Bubble-double-plus: how the AI boom props up the economy with debt, data centers, faith, and valuations without rational expectations of durable and monetizable productivity growth…

The number of people uneasy about the flywheel between the macroeconomy, the stock market, and the ongoing AI bubble is growing. Here is Tracy Alloway:

Tracy Alloway: Here’s what Tracy is thinking about <https://www.bloomberg.com/news/newsletters/2025-10-29/some-thoughts-on-today-s-fed-decision>: ‘Just how central is the stock market to the overall economy? If wealthy people are driving spending and the assets at the heart of that wealth keep hitting new highs, then it would make sense that equity markets become an increasingly critical support for jobs and economic growth…. As stocks have notched new records, we’re seeing new products and strategies designed to help the wealthy tap into those gains…. People using box spread strategies to create a sort of synthetic loan at a lower rate than they might get from a bank… effectively borrowing against their portfolios…. Stelrix… pitches itself as the first credit card that enables users to automatically borrow against their stock portfolio…. The target market for this card — which apparently is “crafted in proprietary glass by the same minds behind the Black Amex Centurion” — seems pretty obvious…. The money’s not just getting spent as stocks go up, it’s getting multiplied…

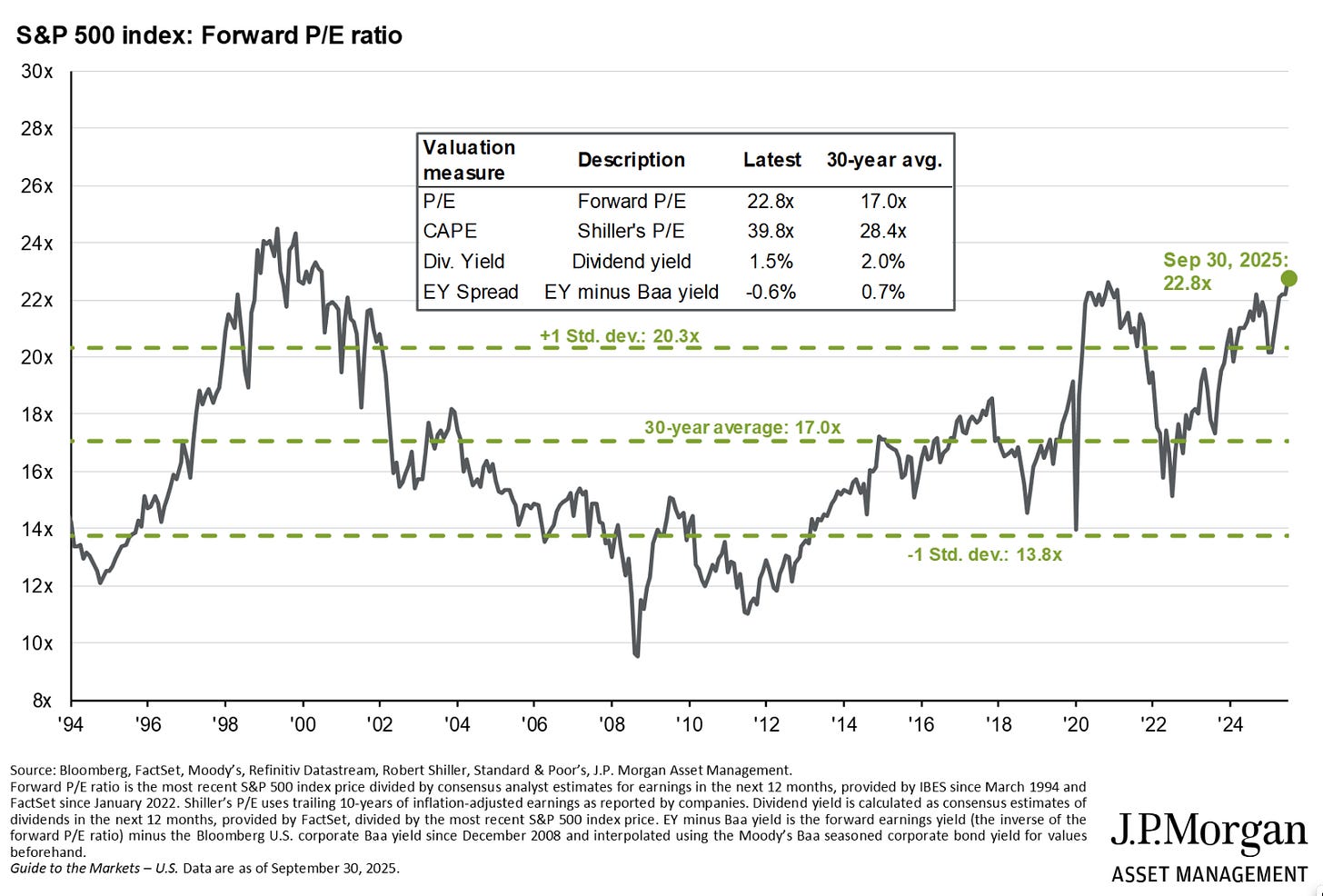

Yes: the AI-bubble is pushing up investment spending directly via construction of data centers, and indirectly via valuation effects on consumption. And then the multipliers kick in. If not for sky-high optimism about AI, the economy would now be in recession with high probability. This sky-high optimism has pushed stocks up to remarkably high valuation ratios rivaling those of the very end of the 1990s:

And this in spite of long-term bond rates that are quite low in historical perspective—inconsistent with any sort of strong expected future productivity boom that might generate income to validate such high valuation ratios. Low bond rates even when there is a furious AI bubble-driven data-center capital investment boom—they are certainly registering the presence of a global savings glut, if not of full-blown secular stagnation:

As best as I can see, this sky-high optimism about stocks is not warranted.

And here is the very sharp Gillian Tett is right now sounding the alarm about the shift in AI data-center funding to debt and to circular vendor financing. When the people who are giving you the money do not trust that your speculative enterprise, that is a bad sign. And when you can only get customers by lending them the money to buy your products—that is a very bad sign too. Gillian Tett:

Gillian Tett: AI has a cargo cult problem <https://www.ft.com/content/f2025ac7-a71f-464f-a3a6-1e39c98612c7>: ‘Spending vast sums and inflating an investment bubble is no guarantee of unleashing technological magic: Is it just a Ponzi scheme? That is the question that currently haunts American tech — and wider markets — as the valuation of artificial intelligence-linked groups soars to evermore eye-popping heights…. Ten lossmaking AI start-ups — such as OpenAI, Anthropic and Elon Musk’s xAI — now command a collective valuation of close to $1tn, while venture capital has poured $161bn into AI overall this year…. Fw of these entities expect to turn a profit anytime soon — and these valuations are being boosted by variants of cross-cutting vendor financing, like recent deals between OpenAI, Nvidia, Oracle, AMD and Broadcom… [in] a pattern of circular flows that echo some of the hairball of interconnections that emerged between banks and insurance companies via credit derivatives before 2008… [which] resulted in unseen concentrations of risk — and subsequent contagion when the bubble burst…. And… even tech luminaries, like Jeff Bezos, admit there is excessive exuberance…

But, right now, it is a bad sign only for those invested in the technology’s long-term superprofitability and in making money by building and running data centers. For while it is to some degree a Ponzi scheme, it is not “just” a Ponzi scheme. And that makes a big difference: that means that it will probably go on for quite a while, and that when there is the ultimate shakeout the tech world will look very different and very weird because of all the money poured into data centers, software development, and business-model experimentation.

Back up. These days I like to say that the AI bubble is eight things. It is:

-

one part: reasonable expectation of providing and financially capturing true end-user value,

-

two parts: millennarian religious hype on the part of those hoping for the Rapture of the Nerds,

-

three parts perhaps-reasonable expectation of improved advertising targeting for user good and user ill,

-

four parts: grifters seeking easy investor marks moving over from crypto,

-

five parts: platform near-monopolists fearing the loss of their profit flows to a Christensenian disruption from the Next New Big Thing,

-

six parts:

-

speculative possible enormous increases in utilizer surplus from the ability to add natural-language interfaces to every interaction with structured and unstructured databases,

-

or decreases in human flourishing as natural-language interfaces serve as a stalking-horse for yet another round of hacking users’ attention, and not for their benefit,

-

but in either case not a likely source of Google-Facebook-Apple-style platform monopoly profits,

-

-

seven parts: the downstream consequences for human society and culture flowing from enormous increases in human data-analysis capabilities driven by the unbelievably large scope of huge data, enormous dimension, highly flexible-function classification tools coming online now and soon, and last:

-

eight parts: the downstream consequences for human society and culture flowing from MAMLM-mediated—Modern Advanced Machine-Learning Model-mediated—human interaction with the infosphere.

Of these, only (1) and (3) are likely sources of superprofit for investors.

(6), (7), and (8) are transformative, potentially, for human society and culture, but not likely sources of superprofits from investors in providing AI-services or AI-support right now. (5) is a defensive move: not an attempt to boost the profits of platform monopolists, but to spend a share of those profits—a large and growing share—defending them against Clayton Christensenian disruption. (2) and (4) are culturally important, and are driving much of investor interest on the belief that with so much excitement about this pile of manure there must be a pony in there somewhere. But focusing on them is not likely to lead to good investment decisions.

Yes, the grifters moving over from crypto are definitely trying to run a Ponzi scheme: if the person trying to sell you something has just spent a decade selling BitCoin, DogeCoin, and Web3 use cases coming real soon now, you should probably block them and add them to your spam list.

And anyone saying either of these two things: (i) soon everyone will be under threat from a malevolent digital god that will soon control all of our minds through flattery, misdirection, threats, and sexual seduction, the negative millennarians; or (ii) they are on the cusp of building a benevolent digital god. Shake your head and walk away. And if they then turn to “give me money! lots of money!”—well, then run.