line

The data on jobs, and the narrative on inflation this week, should heavily influence the Fed at the end of the month.

Re-awakening animal spirits across the economy is probably necessary to justify current market levels, but this will depend on which direction the administration heads in on several fronts. Currently, they seem to be leaning towards steps that go towards changing caution to excitement.

Have a great weekend and thank you for allowing Academy the opportunity to help you navigate these incredibly tricky times.

Loading…